The next is an excerpt from the most recent version of Bitcoin Journal Professional, Bitcoin Journal’s premium market e-newsletter. To be among the many first to obtain these insights and different on-chain Bitcoin market evaluation straight into your inbox, Subscribe now.

Because the Hong Kong Bitcoin ETF looms, new functions are coming from an sudden supply: a few of mainland China’s largest conventional asset managers.

Hong Kong’s new ETF has been within the works for months and has attracted appreciable curiosity from the worldwide digital asset sector. Its bodily technology mannequin will not be solely utterly completely different from the favored Bitcoin spot ETF fashion in america, however can also be an necessary foothold for East Asia to simply accept ETFs. The overall belongings below administration (AUM) of authorised Hong Kong futures ETFs exceeded the US$100 million mark in February, whereas spot ETFs have carried out higher in each nation the place they’ve been authorised. Hong Kong can be an ideal candidate for this market’s new testing floor because of the massive capital funding and wealthy worldwide monetary connections on this financial area.

Nevertheless, even essentially the most optimistic interpretations of the state of affairs didn’t predict the emergence of latest gamers on this discipline. As of late March 2024, numerous Hong Kong capital corporations have expressed some type of curiosity in launching their very own ETFs, however only some capital corporations have truly submitted formal functions. This example modified basically on April 8, when a collection of huge names from mainland China got here on stage. Harvest Fund, with a complete administration scale of greater than 230 billion US {dollars}, and Southern Fund, with a administration scale of greater than 280 billion US {dollars}, each submitted functions by their Hong Kong subsidiaries. Individually, native media reported {that a} unit of China Asset Administration, which has $270 billion in belongings below administration, has entered into an unspecified partnership with an current Bitcoin ETF supplier within the metropolis.

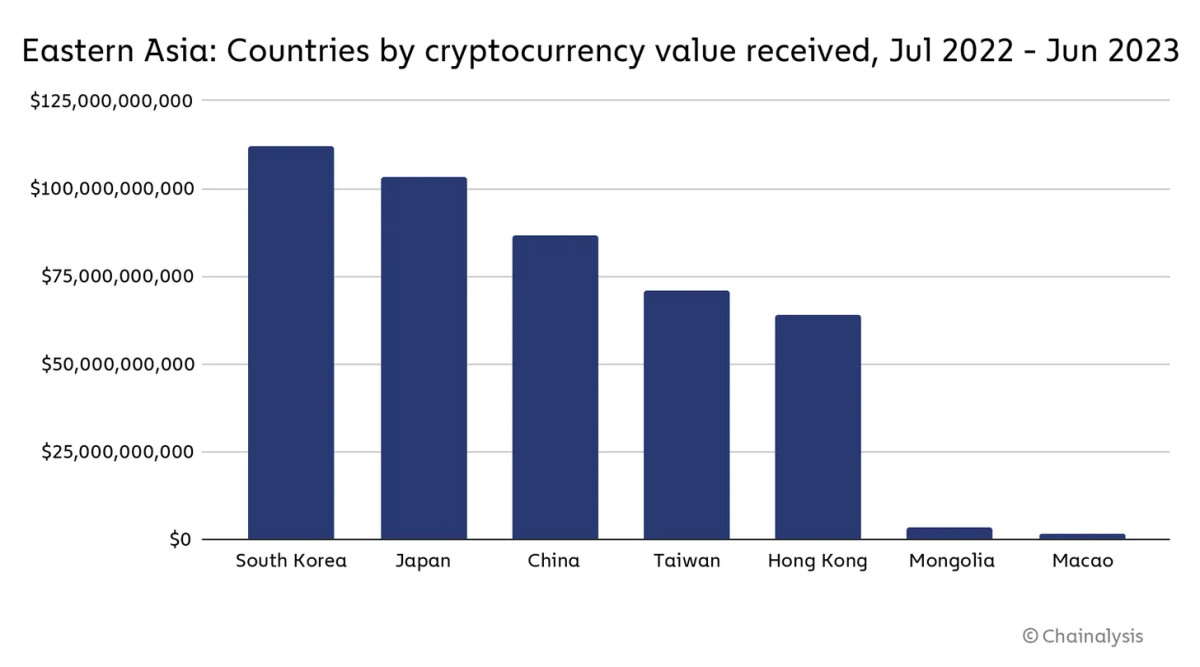

Contemplating that the ETF hype within the US market has proven indicators of waning, this information is undoubtedly refreshing. Even when U.S. ETF issuers like BlackRock or Constancy have trillions in belongings below administration, the sudden emergence of those multi-billion greenback corporations can’t be underestimated. Nevertheless, it does elevate the query of how easily the interplay between these mainland corporations and Hong Kong’s monetary regulators can truly work. Isn’t Bitcoin banned in China? Use by Chinese language residents virtually solely underground? How lengthy can such a partnership truly final? It seems that the blanket ban on Western media was exaggerated. In spite of everything, if Bitcoin was purely contraband in China, why would Chainaanalysis report $90 billion price of transactions in a single 12 months?

