Ethereum has been making new attempts at recovery recently. Here’s what on-chain data suggests as to whether this run is sustainable.

The growth and utility of the Ethereum network have been on the rise lately

According to data from on-chain analytics companies saintRecently, the ETH blockchain has shown encouraging trends in daily active addresses and network growth. These two metrics are used to track the effectiveness and growth of the chain.

The first, “Daily Active Addresses,” measures the unique number of addresses that participate in some type of transaction activity on the blockchain each day.

This number of unique addresses can be considered similar to the number of unique users participating in the network, and therefore the value of this metric can provide a hint about the intensity of traffic that Ethereum is currently witnessing.

Another interesting metric here, “Network Growth,” tells us the number of addresses making their first transaction on the blockchain every day.

Generally speaking, such new addresses correspond to new investors entering cryptocurrencies, so the value of network growth can provide a hint as to how the adoption of the asset is progressing.

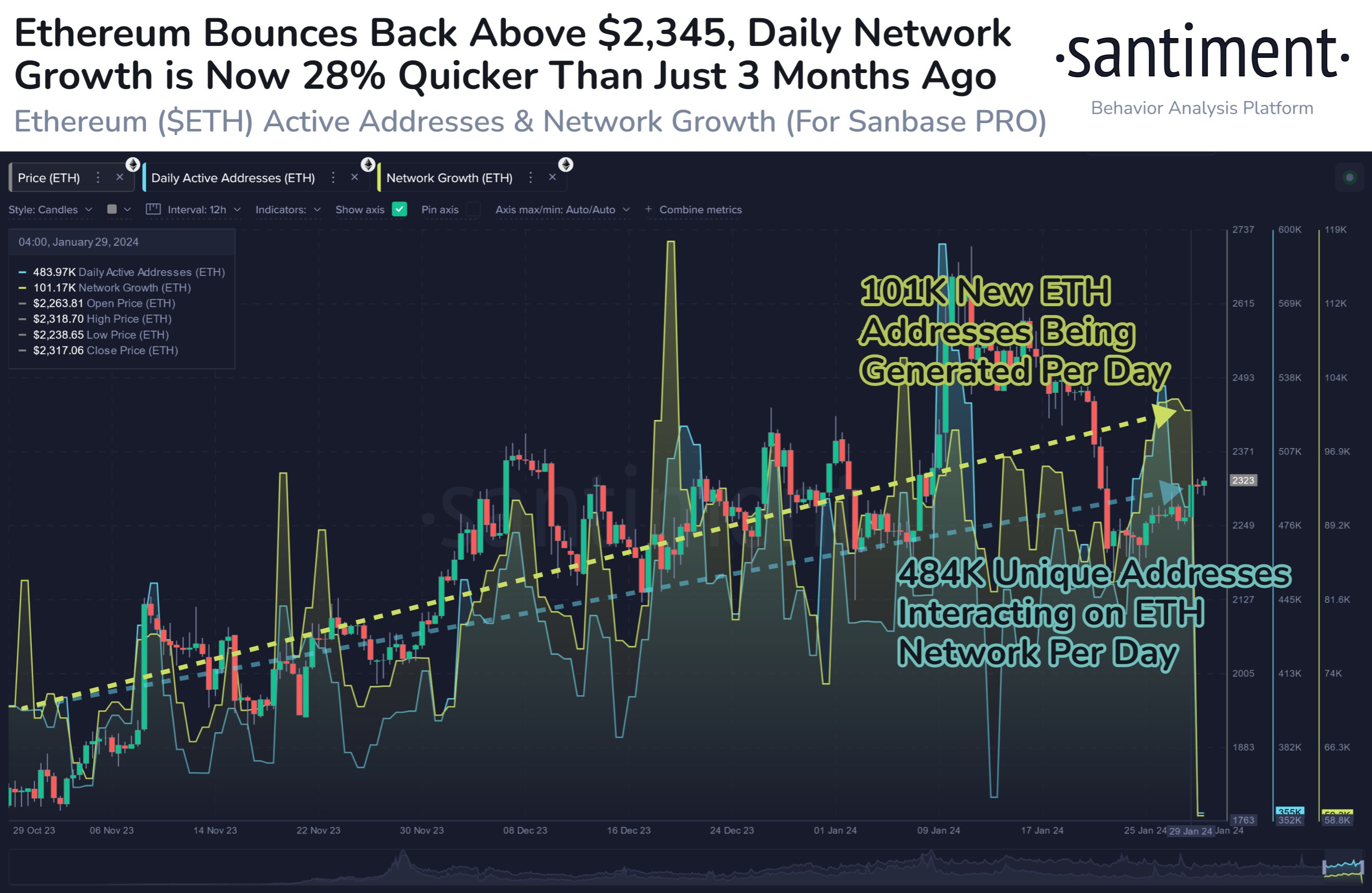

Now, the chart below shows the trend of Ethereum’s daily active addresses and network growth over the past few months:

Looks like both of these metrics have seen growth in recent weeks | Source: Santiment on X

As can be seen from the figure, Ethereum’s daily active addresses and network growth have been steadily increasing recently. Following the increase, the chain now sees 101,000 new addresses appearing daily, with 484,000 unique addresses transacting daily.

This shows that cryptocurrencies are seeing significant interest not only from existing users as they take action online, but also from new investors. Santiment noted: “Increased utility is the main pillar of ETH’s growing market capitalization.”

On-chain analytics firm Glassnode discussed the activity happening on the Bitcoin blockchain in its latest weekly report. Below is a chart shared by Glassnode that reveals the trend in the number of active entities at the original cryptocurrency’s 7-day moving average (MA):

The value of the metric appears to have been relatively low in recent days | Source: Glassnode's The Week Onchain - Week 5, 2024

This metric is similar to Daily Active Addresses, except it tracks “active entities” rather than addresses. An entity refers to a group of addresses that Glassnode believes belong to the same investor.

It’s clear from the chart that Bitcoin’s active body has recently fallen to cyclical lows. This is different from what is observed with Ethereum, where utility appears to be on the rise.

However, the analytics firm explained that “on the face of it, this might suggest that despite significant increases in Bitcoin prices, growth in Bitcoin users has not followed suit.”

“This is primarily a result of increased activity related to sequence numbers and inscriptions, where many actors reuse Bitcoin addresses, and reduces the number of measured ‘active entities’ (not double-counted).”

Ethereum price

Ethereum has been attempting a recovery of late, but the coin plummeted over the past day, causing the asset’s price to drop to around $2,300. Still, the rally is likely to continue given strong online activity.

The price of the coin appears to have plummeted during the past 24 hours | Source: ETHUSD on TradingView

Featured images from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com, Santiment.net