Fast shot

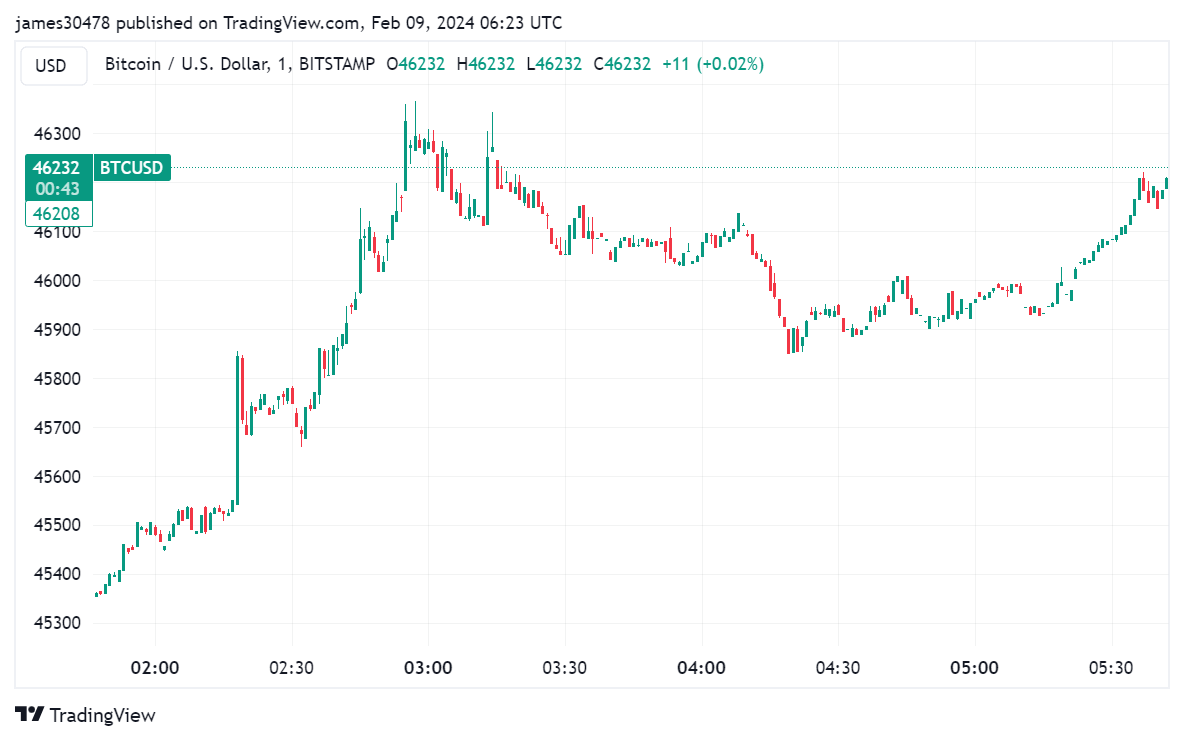

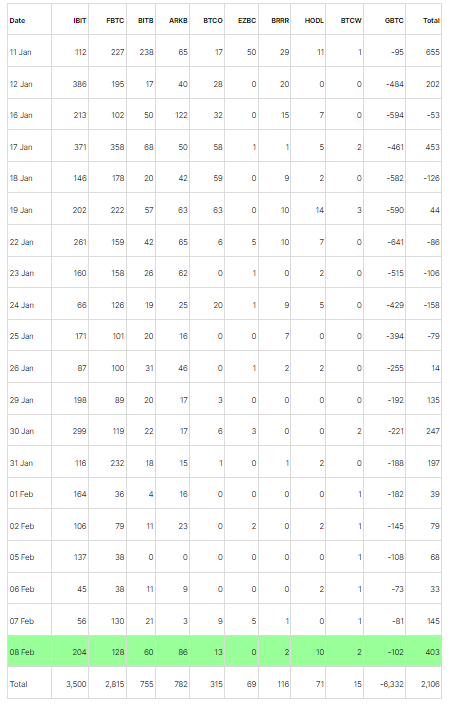

Farside Buyers information reveals that on February 8, Bitcoin ETFs skilled vital inflows, with a internet influx of US$403 million, the best stage since January 17. The rally additionally noticed Bitcoin break by way of the $46,000 threshold and peak above $46,300. The bullish pattern in varied ETFs is sort of robust. BlackRock’s IBIT topped the record with vital inflows of $204 million, bringing its whole internet inflows to a formidable $3.5 billion, in keeping with Farside Buyers.

Constancy’s FBTC additionally noticed vital progress, with internet inflows of $128 million, bringing the cumulative whole to $2.8 billion. Bitwise’s BITB ETF adopted swimsuit with internet inflows of $60 million, its finest single-day efficiency since January 17. Ark Funding’s ARKB had the second strongest efficiency, with internet inflows of $86 million, taking each BITB and ARKB’s whole internet inflows above the $750 million influx mark.

Nevertheless, it’s price noting that GBTC confronted a internet outflow of greater than US$100 million, leading to a cumulative internet outflow of US$6.3 billion. Nonetheless, whole buying and selling quantity throughout all Bitcoin ETFs is at present holding regular at $2.1 billion, indicating continued curiosity in these funding automobiles.

The publish Bitcoin Tops $46,000 Amid Surge in ETF Inflows to $403M appeared first on CryptoSlate.