Knowledge reveals that as Bitcoin skilled volatility, the cryptocurrency futures market noticed as a lot as $700 million in liquidations over the previous day.

Bitcoin value has moved sharply over the previous 24 hours

The previous day has been a little bit of a rollercoaster for Bitcoin, with the asset seeing wild value strikes in each instructions however in the end rising because the bulls prevailed.

The chart beneath reveals the cryptocurrency’s latest value motion.

The value of the asset appears to have loved sharp bullish momentum just lately | Supply: BTCUSD on TradingView

As you may see from the chart, Bitcoin initially noticed some sturdy bullish momentum, not solely breaking by means of the $60,000 stage but in addition hitting the $64,000 mark.

Nevertheless, this excessive level (the very best thus far this 12 months) solely lasted a brief time frame, with Bitcoin falling considerably beneath the $59,000 mark. The asset has since recovered to greater ranges and is at present buying and selling round $62,700.

The remainder of the cryptocurrency house has additionally skilled volatility, with costs of varied tokens fluctuating. As is often the case with such dramatic value strikes, the futures market suffered a number of liquidations.

Cryptocurrency futures market skilled squeeze over the previous day

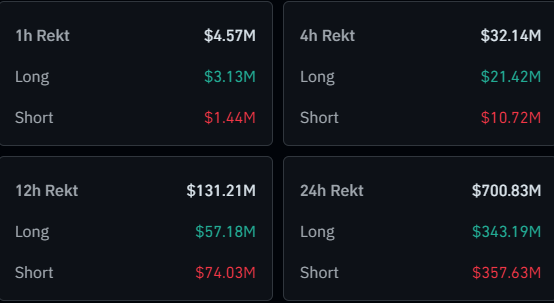

Knowledge from CoinGlass reveals that over the previous 24 hours, greater than $700 million price of contracts have been liquidated within the cryptocurrency futures market.

The desk beneath reveals related details about liquidations.

An enormous quantity of liquidations seem to have occurred previously day | Supply: CoinGlass

It seems that solely $131 million of liquidations occurred inside 12 hours, suggesting that almost all flushes occurred inside the first half of the day. This is sensible as Bitcoin is most unstable throughout this window.

And, regardless of the value good points over the previous day, the long-short ratio on this liquidation occasion seems to be pretty balanced. This means that there was some aggressive need as Bitcoin approached $64,000, with the following pullback wiping out these prime patrons.

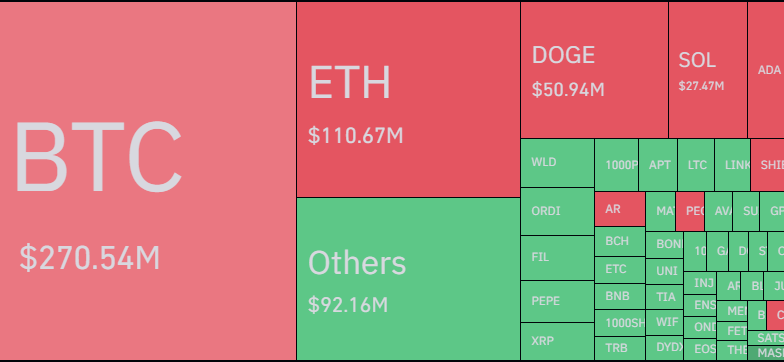

The next desk reveals how this distribution finds numerous symbols.

Appears like BTC has topped the charts as soon as extra | Supply: CoinGlass

As is mostly the case, Bitcoin futures contracts as soon as once more accounted for the biggest portion of complete market liquidation, contributing roughly $270 million.

The distinction this time, nevertheless, is that this share, whereas the biggest, is lower than half of the full liquidations. This will likely come right down to the truth that speculators could now be toying with altcoin positions after gaining confidence from Bitcoin’s value surge.

Dogecoin was the very best performer among the many prime cash, gaining 34% and accounting for the biggest share amongst altcoins, with liquidations approaching $51 million.

Featured picture by way of Unsplash.com, André François McKenzie at CoinGlass.com, chart by way of TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is strongly recommended that you simply conduct your personal analysis earlier than making any funding choices. Use of the data supplied on this web site is completely at your personal threat.