To make sure, mainland China has taken a more durable stance on Bitcoin lately. After the Bitcoin mining ban was carried out in 2021, one of many world’s largest mining facilities dried up virtually in a single day. Nevertheless, the obvious crackdown has opened many home windows for the market. In essence, the principle objective of the Chinese language authorities is to lift the obstacles to entry and make it extra annoying and troublesome for atypical residents to proceed to enter this market. Moreover, with many reputable companies unable to function, Bitcoin holders in China have been given an implicit warning: “In case you are scammed, don’t anticipate our assist or sympathy.” Nonetheless, savvy followers have discovered methods to proceed Utilizing their leaderless forex strategy, these quiet transactions are apparently price billions of {dollars}.

It is this ambiguity that makes these new ETF developments so encouraging. China’s three largest asset administration corporations have signed on to the undertaking, which isn’t any small dedication; if these corporations turn out to be ETF issuers, they are going to be concerned in a enterprise with report buying and selling volumes and widespread worldwide curiosity. This isn’t the primary time that Chinese language capital corporations have invested closely in Bitcoin-related corporations, however the mining {hardware} in distant Ethiopia could be very completely different from the monetary devices in authorized Chinese language cities. With this leap, these corporations have discovered a solution to legally entangle themselves with the Bitcoin world, and that entanglement will primarily contain even Chinese language residents.

This transfer may present traders and regulators that the Bitcoin world is nothing to be afraid of, however quite a really thrilling alternative. The above-mentioned bodily mannequin in Hong Kong signifies that new patrons should change custodial Bitcoin for corresponding shares within the ETF, quite than simply shopping for with fiat forex. In different phrases, there will probably be an simple direct hyperlink between a distinguished nationwide enterprise and an trade that operates largely out of sight. Might this connection persuade Chinese language officers that Bitcoin has a spot in China? Will ETF issuers attempt to exert affect and foyer for Bitcoin to re-enter the authorized system? How will the complicated relationship between China and Hong Kong have an effect on the general association?

So far as Hong Kong’s preparations go, they look like very dedicated to their dream of making a regional cryptocurrency hub. Not solely are native banks more and more receptive to the whole digital asset house, however that is minor information in comparison with the information from HashKey World. South China Morning Put up It was reported on April 8 that HashKey Group, an change headquartered in Hong Kong that solely trades Bitcoin and Ethereum, has launched a brand new “world” plan with an change primarily based in Bermuda. HashKey introduced the plans on the Web3 Competition, and the Bermuda operation will probably be simply step one in an formidable endeavor: the long-term hope is to “surpass the buying and selling quantity of US crypto large Coinbase inside 5 years.” Very demanding.

Nevertheless, chief working officer Livio Weng would not appear significantly apprehensive, telling postal “We have seen their knowledge and we do not suppose it will likely be troublesome.” He added that the majority world opponents are both “simple to make use of however not compliant” or “compliant however troublesome to make use of,” and that the challenges of Chinese language regulation have given his firm an enormous benefit on this space. It is troublesome to offer sensible and engaging companies to prospects whereas sustaining regulatory compliance, so looser restrictions world wide will make HashKey a giant fish in a small pond. For instance, the Bermuda Trade is able to supply practically 20 extra digital belongings than the unique Hong Kong Trade. Chinese language residents residing abroad are additionally a transparent goal group.

This type of enthusiasm is definitely a daring assertion within the Bitcoin world! Even in such a chaotic market, the reigning champion of the change trade is not going to be simply toppled. Nevertheless, different attendees on the Web3 Competition reportedly echoed this confidence, as the whole group is pinning its hopes on a rising Bitcoin worth. Mainland corporations have proven an actual willingness to enter the Bitcoin world by Hong Kong, and current corporations in Hong Kong are assured that they are often price billions of {dollars} within the quick time period. Is it actually that troublesome to think about that success right here may change the whole paradigm in China?

It’s for these causes that the upcoming Bitcoin ETF in Hong Kong is eagerly anticipated by world observers. New variations on the identical monetary instrument might shake up the whole paradigm and convey vitality to worldwide ETFs. Nevertheless, if China reverses its hostility towards Bitcoin, frankly, that might trigger extra bother than the spot ETF itself. It’s for these causes that we must always watch developments on this space rigorously, as its results are more likely to reverberate not directly. All indicators are bullish for Bitcoin and the following massive alternative could also be across the nook.