Demand for spot Bitcoin exchange-traded funds (ETFs) has surged since their approval on January 10, BlackRock’s IBIT Bitcoin ETFs are main the best way. The ETF reached the spectacular milestone in lower than two months, attracting enormous investor curiosity and opening the door for numerous market gamers to straight spend money on the most important cryptocurrency.

As institutional and retail buyers flock to those new funding automobiles, market specialists are predicting bullish tendencies and anticipating potential value surges.

Bitcoin ETF craze

in accordance with Bloomberg ETF professional Eric Balchunas says BlackRock’s IBIT Bitcoin ETF has shortly joined the esteemed “$10 billion membership,” reaching that mark sooner than some other ETF, together with Grayscale Bitcoin Belief (GBTC) milestone, noting that solely 152 of three,400 ETFs have exceeded $10 billion. crucial level.

Balchunas identified that the primary purpose for IBIT to hitch this membership is the big influx of funds, accounting for 78% of its whole funds. Handle property (AUM). This displays rising curiosity in Bitcoin publicity amongst buyers looking for diversified and controlled funding choices.

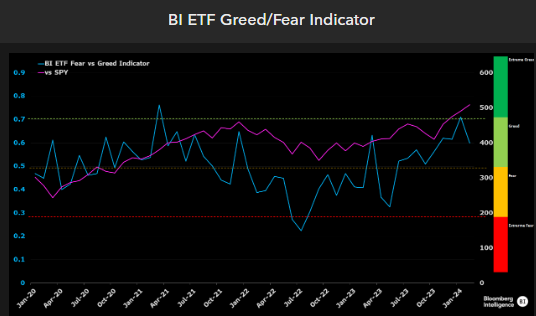

Specifically, the present trajectory of the ETF market paints an image of market resilience and bullish sentiment.truthful ETF flows, Balchunas famous that leverage buying and selling ranges are a optimistic indicator, though they haven’t but reached the extent of optimism for 2021.

Nonetheless, Bloomberg’s new BI ETF Greed/Worry IndicatorA mix of knowledge highlights the optimistic outlook for ETF buyers, as proven within the chart beneath.

Relating to this matter, cryptocurrency analyst “Chain Academy” went to social media X (previously Twitter) emphasize The massive demand for Bitcoin is evidenced by its speedy exit from exchanges.

In its evaluation, On-Chain School highlighted that Bitcoin ETF purchases had been roughly ten occasions the each day buying and selling quantity. Mining Bitcoin. on the identical time, The upcoming halving occasion will additional cut back mining provide. Analysts predict when demand will exceed out there provide, resulting in potential upward stress on costs.

Highest month-to-month shut since 2021

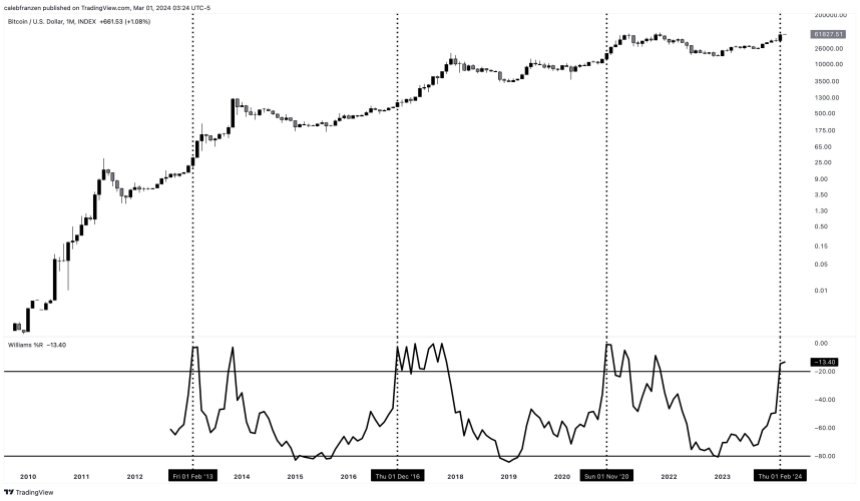

Bitcoin’s current market efficiency has caught the eye of wealth supervisor Caleb Franzen, who emphasize The significance of the very best month-to-month shut since October 2021.

Franzen additional emphasised the bullish momentum, noting that the 36-month Williams %R oscillator closed above overbought stage Solely the fourth time in historical past. Historic knowledge reveals the returns from such indicators are spectacular, suggesting the potential for important features within the coming months.

As well as, Franzen additionally identified that market dynamics are altering with the rise in institutional participation and the comfort of retail buyers coming into the market by means of ETFs.

Franzen made a compelling case for the bullish nature of the overbought sign, urging market members to view it as a momentum indicator quite than a fading sign. Earlier situations of overbought indicators have resulted in important value appreciation for Bitcoin:

- February 2013: 3,900% development in 9 months

- December 2016: 1,900% development in 12 months

- November 2020: 260% development in 12 months

Franzen acknowledged that there are diminishing returns each cycle, however he highlighted the unprecedented stage of institutional participation and the convenience of retail investing by means of ETFs.

Even when Bitcoin matches the +260% achieve from the November 2020 sign, its value will attain $180,000, surpassing Franzen’s lowest value cycle goal $175,000.

Lastly, Franzen famous that bull markets are usually characterised by rising ETHBTC ratios and falling BTC.D (Bitcoin Dominance). Whereas these traits have but to totally emerge, Franzen stated a multi-quarter rebound within the broader cryptocurrency market could also be on the horizon.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It’s endorsed that you simply conduct your individual analysis earlier than making any funding choice. Use of the knowledge offered on this web site is completely at your individual threat.