On February 28, Bitcoin surpassed $60,000 in a single-day candle, rising 20% in simply three days. Nevertheless, this transient keep at this stage means we’ve got to attend one other 24 hours earlier than we’ve got any significant on-chain information.

Nevertheless, given the quantity of unrealized income at present available on the market, the opportunity of a pullback inside the subsequent 24 hours may be analyzed.

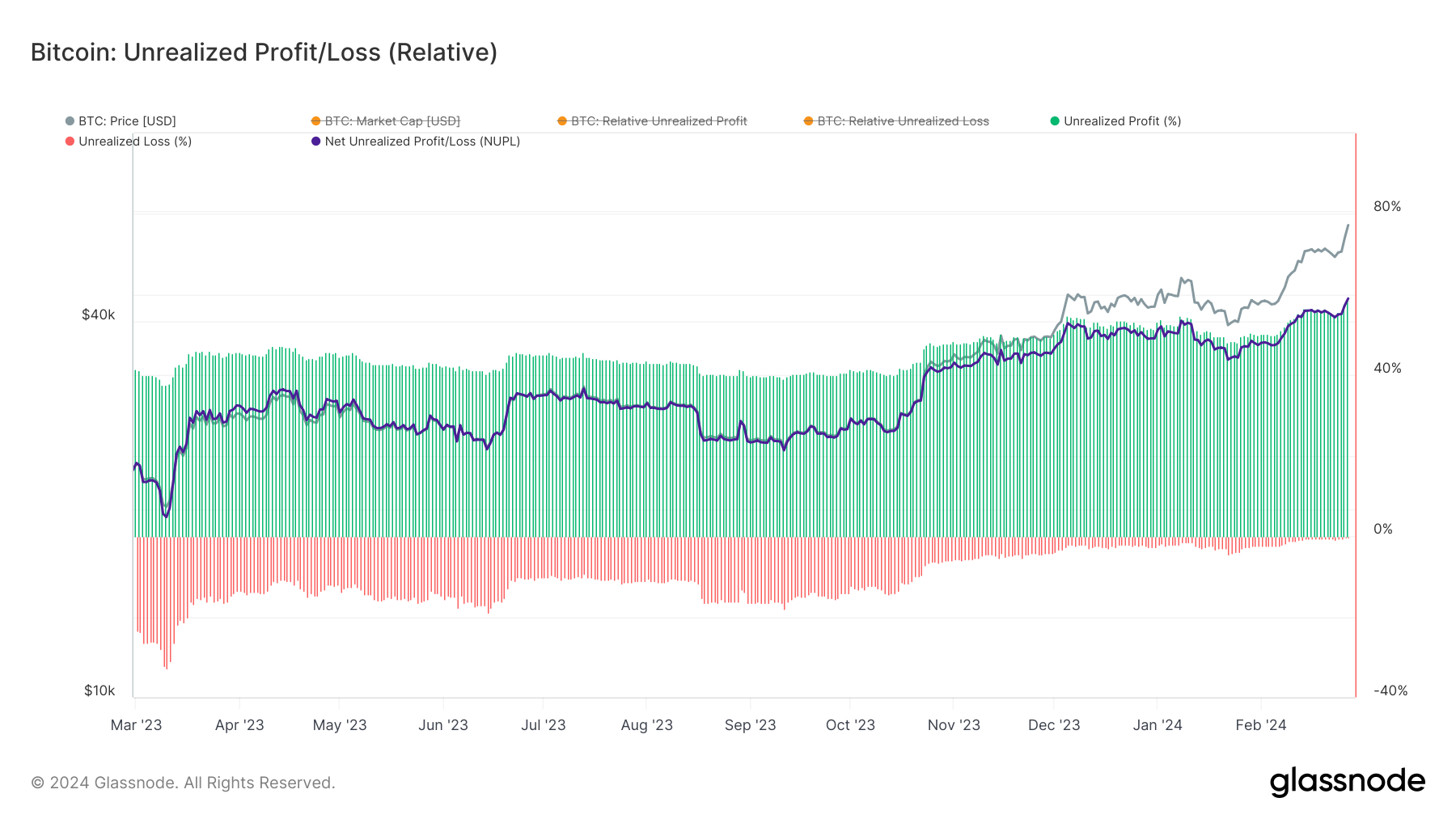

Unrealized income are Bitcoin positive aspects that haven’t been bought or transformed into fiat or different belongings. These are calculated based mostly on the distinction between the present market value and the acquisition value of Bitcoin, assuming the present value is increased.

