10x Analysis’s Markus Thielen unveils main shift in his cryptocurrency technique in response to rising monetary stress and market instability, buyers element notes Posted earlier in the present day. Thielen, an influential determine within the analytics trade, cited a worrying outlook for threat property, together with know-how shares and cryptocurrencies, pushed largely by surprising and protracted inflation charges.

based on predict Financial institution of America predicts that by the point of the November 2024 election, the general U.S. CPI inflation charge will attain 4.8%. Previously three months, the CPI quarterly inflation charge has averaged 0.4%. Accelerating at this tempo means rates of interest will likely be greater than double the Fed’s 2% inflation goal by November.

Why 10x Analysis is promoting (nearly) all cryptocurrencies and threat property

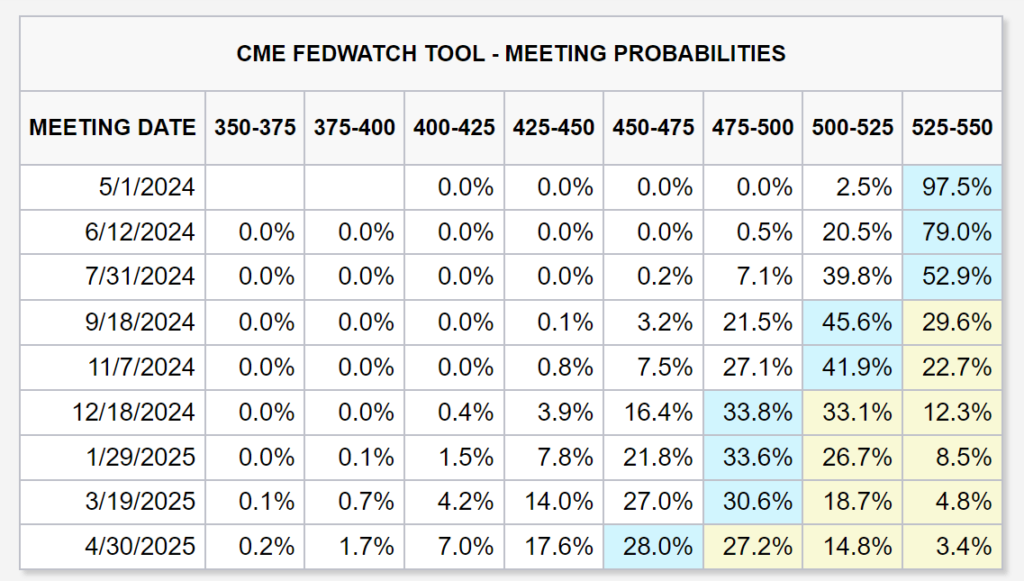

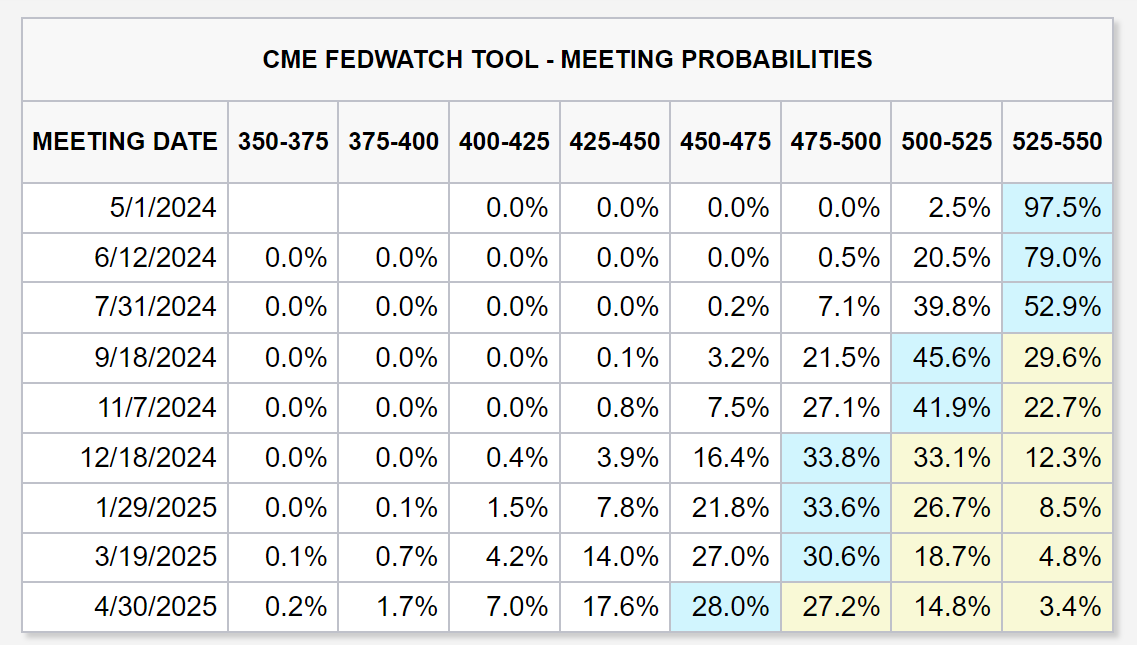

In gentle of this, antagonistic modifications in financial indicators prompted 10x Analysis’s choice to divest dangerous property. Notably, the U.S. bond market now expects the Federal Reserve to chop rates of interest lower than 3 times this 12 months, a major revision from earlier extra optimistic forecasts. In keeping with the CME FedWatch device, most market individuals presently imagine the Fed will minimize rates of interest earlier than the FOMC assembly in mid-September.

As well as, the 10-year Treasury yield peaked at 4.61% this month, the very best degree since November 2023, additional complicating the funding atmosphere for threat property together with know-how shares and cryptocurrencies.

“We’re more and more involved that threat property are teetering getting ready to a major value correction,” Thielen stated within the report. “We offered all of our tech shares final night time because the Nasdaq traded very poorly and weighed on bond yields. Rising response. We solely maintain a couple of high-conviction cryptocurrencies. Total, we’re bearish on threat property.

