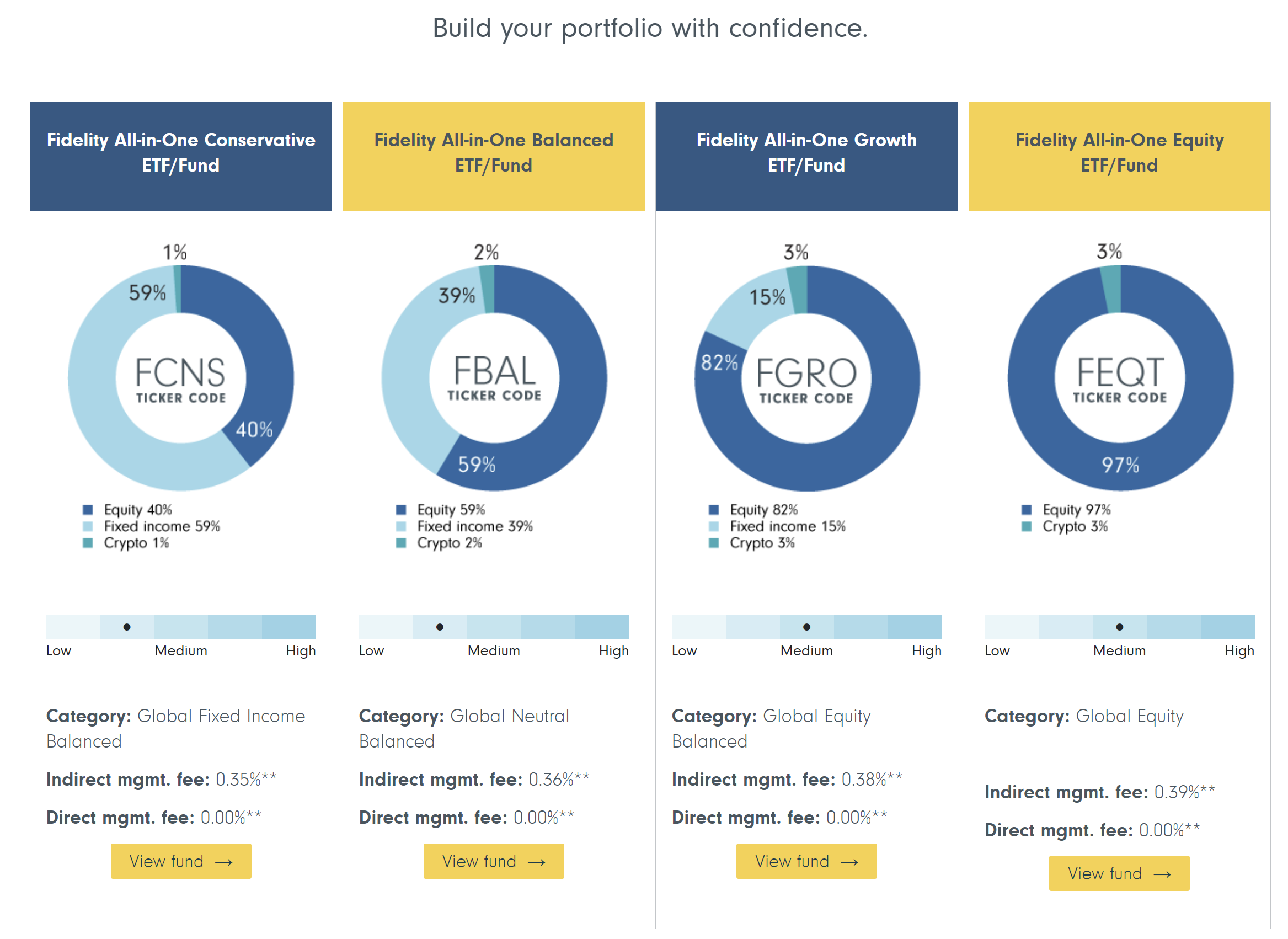

In a serious shift within the monetary business, Constancy Investments, which manages a large $12.6 trillion in belongings, now recommends that the normal 60/40 portfolio mannequin ought to evolve to incorporate a 1-3% allocation to cryptocurrencies, significantly by way of its Spot Bitcoin ETF (FBTC). This groundbreaking transfer is just not solely a nod to the booming cryptocurrency market, however a possible catalyst for unprecedented demand that has the potential to funnel lots of of billions of {dollars} into Bitcoin.

Matt Ballensweig, head of the BitGo Go community, expressed his expectations on X (previously Twitter), statement”, “I’ve stated this from the day the ETF was accepted – now Pandora’s field has been opened and multi-trillion greenback asset managers will promote BTC and cryptocurrencies for us by way of their huge distribution channels. Constancy now creates Blueprint Portfolios containing 1-3% of cryptocurrencies. “

That sentiment was echoed by outstanding analyst Will Clemente III, who commented on the potential ripple results of Constancy’s recommendation. “Constancy now recommends allocating 1-3% of your portfolio to cryptocurrencies. Gateway drug. What occurs when 1-3% turns into 3-6%? Slowly, then all of a sudden,” Clay Mente famous, highlighting the expansion potential of cryptocurrency distribution.

What this implies for Bitcoin worth

CEHV Accomplice Adam Cochran additional said detailed On the impression of Constancy’s transfer on Bitcoin adoption and worth trajectory. In an in depth evaluation shared on “It is loopy. A 60/40 portfolio is now 59/39/2,” Cochran started, highlighting the historic milestone of cryptocurrencies changing into a core asset class.

Cochran in contrast the adoption charges of the online to cryptocurrency, stating: “Gosh, the online was 30 years within the making and didn’t attain 10 million customers till 1995. However the least conservative estimates recommend that international cryptocurrency possession 450 million (conservatively extra like 200M), identical to the Web in 2001.”

He emphasised the massive impression of digital development on the economic system, “In the present day, the Web has about 5.5B customers, 12 occasions greater than in 2001. However in line with BEA knowledge, with every year of development, the impression of the digital economic system is rising exponentially.” By way of this comparability, Cochrane laid the groundwork for a cryptocurrency market that would develop exponentially in worth and affect.

Cochrane’s method to calculating Bitcoin’s future valuation entails analyzing potential inflows of conventional funding funds. “If that adjustments after 5/39/2, you’ll see $1.6T in new purchases…given the present complete market cap is $2.24 trillion…our money worth ratio is 9.3%.”

The core of Cochran’s evaluation lies in his valuation projections, stating, “At present charges, professional rata uncooked spot purchases between the tokens can be $748,500 for BTC and $43,635 for ETH. However since we all know the nominal issue It can trigger issues to run, and we’ve got info on yield demand and destruction of ETH, so our worth is normally a number of occasions larger than the worth of the unique spot demand.”

Cochrane’s conclusion displays a agency perception within the transformative potential of cryptocurrencies inside conventional funding portfolios. “The underside line is that even gold has not damaged out of the 60/40 portfolio in a significant approach, so I feel a big transfer past gold’s 12T mcap over time is a no brainer.”

At press time, BTC was buying and selling at $57,175.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is suggested that you just conduct your personal analysis earlier than making any funding choices. Use of the knowledge supplied on this web site is solely at your personal danger.