Bitcoin’s surge above $50,000 has catalyzed a broader market rally, driving large good points in Ethereum (ETH), Solana (SOL) and lots of different giant different digital property.

Based on information Encryption Slate, Ethereum rose 7% to $2,661, whereas SOL surged 8% to $114. Among the many prime ten digital property, Avalanche’s AVAX surged 6% to $41, Cardano’s ADA rose 3.74% to $0.5574, whereas BNB Coin (BNB) and Ripple’s XRP noticed extra modest good points, each up lower than 3%.

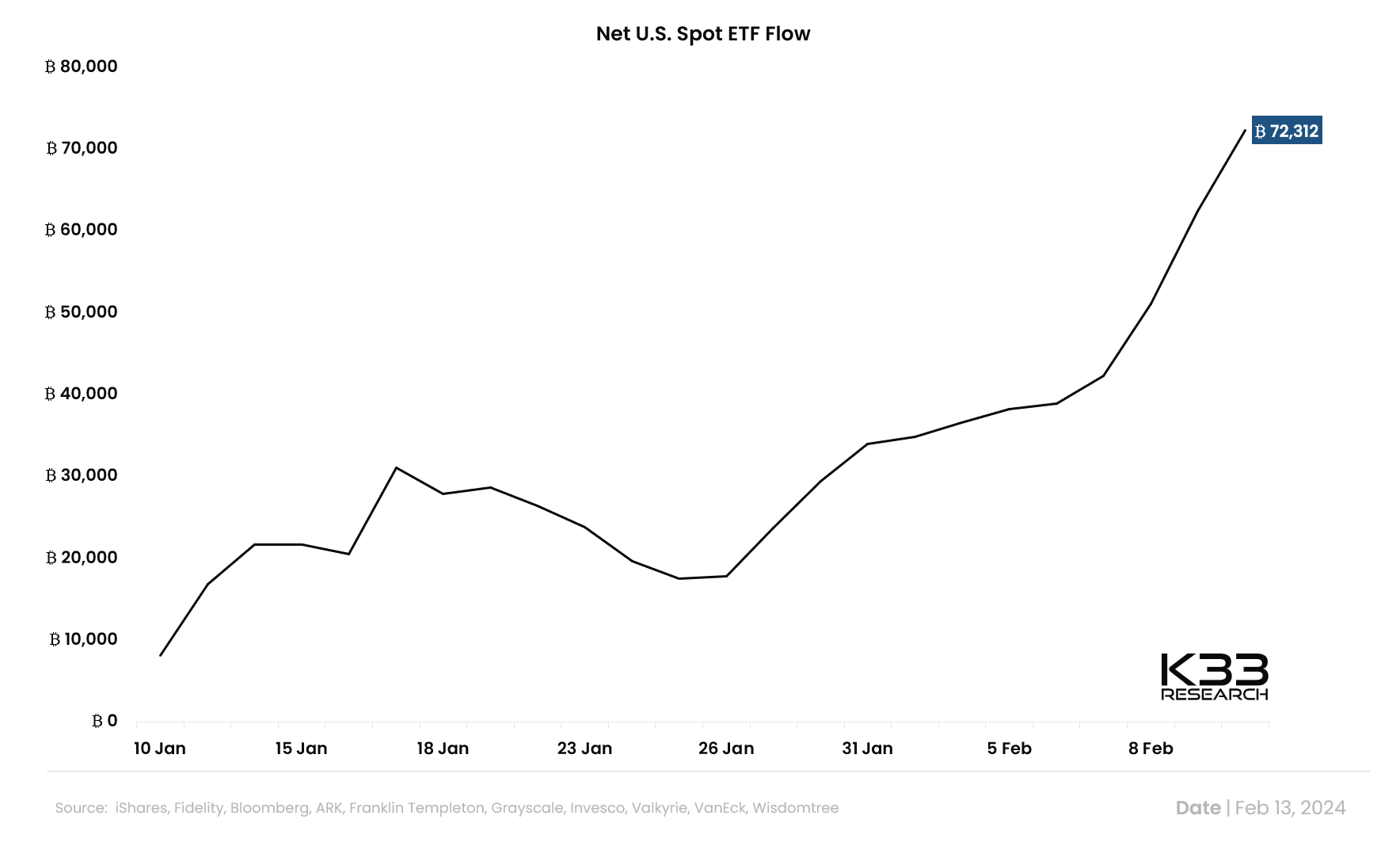

Market analysts attribute this bullish development to the heated dialogue amongst a number of spot Bitcoin exchange-traded funds (ETFs) in the US. K33 Analysis senior analyst Vetle Lunde identified that greater than a month after the launch of those ETFs, capital inflows are nonetheless robust.

“Yesterday’s web inflows of 9,870 BTC pushed the U.S. spot ETF’s web inflows since launch to 72,312 BTC. 9 new people now maintain 228,000 BTC,” Lunde added.

Over the previous day, the worth of BTC crossed the $50,000 mark for the primary time since late 2021. At press time, the worth of the highest cryptocurrency had risen 4.2% to $50,146, persevering with a optimistic development that noticed a 16% achieve over the previous week.

$184 million liquidated

The broader cryptocurrency market rally resulted in large liquidations totaling greater than $184 million by greater than 56,000 merchants, in accordance with Coinglass.

Quick merchants, or speculators who guess on larger costs, suffered losses of as much as $134 million, whereas lengthy merchants who guess on larger costs misplaced about $50 million.

Amongst all property, Bitcoin topped the record of liquidations with a complete lack of $69.8 million. Bitcoin brief merchants misplaced $55.04 million, whereas lengthy merchants misplaced $14.76 million. Ethereum adopted carefully behind, contributing $39.85 million to the general liquidation.

Different property comparable to Solana, LINK and ORDI additionally skilled liquidations of $10.14 million, $5.93 million and $4.81 million respectively.

Amongst numerous exchanges, Binance has the best liquidation ratio at 43.13%, totaling $79.42 million. Different platforms comparable to OKX and ByBit noticed liquidations of $58.29 million and $18.73 million respectively.

It’s value noting that a very powerful liquidation order occurred for LINKUSD on Bitmex, with an quantity of $3.14 million.