The disappointing efficiency of the U.S.-listed spot Bitcoin ETF additional helps the bearish stance. Whereas the SEC’s approval of almost a dozen such ETFs in January initially spurred a surge in Bitcoin costs, capital inflows have slowed considerably. This month, the five-day common web inflows into these ETFs plummeted to zero, in stark distinction to the almost $12 billion that flowed into these funding autos earlier this 12 months.

Thielen’s feedback additionally addressed the broader implications of the Bitcoin community’s upcoming quadrennial halving on April 20. BTC. Whereas traditionally such halvings have spurred bullish sentiment and value will increase as a result of perceived shortage of Bitcoin, Thielen stated present market situations may dampen any potential rally.

“It’s vital to know that buying and selling is an ongoing sport, stuffed with compelling alternatives. The bottom line is to repeatedly analyze the market and spot alternatives after they work in your favor. Typically we advocate a full-risk strategy, And the precedence is to guard your capital so you possibly can make the most of lower-level alternatives,” Thielen stated.

In a noteworthy trade with Ryze Labs’ Matthew Graham, Thielen defended his firm’s buying and selling technique after it was criticized for erratic decision-making. Graham pointed to current fluctuations in 10x Analysis’s stance on Bitcoin, citing an early April analysis report that predicted Bitcoin may rally to $80,000, adopted by a extra cautious view and up to date sell-off.

Thielen responded“Truly, no. We’ve got been cautious since March 8, and when the triangle breakout failed, we positioned a cease loss at $68,300. That is merely a risk-reward commerce. This defensiveness highlights the character of cryptocurrency buying and selling Volatility and the necessity to undertake agile methods to reply to quickly altering market situations.

Thielen concluded, promising a powerful return to the market below extra favorable situations: “Will purchase again with each arms at 52,000 – promised.”

At press time, BTC was buying and selling at $63,045.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for academic functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is strongly recommended that you just conduct your individual analysis earlier than making any funding choices. Use of the data supplied on this web site is solely at your individual threat.