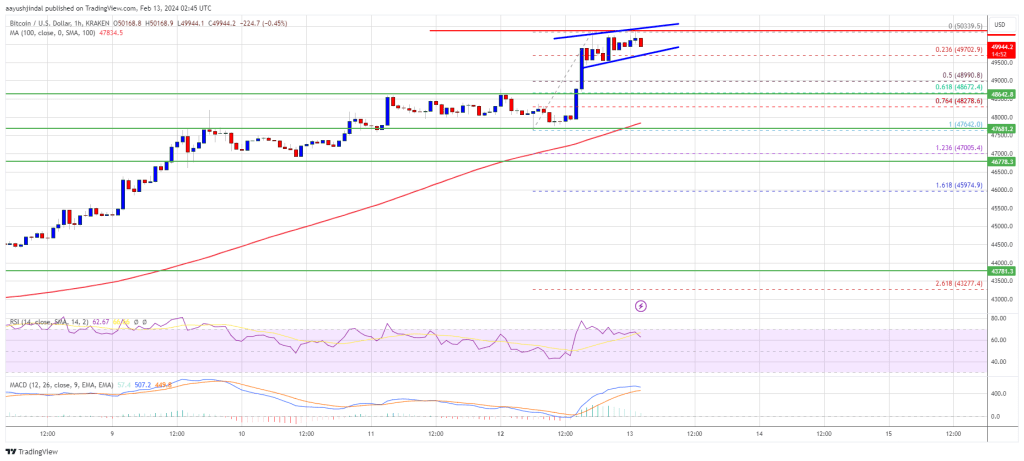

Bitcoin worth prolonged its positive aspects and broke by means of the $48,800 resistance degree. BTC examined $50,000 and is at present displaying indicators of a draw back correction.

- Bitcoin worth climbed above the $48,500 and $48,800 resistance ranges.

- The worth is buying and selling above $48,800 and the 100 hourly easy shifting common.

- A brief-term ascending channel is forming with assist at $49,750 on the hourly chart of the BTC/USD pair (information by way of Kraken).

- The pair is more likely to begin a draw back correction under $49,750 and $49,500.

Bitcoin worth rises 5%

Bitcoin worth stays in optimistic territory above the $48,000 resistance zone. BTC prolonged its positive aspects and climbed above the $48,800 resistance zone. Ultimately, the value jumped to over $50,000.

A brand new multi-week excessive was fashioned close to $50,339 and the value is now consolidating positive aspects. It fell barely to under $50,000. The worth stays above the 23.6% Fib retracement degree of the current rebound from the $47,642 swing low to $50,339 excessive.

Bitcoin worth is at present buying and selling above $48,800 and the 100 hourly easy shifting common. There’s additionally a short-term ascending channel forming on the hourly chart of the BTC/USD pair with assist at $49,750.

Supply: BTCUSD on TradingView.com

Quick resistance is close to $50,250. The following key resistance degree could possibly be $50,400, above which the value may begin one other main rise. The following cease for the bulls could possibly be $51,200. A transparent break above the $51,200 resistance could push the value in the direction of the $52,000 resistance. The following degree of resistance could also be close to $53,000.

Bitcoin’s draw back correction?

If Bitcoin fails to interrupt above the $50,250 resistance zone, it might begin a draw back correction. Quick assist on the draw back lies close to the $49,750 degree or the channel trendline.

First main assist is seen at $49,000 and the 50% Fib retracement degree of the current rally from the $47,642 swing low to $50,339 excessive. If there’s a shut under $49,000, the value could achieve bearish momentum. Within the above situation, the value could fall in the direction of the $47,650 assist.

Technical indicators:

Hourly MACD – The MACD is now dropping velocity within the bullish zone.

Hourly RSI (Relative Power Index) – The RSI for BTC/USD is at present above the 50 degree.

The principle assist degree – $49,750, adopted by $49,000.

The principle resistance ranges – $50,250, $50,400 and $51,200.

Disclaimer: This text is for academic functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It’s endorsed that you simply conduct your personal analysis earlier than making any funding choices. Use of the data offered on this web site is completely at your personal danger.