Amid risky occasions, the cryptocurrency market has been rattled by a pointy drop within the value of Bitcoin. After a interval of serious positive aspects and report highs, Bitcoin has fallen to weekly lows of $65,000, a significant setback for buyers.

On the time of writing, Bitcoin costs are all painted crimson, buying and selling at $65,710, down 5.6% and 4.5% respectively on the 24-hour and weekly timeframes, in line with Coingecko.

Simply days after hitting earlier lows of $68,000, Bitcoin plunged to present ranges as bears continued to come back below downward stress, numbers not seen in per week.

Bitcoin plunging within the final 24 hours. Supply: Coingecko.

Altcoins additionally take a success

Whereas Bitcoin has borne the brunt of the financial downturn, altcoins haven’t been immune. Ethereum (ETH) and Binance Coin (BNB) additionally suffered vital losses, dropping 10% or extra of their worth.

Dogecoin and Shiba Inu, two widespread meme cash, fell even additional, down 20% and almost 30% respectively. The broader altcoin market mirrored Bitcoin’s downward trajectory, including to investor jitters.

BTC market cap at the moment at $1.29 trillion. Chart: TradingView.com

Bitcoin: Impression on Market Dynamics

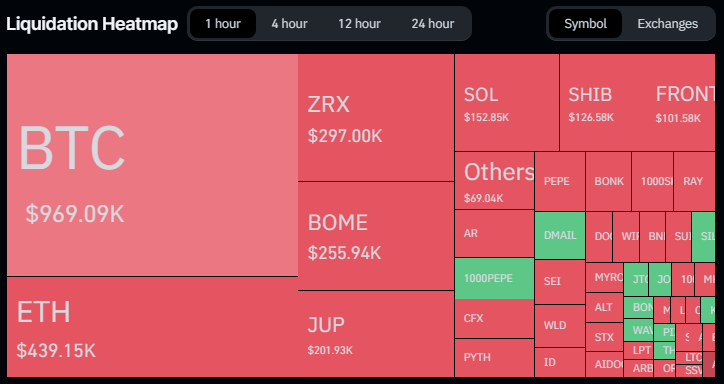

Bitcoin’s latest value correction has reverberated throughout the cryptocurrency house, reshaping market dynamics and investor sentiment. Liquidations surged, with greater than 151,000 merchants going through margin calls previously 24 hours, underscoring the extent of the market turmoil. Bitcoin’s dominance out there is obvious because it accounts for the biggest share of complete liquidations, highlighting its key function in shaping general market developments.

Whole market liquidations have reached $426 million as a result of drop in worth, with Bitcoin being the toughest hit.

Liquidation rush

Over the previous 24 hours, Bitcoin costs have seen greater than $104 million in liquidations, with lengthy merchants dropping probably the most — they misplaced $86 million, whereas brief sellers misplaced $18 million. Because of the losses, complete liquidations on Ethereum had been $48 million, with $33 million going to lengthy merchants and $15 million going to brief merchants.

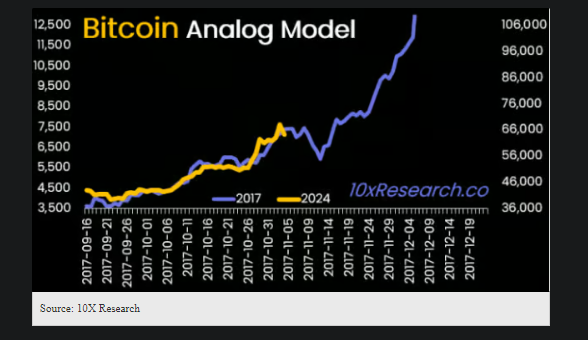

Analysts sound the alarm

On the identical time, market analysts comparable to 10x Analysis CEO Markus Thielen have sounded the alarm, warning that Bitcoin has additional draw back dangers. Thielen’s prediction that the worth may fall to $63,000 sends a sobering message to buyers, urging them to stay cautious and cautious within the present market surroundings.

His insights make clear underlying considerations about Bitcoin’s market construction, together with low buying and selling quantity and liquidity, exacerbating the danger of a pointy value correction.

Amid the market turmoil, buyers are struggling to grasp the implications of Thielen’s evaluation and regulate their methods accordingly. The period of meme coin mania seems to be fading, prompting buyers to reassess their positions and safe income whereas they nonetheless can.

Featured picture from Kinesis Cash, chart from TradingView

Disclaimer: This text is for instructional functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is suggested that you simply conduct your individual analysis earlier than making any funding resolution. Use of the data offered on this web site is solely at your individual threat.