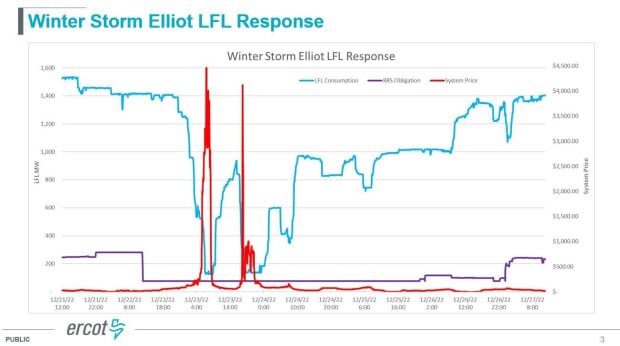

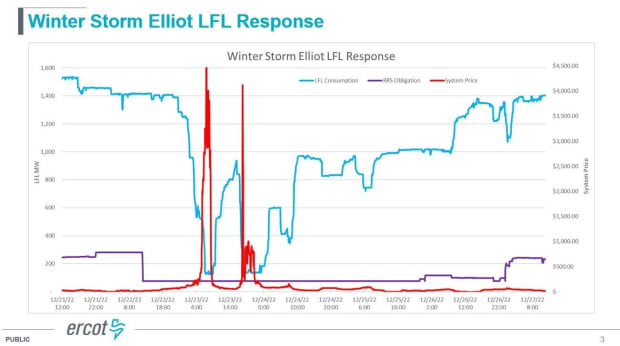

A number of current headlines described a 25% drop in Bitcoin community problem through the Finn winter storm in January. Most attribute the decline to energy curtailment actions in Texas. Whereas Texas does account for 17% of world Bitcoin hashrate, ERCOT knowledge exhibits that a part of the ability curtailment exercise is a mixture of rising costs and “good grid citizenship.” In ERCOT, and to a lesser extent in different ISOs, costs are one of the best proxy for grid stress. There are different metrics akin to PRC (Bodily Responsiveness), however most often worth is a greater measure. Due to this fact, to forestall worth fluctuations and create tougher grid circumstances, the optimum surroundings is one the place costs don’t transfer up or down considerably. Nonetheless, worth swings happen often in ERCOT, as evidenced by Winter Storm Elliott in December 2022 (see chart under).

Bitcoin miners are economically good shoppers of electrical energy. This isn’t to say that Bitcoin miners devour electrical energy in an altruistic method, however that Bitcoin miners’ income are significantly delicate to electrical energy costs, so they’re economically affected when electrical energy costs exceed their break-even threshold (the present break-even threshold) Incentives to scale back energy consumption. For many miners, the worth vary is between $100 and $200 per megawatt hour). Which means when the worth is under the break-even worth, they’ll devour energy, and when the worth is above the break-even worth, they’ll shut down. There are some operational and sensible exceptions to this, for instance if the miner has a knowledge heart internet hosting settlement that stipulates or ensures uptime.

Texans ought to count on Bitcoin miners to be out there when electrical energy is plentiful, as their continued consumption will spur the development of further era. Much less counterintuitively, we’d naturally count on Bitcoin miners to mine much less when costs are excessive and the grid is underneath stress.

This brings us to the January 2024 Winter Occasion, which is the week of January fifteenth. These headlines would make you assume Texas’ energy grid is underneath stress once more, and Bitcoin miners are reducing again on manufacturing because of this. The reality is way more delicate. In the course of the three worst days of the storm, the common settlement worth within the ERCOT wholesale electrical energy market was $100.76 per megawatt hour, with costs by no means exceeding $600 per megawatt hour. For context, costs prime out at $5,000 per megawatt hour. Judging from wholesale costs, the grid weathered the storm and was well-stocked all through.

ERCOT does difficulty conservation alerts, however that is extra of a precautionary message for electrical energy shoppers since they aren’t monitoring electrical energy costs minute by minute like Bitcoin miners.

We do see some financial curtailment, which implies miners scale back their electrical energy utilization over longer durations primarily based on worth indicators, and shorter durations when costs exceed 200 MW. Nonetheless, this exercise has been much less pronounced than earlier winter occasions or summer season heatwaves as a result of era reserves are extra considerable throughout the grid. Some Bitcoin miners might lengthen their mining hours as a gesture of fine “grid citizenship” and present their dedication to stabilizing the grid, however that is troublesome to quantify.

All this proof means that final week’s problem drop requires a extra nuanced clarification. Most of that is the results of cuts in Texas, however after evaluating ERCOT pricing knowledge, I imagine a good portion of the cuts are additionally coming from different ISOs in North America. In brief, everybody who has an opinion about Bitcoin mining cuts can be higher off specializing in ERCOT settlement and LMP costs. Knowledge and economics ought to type the spine of all future evaluation.

It is a visitor publish by Lee Bratcher. The views expressed are fully their very own and don’t essentially replicate the views of BTC Inc or Bitcoin Journal.