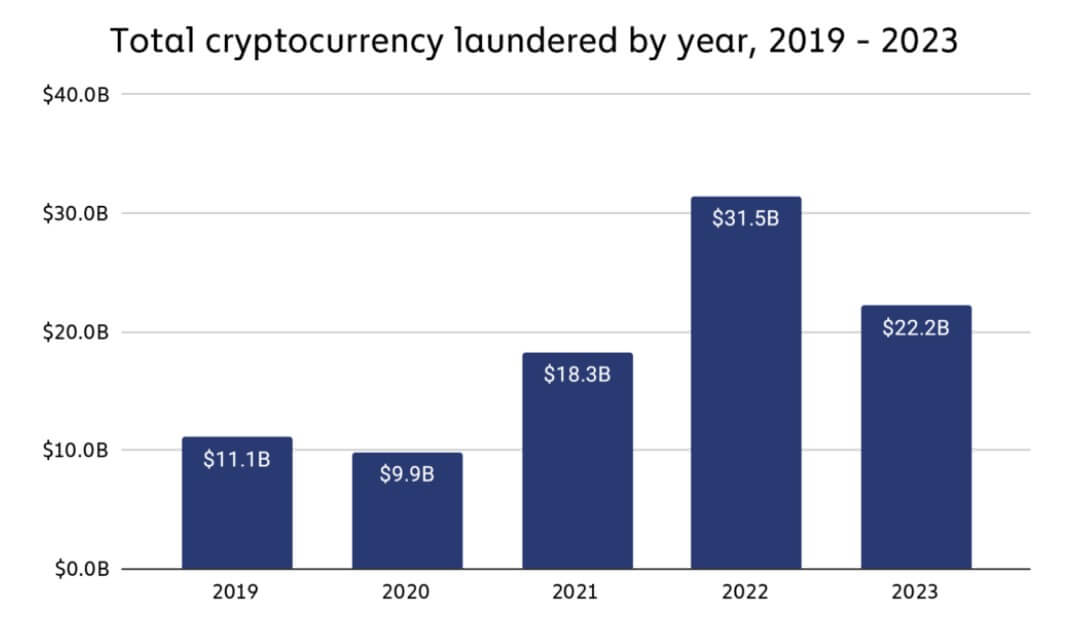

Cryptocurrency cash laundering exercise dropped considerably by 29.5% in 2023 in comparison with the earlier 12 months, primarily as a consequence of a lower in total cryptocurrency buying and selling quantity.

Based on a report by Chainaanalysis, illicit addresses transferred roughly $22.2 billion in digital property to numerous crypto providers in 2023, a major lower in comparison with the $31.5 billion transferred in 2022. This decline is in keeping with a 14.9% lower in authorized and unlawful crypto buying and selling volumes.

Regardless of a transparent enhance in prison funds flowing to playing providers and bridging protocols, centralized exchanges stay the first vacation spot for funds from illicit addresses.

Particularly, 109 trade addresses every obtained greater than $10 million from unlawful sources, totaling $3.4 billion in 2023, a major enhance from the $2 billion obtained by 40 addresses in 2022. Likewise, 1,425 trade addresses obtained over $1 million every, totaling roughly $6.7 By 2023, the quantity will attain 542 addresses, and in 2022 it can attain $6.3 billion.

In the meantime, funds from illicit addresses to bridging protocols surged from $312.2 million in 2022 to $743.8 million in 2023.

“Change technique”

Chainaanalysis famous that subtle cryptocriminals with on-chain cash laundering abilities, such because the infamous North Korea-backed hacker Lazarus Group, are adapting their cash laundering methods and profiting from new providers equivalent to cryptocurrency mixers and cross-chain bridges.

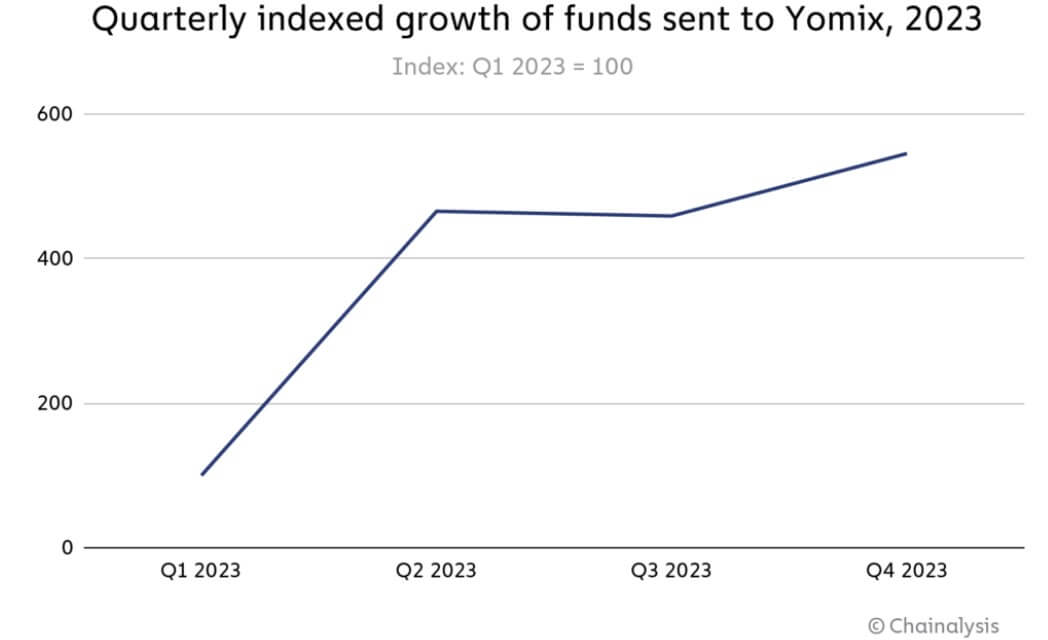

For context, regulatory strain on cryptocurrency mixing providers like Sinbad and Twister Money pressured Lazarus Group to pivot its cash laundering technique to YoMix, A New hybrid service supplier.

Based on Chainaanalysis, this shift resulted in YoMix seeing a major enhance in exercise final 12 months, with its inflows growing greater than fivefold. Moreover, practically a 3rd of YoMix’s inflows could be traced to wallets linked to cryptocurrency hacks.

Chainaanalysis concluded: “The event of YoMix and its reputation with the Lazarus Group is a major instance of the power of skilled gamers to adapt and discover various obfuscation providers when beforehand standard obfuscation providers are shut down.”

Moreover, North Korea-backed hacking teams have been noticed to be among the many commonest cryptocurrency criminals using cross-chain bridges for cash laundering actions.