Cryptocurrency lengthy holders suffered $365 million in liquidations over the previous day as Bitcoin costs fell beneath $66,000, information exhibits.

Cryptocurrency derivatives markets have seen huge liquidations at this time

In accordance with information from CoinGlass, the derivatives facet of the cryptocurrency market has suffered some main liquidations over the previous day, after belongings resembling Bitcoin skilled volatility.

When the contract losses attain a sure degree, the contract shall be “liquidated”, inflicting the derivatives alternate to forcibly shut the place.

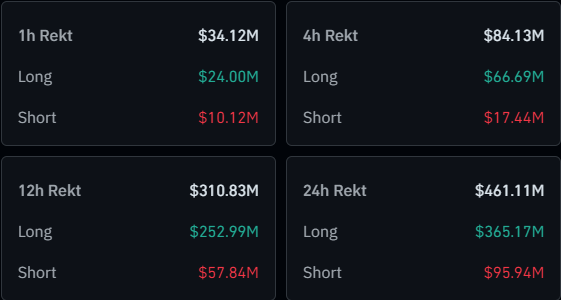

The next desk exhibits info on liquidation occasions that occurred within the cryptocurrency discipline within the final day:

Appears like a considerable amount of liquidations have occurred throughout the previous 24 hours | Supply: CoinGlass

As proven within the chart above, complete market liquidations prior to now 24 hours exceeded $461 million. 144,049 merchants participated on this liquidation, and the biggest single liquidation quantity exceeded US$7 million.

It seems that lengthy traders had been the primary to bear the brunt of the liquidation, with $365 million value of such contracts being liquidated. Which means practically 80% of complete liquidations concerned these merchants betting on bullish outcomes.

Worth motion throughout the business has been adverse over the previous day, with Bitcoin down practically 6%. So it is not stunning to see huge liquidations over the long run.

Giant-scale liquidation occasions are also known as “squeezes.” Because the previous day’s occasions had been dominated by bulls within the sector, the squeeze can be labeled as a “lengthy squeeze.”

Throughout a squeeze, sharp worth swings can result in huge liquidations, which can solely exacerbate additional worth swings. This amplified transfer results in extra liquidations, which unleashes a cascade of liquidations.

A lot of the newest flushes have occurred prior to now 12 hours alone, with $310 million liquidated in that window. This once more corresponds to cost motion, as Bitcoin and different currencies are probably the most unstable throughout this era.

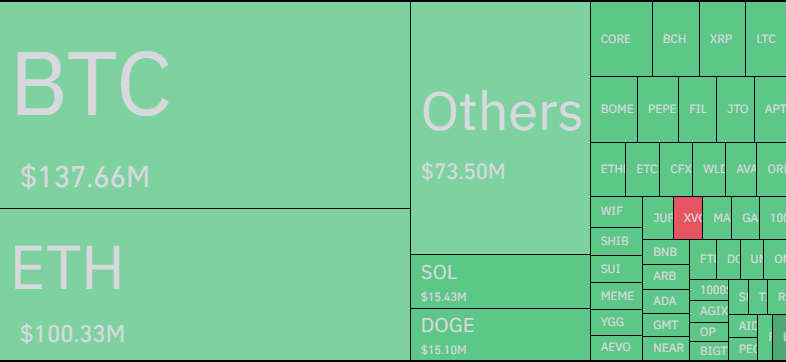

As for a way every image causes a squeeze, the desk beneath breaks it down:

The breakdown of the liquidations in line with image | Supply: CoinGlass

Bitcoin has the biggest share of liquidations at $137 million, whereas Ethereum (ETH) is in second place at $100 million. Amongst altcoins, Solana (SOL) and Dogecoin (DOGE) high the record with roughly $15 million in liquidations every.

Large liquidations like at this time aren’t unusual within the cryptocurrency area, as cryptocurrencies are sometimes extremely unstable and plenty of platforms supply easy accessibility to extraordinarily excessive leverage.

As a consequence of these components, uninformed buying and selling in derivatives within the cryptocurrency market can show to be very dangerous.

bitcoin worth

Bitcoin plunged all the way in which to the $65,200 degree after its newest retracement.

The worth of the asset seems to have gone by means of some important decline prior to now day | Supply: BTCUSD on TradingView

Featured photos from Shutterstock.com, CoinGlass.com, charts from TradingView.com