The next is an excerpt from the newest version of Bitcoin Journal Professional, Bitcoin Journal’s premium market publication. To be among the many first to obtain these insights and different on-chain Bitcoin market evaluation immediately into your inbox, Subscribe now.

Enterprise capital agency Digital Forex Group has filed a movement to dismiss a prison criticism filed in opposition to it by the New York Lawyer Basic’s Workplace.

The authorized battle between DCG and NYAG has been occurring for months and is immediately entangled with disputes between two different outstanding cryptocurrency corporations: Genesis (a now-defunct brokerage) and Gemini (an alternate and financial institution ). The teams have been embroiled in a sequence of disputes over time involving dramatic adjustments in relationships and critical allegations of fraud. One significantly related twist in the entire scenario is that bankrupt Genesis had been a subsidiary of highly effective DCG, which manages billions of {dollars}’ price of belongings and counts ETF issuer Grayscale as simply one other subsidiary.

In different phrases, determining the background of all of the completely different gamers concerned here’s a fairly vital job, particularly given the fraught circumstances that at the moment exist. Not solely is the Lawyer Basic’s lawsuit an equal measure in opposition to DCG, Genesis, and Gemini, however Genesis and Gemini are additionally going through off in unrelated civil lawsuits. The NYAG accused the businesses in October 2023 of collectively defrauding buyers of greater than $1 billion, with mutual accusations making a chaotic environment. First, the current disclosures concerning the firing found in court docket paperwork are a superb place to start out. Particularly, court docket filings in March this 12 months publicly indicated that Genesis and Gemini have been contemplating a merger in 2022.

In 2022, DCG CEO Barry Silbert met with Gemini co-founder Cameron Winklevoss over lunch to debate merging the 2 company entities Some motivations and logistical problems with being collectively. On the time, Genesis was in critical hazard of chapter, and its substantial partnership with Gemini meant the fallout may hurt the opposite firm’s enterprise. Gemini offered vital funding to Genesis as a part of the Gemini Earn program, however Genesis has misplaced this system. Hedge fund Three Arrows Capital was managing the funds when FTX went bankrupt following the crash, leaving Genesis on the hook for $1 billion. As for the unique supply of those misplaced funds, NYAG alleges that the businesses defrauded buyers of the cash.

Through the assembly, Silbert made the gross sales pitch that the 2 firms ought to merge and that they “would develop into a large and compete with Coinbase and FTX.” He added that even when Genesis and Gemini cannot agree on these phrases, “there’s rather a lot Gemini and Genesis can do collectively, and the 2 firms ought to work collectively relatively than go their separate methods.” Though Winklevoss was allegedly “” within the proposed deal, it didn’t occur. Then friction arose as Genesis declared chapter.

There’s one specific level of friction within the aforementioned Gemini Earn partnership, which made headlines in February this 12 months when Genesis gained a court docket ruling in opposition to Gemini. Primarily, Genesis owned a portion of Grayscale Bitcoin Belief (GBTC) shares that have been promised to Gemini as collateral for a foreign money alternate between the 2 firms, however Genesis declared chapter earlier than the shares truly modified arms. As a result of GBTC is exclusive amongst Bitcoin spot ETFs in that it’s an present fund that was transformed into an ETF, the worth of the shares has soared to over $1.2B by early 2024. DCG’s possession of Grayscale and Genesis additional complicates the matter. Gemini objected to Genesis’s authorized proper to promote the shares it had promised years in the past, initiating a prolonged civil lawsuit.

Though the matter was resolved by way of a sequence of settlements that allowed Genesis to proceed with the sale and by which neither Genesis nor Gemini admitted guilt, the NYAG filed a criticism alleging that every one events concerned collectively dedicated vital fraud. Greater than a billion {dollars} are lacking, and the lawyer common’s workplace is bored with the finger-pointing between the events concerned. Even when Genesis may make sufficient cash from the sale to compensate buyers, that also would not remedy the issue of prison exercise. A concrete instance of a hostile setting was demonstrated when Genesis’ guardian firm, DCG, challenged Genesis’ personal settlement with NYAG.

