Bitcoin (BTC) entered uncharted territory this week, breaking by way of limitations and efficiently surging, pushing its worth to the $73,000 mark.

The cryptocurrency world is as soon as once more in an thrilling value discovery section, pushed by bullish indicators and a major shift in investor sentiment.

Associated Studying: Cardano (ADA) Worth Alert: Analysts Predict 60% Rise in Subsequent 7 Days

Large gamers dominate the crypto house

This week’s story unfolds on a stage dominated by two of the largest gamers in finance: BlackRock and MicroStrategy. BlackRock, the undisputed asset administration large, brought on a stir out there by submitting paperwork with the U.S. Securities and Change Fee outlining preliminary plans to incorporate a spot Bitcoin ETF in its international allocation fund.

Though nonetheless in its infancy, the initiative has fueled hopes of elevated demand, notably by way of BlackRock’s IBIT ETF, which already holds a large 204,000 BTC.

Enter MicroStrategy, a staunch evangelist of Bitcoin methods. The company large introduced that it will purchase an extra 12,000 BTC, including gasoline to an already burning fireplace.

This transfer brings MicroStrategy’s whole Bitcoin holdings to a powerful 205,000 cash. Such strikes by trade giants spotlight the rising acceptance of Bitcoin as a respectable and impactful asset class.

Whereas the headlines could also be dominated by institutional energy strikes, a better have a look at the intricate internet of on-chain information can reveal a captivating tapestry of investor conviction.

Supply: IntoTheBlock

$520 million price of Bitcoin on the way in which

IntoTheBlock’s alternate internet circulation indicator exhibits a large outflow of 4,470 BTC on March 11. The key transfer, price over $520 million, noticed the token make its pilgrimage from alternate wallets to chilly storage.

The implication is evident – regardless of reaching all-time highs, buyers are nonetheless enjoying the lengthy recreation, preserving their digital treasures in chilly storage relatively than choosing instant earnings.

This strategic transfer, coupled with the surge in demand, paints an optimistic image of provide and demand dynamics.

Complete crypto market cap at $2.6 trillion on the day by day chart: TradingView.com

Much like historical past, the current alternate exit echoes an identical occasion that occurred on February 27.

On that day, 8,050 BTC internet flows had been related to a staggering 26% value surge in 48 hours. If this historic rhythm continues, the current outflows could be the wind in Bitcoin’s wings, propelling it to beat the $75,000 resistance stage within the close to future.

Because the stage is ready for Bitcoin’s subsequent act, technical indicators have joined the ensemble, singing in concord within the refrain of potential breakouts.

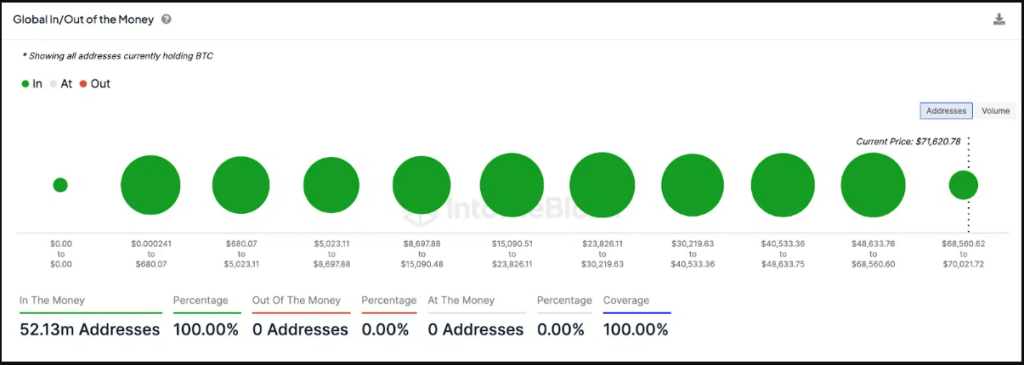

GIOM information. Supply: IntoTheBlock

get pleasure from earnings

IntoTheBlock’s International Inflows/Outflows chart gives a visible feast exhibiting how practically all 52 million holder addresses are actually having fun with earnings on this period of Bitcoin value discovery. The dearth of promoting stress, coupled with a rising institutional wave, paints a canvas with explosive potential.

Whereas bulls are centered on the lofty goal of $75,000, technical evaluation factors to potential assist at $69,000.

This space is a fortress, with over 6.6 million holders buying practically 3 million Bitcoin, and it may well act as a robust psychological barrier within the face of any value pullback.

Knowledge from Coingecko exhibits that on the time of writing, Bitcoin is shortly approaching the coveted $74,000 stage, buying and selling at $73,529, up 2% and 10% respectively on the day by day and weekly time frames.

Featured pictures from Unsplash, charts from TradingView

Disclaimer: This text is for instructional functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is suggested that you simply conduct your individual analysis earlier than making any funding choice. Use of the data offered on this web site is solely at your individual danger.