The talk surrounding Bitcoin’s (BTC) potential market share relative to gold has attracted widespread consideration lately, with the current approval of Bitcoin trade traded funds (ETF) might deliver Bitcoin considerably nearer to gold on key metrics.

Jurrien Timmer, world director of macro at Constancy Investments, offered an evaluation that sheds some gentle on this theme. By analyzing the worth of “financial gold” and Bitcoin’s market capitalization, and contemplating the influence of the halving on Bitcoin’s provide, Timmer presents insights into the longer term dynamics of each belongings.

Gold and Bitcoin

Timmer’s analyze It begins by estimating the share of gold held by central banks and personal traders for financial functions, excluding jewellery and industrial makes use of. Though this estimate will not be correct, in line with the World Gold Council, Timmer stated that financial gold accounts for about 40% of the full gold on the planet.

Based mostly on his earlier calculations, Thiemer believes Bitcoin has the potential to seize a few quarter of the market. forex gold marketand The worth of financial gold is roughly $6 trillion, and the market cap of Bitcoin is $1 trillion.

Timmer additional delved into the influence of Bitcoin’s halving on its value. Traditionally, halvings have had a major influence on the worth of Bitcoin. Nevertheless, Timmer posited that there could also be diminishing returns sooner or later because the incremental provide of latest Bitcoins decreases.

By evaluating Bitcoin’s excellent and incremental provide to gold, Timmer demonstrated that Bitcoin’s affect is waning. halved It might turn out to be extra apparent sooner or later.

Because the variety of cash that may be mined decreases, the influence of every subsequent halving occasion on Bitcoin’s value is prone to diminish. This perception prompted Timmer to discover various strategies of predicting Bitcoin’s value trajectory.

BTC Worth Prediction

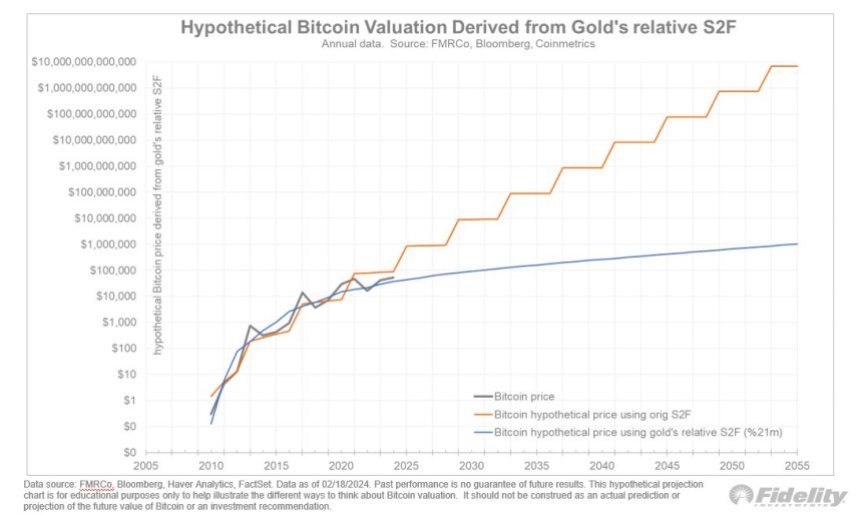

To deal with the difficulty of the waning influence of the halving, Timmer launched the idea of a modified Inventory-to-Stream (S2F) curve. This curve is derived by superimposing the asymptotic provide curve onto the unique S2F curve, which represents the proportion of cash mined relative to the ultimate provide cap.

Timmer recommended utilizing a regression system that takes as impartial variables the unique S2F curve and the asymptotic provide curve of PlanB.The modified S2F curve is extra according to provide Gold informationreflecting the state of affairs that Bitcoin’s shortage benefit continues to exist, however its influence on value regularly weakens over time.

Utilizing a modified S2F mannequin and contemplating the availability traits of gold, Timmer generates the speculation value prediction By the top of 2024, the value of Bitcoin will attain roughly $100,000.

Timmer stated that if Bitcoin captured 1 / 4 of the financial gold market, it will characterize a major shift in world wealth distribution, which might regularly drive up the value of cryptocurrencies within the coming years.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is strongly recommended that you just conduct your individual analysis earlier than making any funding choice. Use of the knowledge offered on this web site is solely at your individual danger.