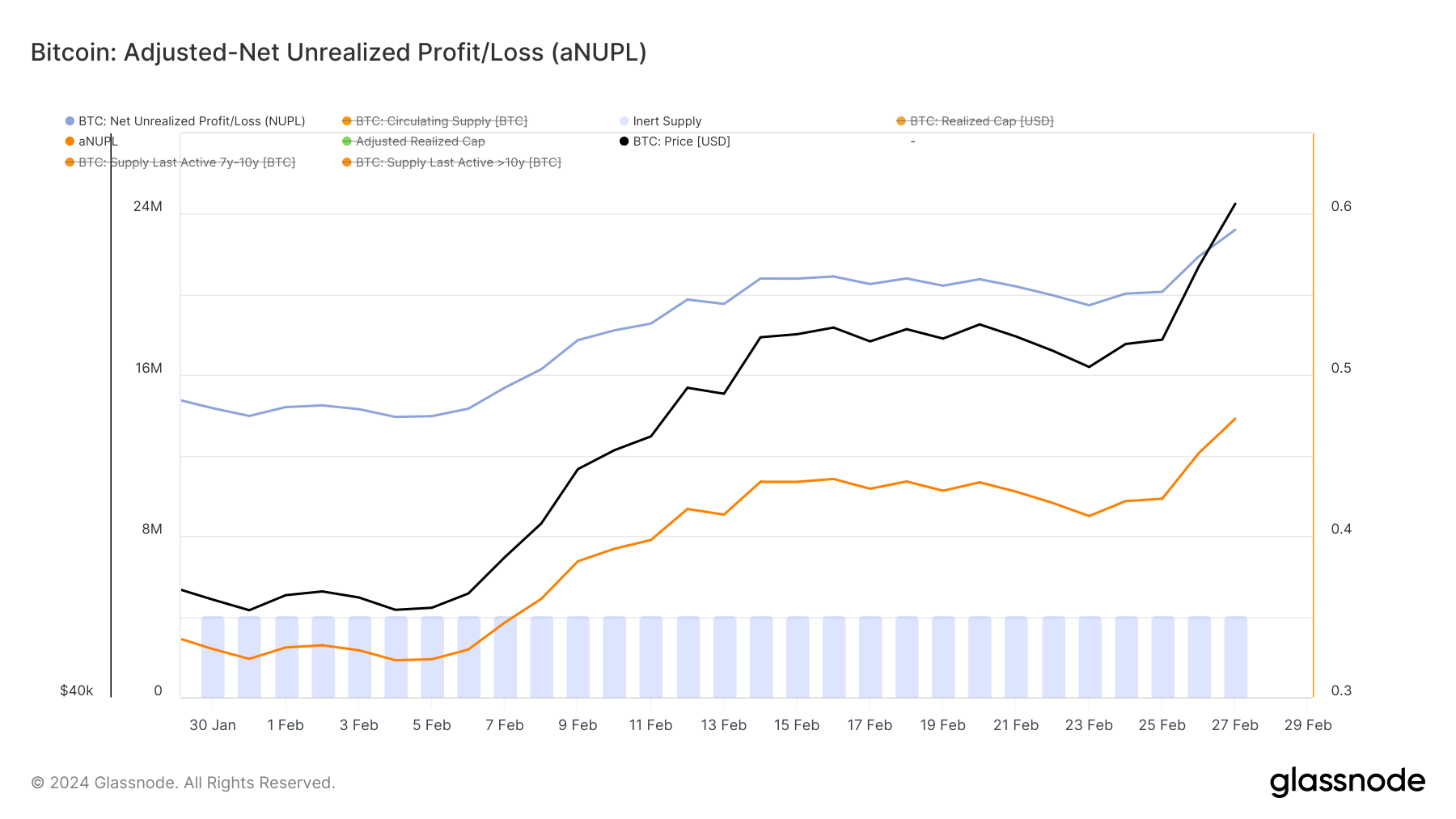

The Web Unrealized Revenue/Loss (NUPL) indicator supplies perception into total market sentiment by plotting the distinction between unrealized income and losses throughout your entire Bitcoin provide, expressed as a proportion of market cap.

In the meantime, Adjusted NUPL (aNUPL) refines this evaluation by considering inert provide (tokens which are lacking or dormant for greater than seven years) to offer a clearer image of profitability in an energetic market.

The aNUPL values noticed over the previous three days (0.4232 on February 25, 0.4515 on February 26, and 0.4729 on February 27) point out that growing Bitcoin provide is worthwhile.