So, that brings us to right now. On March 7, Silbert and DCG filed a movement to dismiss the lawyer common’s lawsuit, claiming that the allegations in opposition to the businesses have been fully baseless. Within the movement, DCG’s authorized crew claimed that “the allegations in opposition to DCG on this case are a skinny net of baseless insinuations, blatant mischaracterizations, and unsubstantiated conclusive statements. In an effort to seek out headline-worthy justification for the harm prompted to others, Scapegoat, OAG [Office of the Attorney General] Falsely makes an attempt to characterize DCG’s good-faith help of subsidiaries as partaking in fraud.” Specifically, they allege that DCG channeled funds to Genesis in good religion after Sanjian went bankrupt and “invested lots of of hundreds of thousands of {dollars} in further funding to its subsidiary within the months main as much as the chapter, though DCG was below no obligation to take action.” so”. The Lawyer Basic took a unique view, arguing that DCG’s internet contributions masked Genesis’ huge lack of funds at a important second: DCG withdrew the funds, Genesis declared a “liquidity crunch” and didn’t permit customers to withdraw cryptocurrencies, and Genesis went into fast chapter . Nevertheless, they’ve the burden of proof to show this was a deliberate misleading technique.

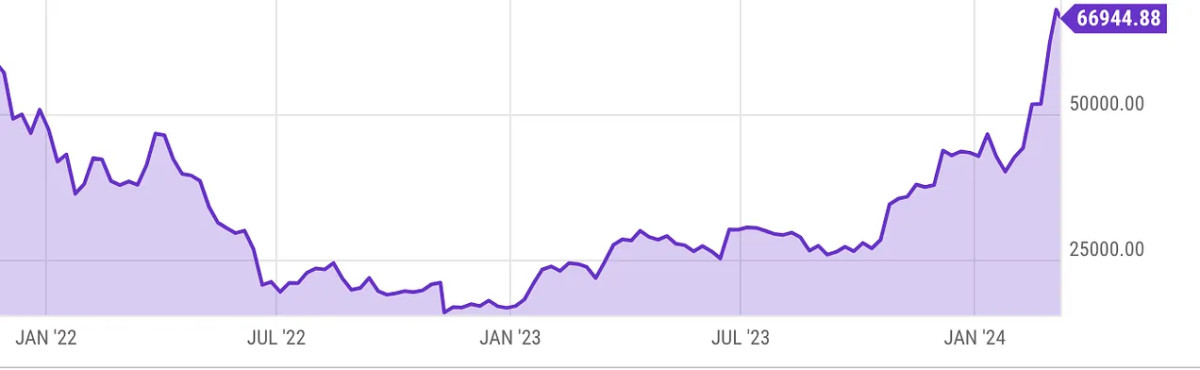

As of but, we now have no approach of understanding what the choose will take into consideration DCG’s protection or movement to dismiss, or whether or not a settlement is possible if the movement to dismiss is denied. Nevertheless, a transparent good signal has emerged from the troubled scenario: Gemini has introduced plans to completely repay allegedly defrauded customers of the Gemini Earn partnership in actual belongings. In different phrases, these customers had their Bitcoins stolen in 2022 and Gemini promised to pay them again, which is why the value of Bitcoin has risen since then. That provides one other $700 million to the value tag to repay greater than $1 billion in belongings, a transparent signal of the corporate’s confidence.

If nothing else, the choice to reimburse customers like this reveals the sincerity and goodwill of Gemini. Gemini is known as as a co-defendant in all authorized paperwork filed by Silbert’s authorized crew concerning the NYAG lawsuit and stands to profit considerably if the lawsuit is dismissed. This gesture of goodwill might not be sufficient to clear the way in which for DCG and Genesis, however it definitely will not harm anybody’s probabilities of escaping your complete fiasco with out a prison conviction. Though Gemini did not cease Genesis’ makes an attempt to acquire funds from GBTC gross sales, Gemini stays a profitable and outstanding alternate. Apparently, it was in a position to receive compensation of this magnitude with out counting on the GBTC portion.

How the lawsuit will play out within the coming months is anybody’s guess. When the NYAG first filed its criticism after the primary spherical of settlements, it was clear prosecutors have been bored with the acrimony of those former enterprise companions. Nonetheless, Gemini’s compensation plan definitely goes a great distance towards proving their intention to do the precise factor for his or her customers. If nothing else, it reveals that they’re taking this problem significantly and proactively. We must watch occasions unfold rigorously, however it’s clear that the mutual dislike and imply habits displayed thus far has not been reciprocated. The broader digital asset house has periodically been affected by shaky companies and outright scams, solely to ultimately crumble. Alternatively, Bitcoin’s success is respectable. When the mud settles, the most important winners may very well be defrauded customers who can have practically doubled their anticipated payouts because of the energy of Bitcoin itself. In comparison with these features, it is laborious to think about a rip-off that might be any higher.