Ki Younger Ju, founding father of crypto evaluation platform CryptoQuant, predict There shall be a severe Bitcoin “vendor liquidity disaster” within the subsequent six months. The founders consider that on this case, not solely will costs rise to new ranges, exceeding expectations, however the disaster will most certainly result in market disruption.

Bitcoin hits all-time excessive

Following a pointy value improve on March 11, Bitcoin is presently buying and selling at an all-time excessive. Bitcoin surged to a brand new all-time excessive of $72,800 earlier than cooling again to identify ranges.

Though upward momentum is waning as costs transfer horizontally at time of writing, the uptrend stays. Because of this, extra merchants anticipate BTC to fall again above yesterday’s highs as bulls goal a seven-figure value of $100,000. Technical and basic analysts say that if bulls break by means of this psychological quantity, it is going to be a key turning level for Bitcoin.

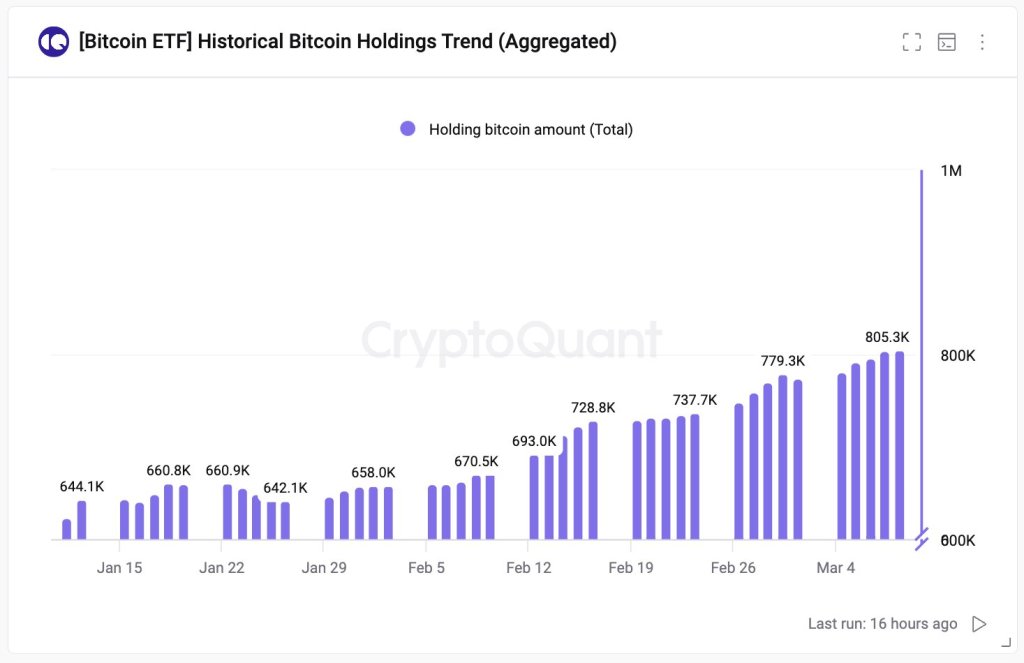

The founders anticipate Bitcoin costs to blow up throughout the subsequent six months, primarily on account of two elements. Ju identified that the primary is the huge inflow of institutional demand by means of spot Bitcoin exchange-traded funds (ETFs). Up to now, analysts have linked Bitcoin’s present rise to institutional demand.

Final week, Ju noticed a internet influx of over 30,000 BTC. This implies establishments are taking extra cash out of circulation at unprecedented ranges, exacerbating shortage. Establishments and rich people can acquire publicity to BTC by means of spot ETFs with out proudly owning it instantly.

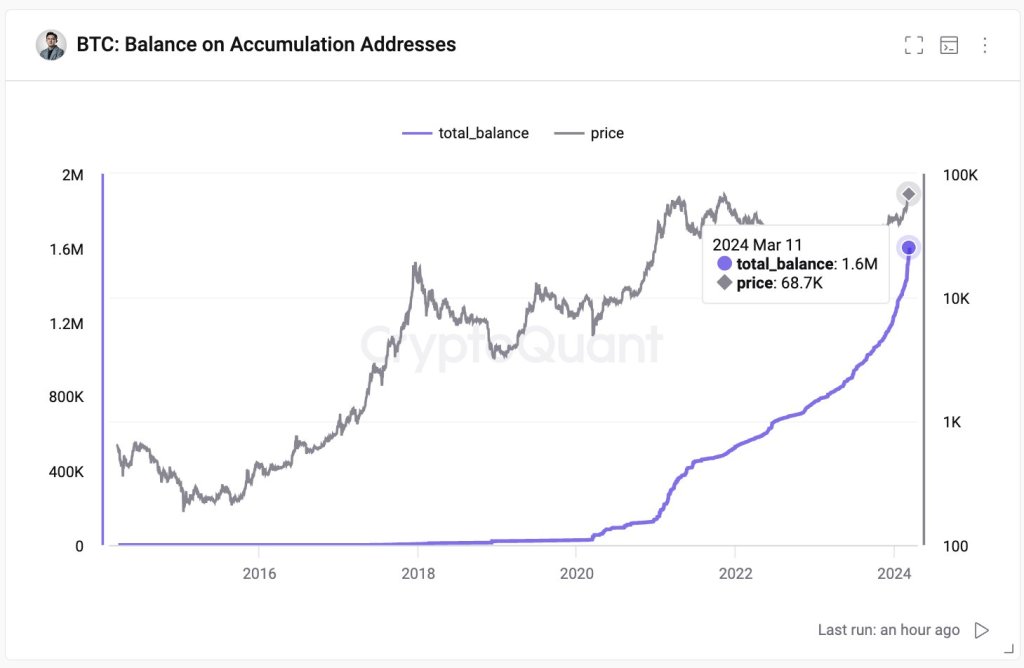

Past this, there may be concern concerning the restricted variety of tokens held by centralized exchanges and identified entities, particularly miners. The founders estimate that exchanges and miners maintain roughly 3 million Bitcoins. Ju defined within the submit that entities in america maintain 1.5 million Bitcoins.

Anticipated Bitcoin Shortage Disaster

The founder identified that the rising demand for spot ETFs and the restricted provide will trigger a “sell-side liquidity disaster” inside six months. This example might lead to not sufficient sellers to fulfill the excessive demand from consumers, additional pushing costs to new ranges.

The Bitcoin community will minimize miner rewards in half from the present 6.125 BTC in April. Because of this, Bitcoin emissions will fall, that means solely a small quantity of Bitcoin shall be launched into circulation, worsening the scenario additional.

Subsequently, if present demand ranges maintain and establishments proceed to double down, the anticipated shortage disaster might trigger important disruption to the market, benefiting token holders.

Function photos are from DALLE, charts are from TradingView

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is strongly recommended that you just conduct your individual analysis earlier than making any funding resolution. Use of the knowledge offered on this web site is totally at your individual threat.