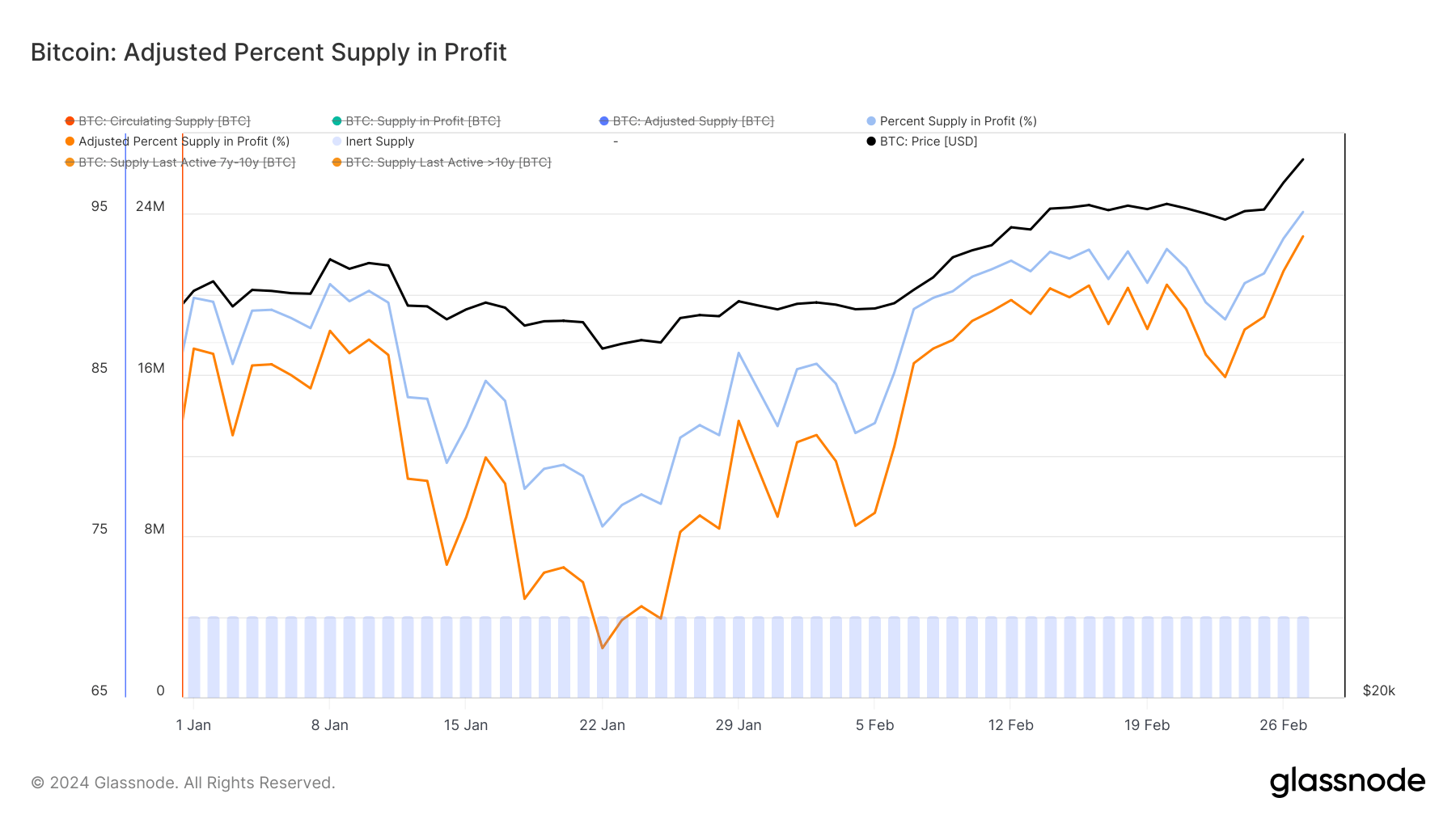

That is additional mirrored by the revenue margin rising from 55.795% to 59.174% and the loss charge falling from -0.682% to -0.155% throughout the identical interval. Like aNUPL, this indicator exhibits that many of the Bitcoin provide is worthwhile with minimal losses.

Provide as a proportion of revenue reached 95.12% on February 27, and the adjusted provide as a proportion of revenue was 93.6%, exhibiting this profitability from a barely completely different perspective.

If Bitcoin continues to rise within the coming weeks, the present usually worthwhile standing might translate into decreased promoting strain. In anticipation of additional development, holders could also be much less keen to promote their belongings, thereby decreasing volatility and setting the stage for extra secure value will increase.

If costs rise additional, the present revenue scenario might reinforce bullish sentiment amongst traders. The large inflows into U.S. spot Bitcoin ETFs, notably BlackRock’s IBIT, recommend a section of the market, made up of institutional and complicated traders, is able to put cash on the desk, pushed by optimistic traits and worry of lacking out (FOMO). Configured into Bitcoin.

Nevertheless, unstable and sideways strikes in value can result in increased volatility. With a big portion of the market taking income, the temptation to understand these positive aspects might set off a large sell-off, particularly if issues of a market peak or detrimental information emerge within the coming days.

Whereas prevailing sentiment is bullish, pushed by widespread profitability and institutional curiosity, the market should cope with potential challenges from unrealized positive aspects. The subsequent 24 hours can be essential in figuring out whether or not Bitcoin can keep its footing at $60,000, or whether or not the strain to understand income will exacerbate volatility.

The article Bitcoin Market Faces Essential Second as Unrealized Income Surge appeared first on CryptoSlate.