Franklin Templeton Digital Property issued a be aware to traders about Bitcoin-based Non-fungible tokens (NFT), highlighting the surge in exercise throughout the Bitcoin ecosystem.

The asset supervisor attributes this development momentum to a wide range of elements, together with the emergence of Bitcoin (BTC) NFTs known as Ordinals, the event of latest different requirements akin to BRC-20 and Runes, the expansion of Bitcoin Tier 2 (L2s) options, and extensions for decentralized finance (DeFi) functions constructed on the Bitcoin community.

Bitcoin Ordinal Shines

In line with knowledge from Bitcoin ETF issuers ReportExercise within the Bitcoin NFT house is booming. Particularly, Ordinals’ buying and selling quantity has elevated considerably over the previous few months.

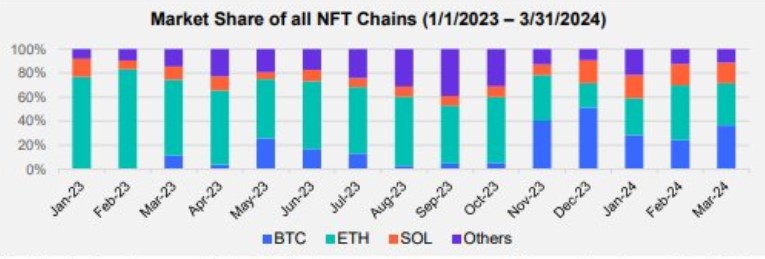

This development is mirrored in Bitcoin’s dominance in transaction quantity, which surpassed Ethereum (ETH) in December 2023, as proven within the accompanying chart.

As well as, a number of collections of Bitcoin ordinals have gotten dominant gamers within the NFT market, each when it comes to transaction quantity and market capitalization.

These collections embrace NodeMonkes, Runestone, and Bitcoin Puppet, which have mixed market caps of $353 million, $339 million, and $168 million respectively. They’re probably the most well-known assortment.

exist Quantity situations The report reveals that previously 30 days, the transaction quantity of those three collections was US$81 million, US$85 million, and US$38 million respectively.

The asset administration agency additional claimed that what’s the distinction between BTC Ordinals and NFTs on different blockchains akin to Ethereum or Ethereum? Solana, is that they include uncooked knowledge recorded straight on the Bitcoin blockchain. This function enhances the attraction and rising recognition of Bitcoin serial numbers, as evidenced by market cap and quantity knowledge.

Franklin Templeton is greatest recognized for his involvement within the ETF market and is among the fund’s issuers roll out Earlier this 12 months, the USA launched a spot BTC ETF.In line with BitMEX analysis, its ETF (inventory code “EZBC”) has seen complete inflows of US$281.8 million since its launch on January 11 knowledge As of April third.

Regardless of its zero-fee construction, Franklin Templeton’s ETF has seen a major disparity in flows in comparison with main gamers within the newly permitted ETF market akin to Blackrock (IBIT) and Constancy (FBTC), which have greater than 140 billion, respectively 7.7 billion.

Binance will cease supporting BTC NFTs

in the latest Weblog articleCryptocurrency change Binance has introduced that it’s going to cease supporting Bitcoin-based NFTs on its market. Lower than a 12 months after launch, Binance will not provide airdrops, perks or utilities associated to BTC NFTs, citing a must streamline its product choices within the NFT house.

Binance acknowledged that it is strongly recommended that customers who personal Bitcoin NFTs withdraw from the Binance NFT market by the Bitcoin community earlier than Could 18, 2024.

Beginning April 18, 2024, customers will not have the ability to purchase, deposit, bid, or record NFTs by the BTC community on the Binance NFT Market. Any current itemizing orders affected by this alteration shall be robotically canceled on the identical time.

At present, BTC is buying and selling at $68,300, up barely by 3% prior to now 24 hours. It’s approaching the essential milestone of $70,000, a stage that the cryptocurrency has struggled to take care of a number of instances.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is suggested that you simply conduct your individual analysis earlier than making any funding resolution. Use of the data offered on this web site is solely at your individual threat.