Bitcoin’s reminiscence pool is the holding space for transactions broadcast to the community however not but included in a block. Analyzing reminiscence swimming pools offers insights into community congestion, transaction demand, and price tendencies, offering a singular benefit in understanding the state of the Bitcoin ecosystem.

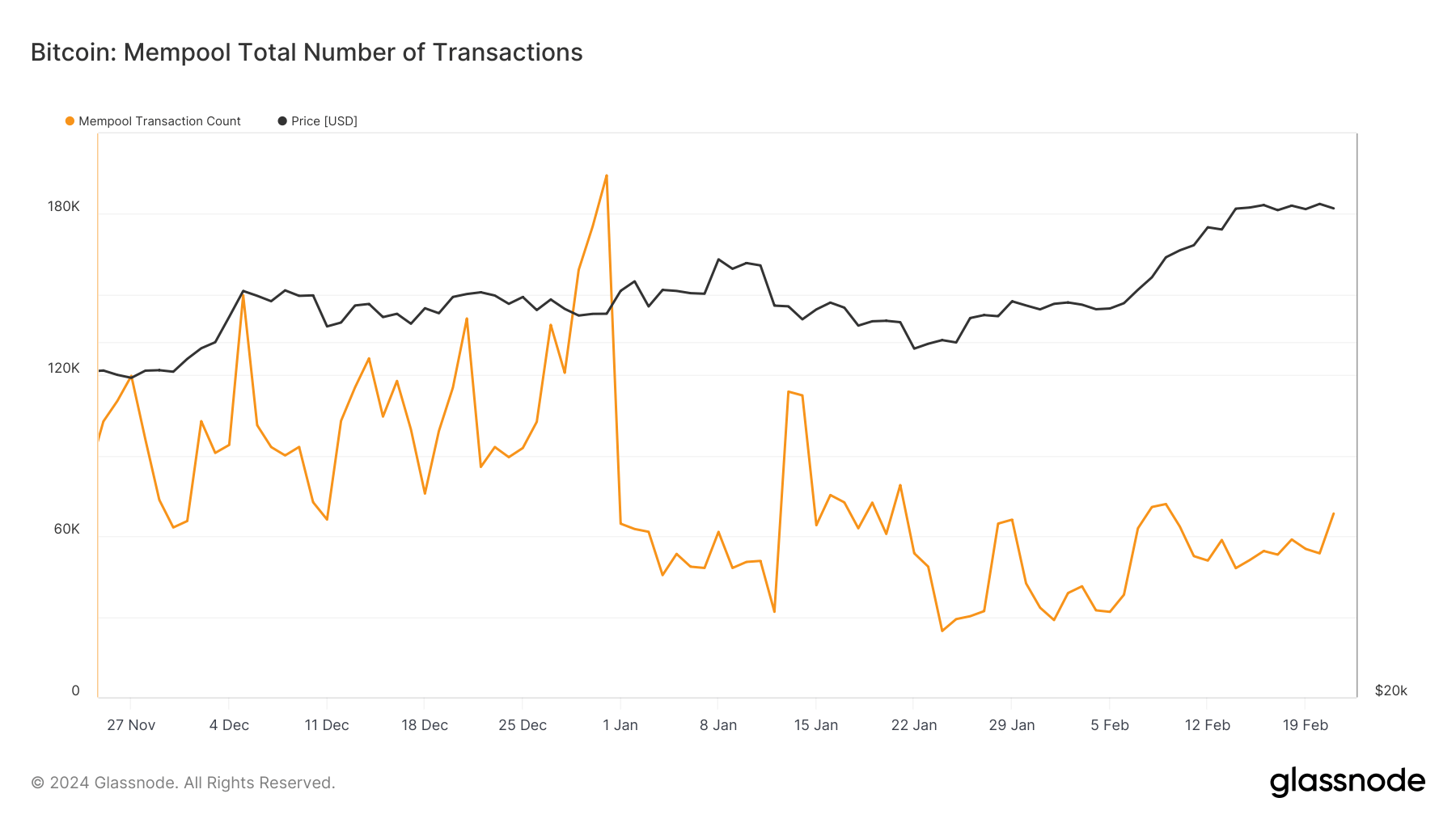

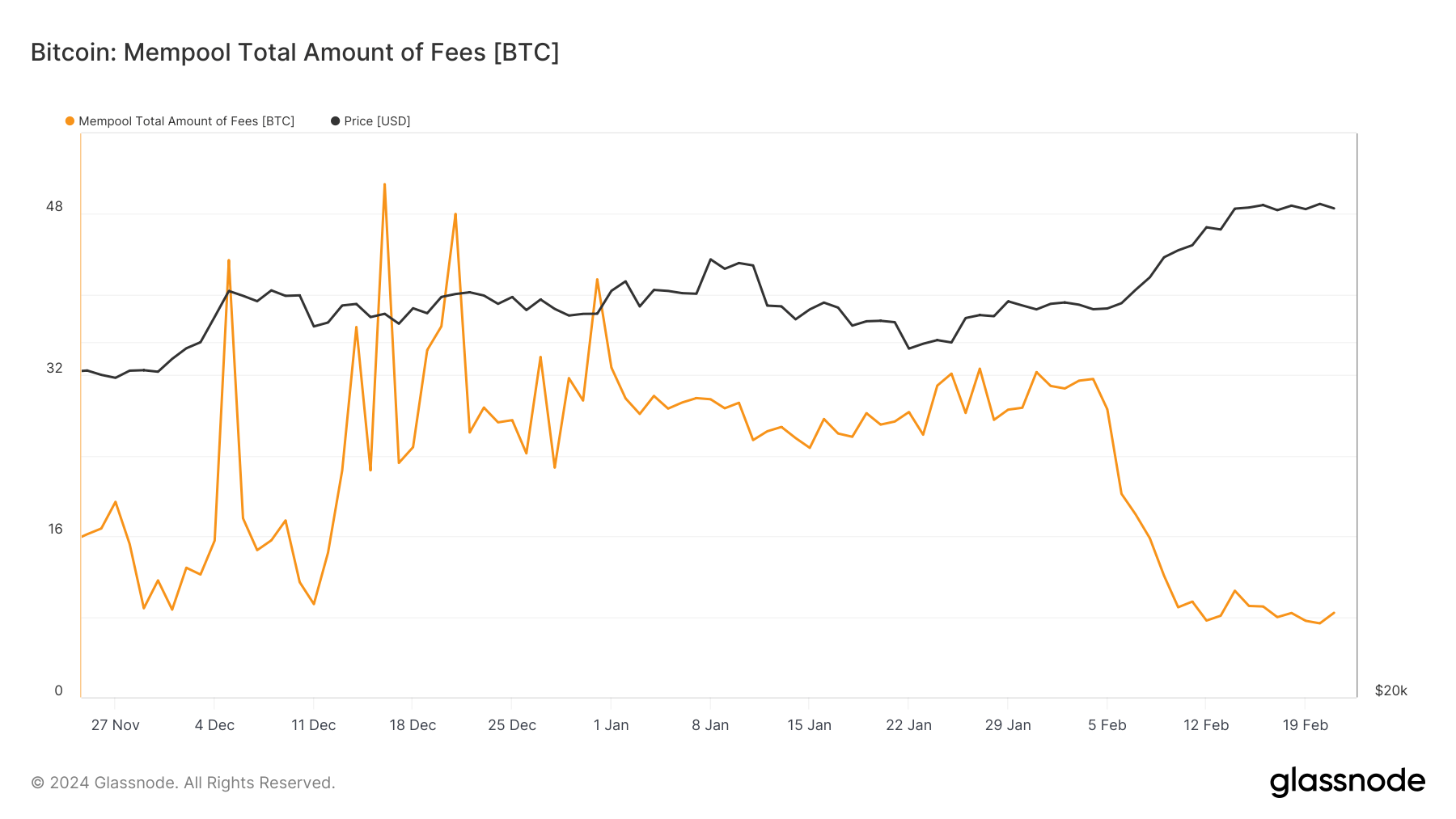

Within the closing months of 2023 and the primary weeks of 2024, the Bitcoin community skilled extreme congestion, as evidenced by the enlargement of reminiscence pool sizes. In mid-December, there have been 117,813 pending transactions within the mempool, with transaction charges totaling 50.9 BTC.

This congestion exhibits excessive demand for block area and highlights the challenges the community faces in adapting to surging transaction volumes. By the top of December, the state of affairs additional intensified, with the mempool dimension rising to 194,374 transactions, indicating a peak in community exercise and person engagement.

This congestion had little influence on Bitcoin’s worth, which spent a lot of December at about $42,000. Transaction volumes and costs remained excessive till early January, with mempool internet hosting 64,664 transactions and 32.7 BTC in charges on the primary day of the 12 months, underscoring the pressure the community was below below the strain of unprocessed transactions.

The entire dimension of transactions awaiting affirmation within the mempool additional surged to 106.369 million bytes, reaching a peak of 139.457 million bytes by the top of January, reflecting transaction backlogs and will increase in transaction complexity or dimension.

The turning level of the lengthy congestion got here in February. As of February 21, the mempool was considerably emptied, the entire transaction price dropped to eight.3 BTC, and the variety of pending transactions dropped to 68,433. The entire transaction dimension within the reminiscence pool additionally decreased to 90.439 million bytes, indicating that community congestion has been considerably alleviated.

Following Bitcoin’s bull rally, congestion eased, with Bitcoin climbing above $52,000 earlier than settling at $51,800 ranges.

Regardless of the rise in Bitcoin costs, the clearing of mempool congestion in February signifies a rise within the community’s capability to course of transactions, presumably by miners prioritizing higher-fee transactions or customers taking effectivity measures corresponding to transaction batching or Leverage off-chain options.

Second, diminished congestion and costs may contribute to a constructive shift in investor sentiment, viewing elevated community efficiency as a bullish indicator of Bitcoin’s availability and scalability.