Bitcoin already has a eventful few weeks when it comes to value motion. The world’s largest cryptocurrency is at present up 19% over the previous seven days and 43% over the previous 30 days, its highest proportion achieve in additional than a yr. In consequence, a lot of BTC addresses have been pushed into the revenue zone. 97% of Bitcoin addresses are worthwhile for the primary time in additional than two years.

Variety of Bitcoin addresses in earnings surges as value surges

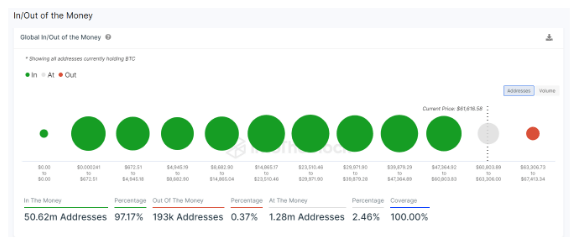

In keeping with the encryption on-chain evaluation platform Enter the neighborhood, at present value ranges, 50.62 million Bitcoin addresses are at present in revenue. This big quantity accounts for greater than 97% of the entire pockets addresses. It’s price noting that the final time holders noticed such excessive profitability was in November 2021, when Bitcoin’s value was round $69,000, near all-time highs.

Notably, market efficiency has seen Bitcoin proceed to rise considerably over the previous few months. simply final month, 91% of the addresses are worthwhile. Regardless of some sporadic promoting and a few profit-taking by buyers attempting to interrupt even, the revenue proportion of addresses continues to develop as big profitability means promoting stress now not has a big impression.

How lengthy can Bitcoin’s upward momentum be sustained?

Bitcoin value has soared over the previous few months Just lately exceeded $60,000 once more. As of this writing, the highest cryptocurrency is at present buying and selling at $62,233, with 1.28 million addresses (2.46% of complete addresses) on the break-even level.

Bitcoin is now buying and selling at $62,233. Chart: TradingView.com

The worth surge may be attributed to Elevated mainstream adoption in by Spot Bitcoin ETF. This ushered in a brand new wave of holding mentality. In February, 69,244 BTC have been price over $3.6 billion Exited from cryptocurrencies comminicate.

It’s price noting that the individuals who profited essentially the most have been those that held Bitcoin for the long run. In keeping with IntoTheBlock, buyers who’ve held property for greater than a yr personal 13.6 million Bitcoins.

Nonetheless, new buyers can nonetheless anticipate continued value features as Bitcoin encounters few resistances on its path. Solely 0.37% of addresses (193,000) are nonetheless ready to revenue at present costs.

Most specialists stay optimistic about Bitcoin’s value potential for the rest of 2024 and past. With the bull market in full swing, many merchants and cryptocurrency analysts imagine that Bitcoin will proceed to achieve new all-time highs in 2024. 12 months-end value targets vary from $100,000 to $300,000 per Bitcoin.

Featured photos from Pexels, charts from TradingView

Disclaimer: This text is for academic functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is strongly recommended that you simply conduct your individual analysis earlier than making any funding selections. Use of the knowledge supplied on this web site is completely at your individual danger.