Welcome to the February CryptoSlate Alpha Month-to-month Snapshot, an unique roundup designed completely for our CryptoSlate Alpha subscribers.

All through the month of February, our complete reporting and insightful articles delve into the cryptocurrency ecosystem, offering a mixture of market evaluation, analysis insights and forward-looking developments that would form the way forward for finance and expertise.

Our February Alpha Markets report delves into the financial impression of the Fed’s reverse repo (RRP) facility and its potential ripple results on Bitcoin, whereas taking a crucial have a look at credit score spreads and their significance to the crypto market analyze.

We additionally discover why governments ought to assist regulating stablecoins fairly than creating central financial institution digital currencies (CBDC), offering a nuanced perspective on digital forex governance.

Analysis articles spotlight Bitcoin’s record-breaking financial funding, analyze the calm earlier than the storm in Bitcoin market conduct, and describe the unprecedented stability of Bitcoin futures and choices open curiosity.

Notably, our insights level to the crucial function of U.S. exchanges in offering liquidity to the Bitcoin market, in addition to a shift towards longer-term holdings as change balances fall to their lowest ranges since 2018.

Our top-tier Alpha Insights present a complete view of the cryptocurrency panorama, from the impression of HODL waves and on-chain indicators indicating declining speculative markets and underlying community well being, to the numerous impression of short-term buying and selling quantity and institutional participation.

We dissect the true value of mining one Bitcoin, study the speculative and resilient nature of Bitcoin traders, and conduct an in depth evaluation of Bitcoin’s buying and selling patterns, provide distribution, and the impression of ETFs on market dynamics.

Be part of us as we unpack these subjects to supply our Alpha subscribers with intensive data-driven evaluation and professional commentary on the evolving cryptocurrency house.

February Alpha Market Report

The Financial Influence of the Fed’s Reverse Repurchase (RRP) Facility

CryptoSlate explores the complexities of the RRP mechanism, exploring its impression on conventional monetary markets and its potential impression on Bitcoin.

What are credit score spreads, why are credit score spreads so tight, and what do they imply for Bitcoin?

CryptoSlate delves into the idea of credit score spreads and analyzes their present state to grasp their impression on the broader monetary and crypto markets, particularly Bitcoin.

Why governments ought to regulate stablecoins fairly than develop CBDCs

CryptoSlate examines the advantages of stablecoin regulation to discover why it could serve personal and public pursuits higher than CBDC.

February Alpha Analysis Articles

Report realized cap exhibits unprecedented financial funding in Bitcoin

The Bitcoin community and its contributors have by no means been extra financially invested in Bitcoin than they’re now.

Bitcoin market faces crucial second as unrealized earnings surge

Whereas unrealized beneficial properties will be risky, spot ETF inflows and bullish sentiment have boosted Bitcoin.

Bitcoin’s surge to $57,000 didn’t spark a storm of liquidations, defying anticipated developments

Regardless of Bitcoin’s skyrocketing value, liquidations have remained stagnant — an indication of warning out there.

February Bitcoin futures and choices open curiosity surges

Bitcoin choices tilt towards bullish calls regardless of short-term rise in defensive places

Bitcoin community congestion eases as February mempool cleanup

The Bitcoin mempool was unblocked in February, bringing a breath of contemporary air to transaction processing.

How do U.S. exchanges contribute to Bitcoin market liquidity?

U.S. exchanges account for a comparatively small proportion of worldwide buying and selling quantity however present 49% of worldwide liquidity, indicating that they’ve better market depth and may present bigger trades to a smaller variety of merchants.

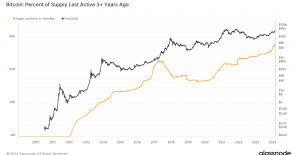

Bitcoin buying and selling balances fall to lowest stage since 2018 as market shifts to holdings

Bitcoin holders are staying away from exchanges in a long-term holding pattern.

Improve in stablecoin provide exhibits capital pouring into cryptocurrency market

The expansion in stablecoin market capitalization exhibits elevated capital inflows into cryptocurrencies and investor readiness for market strikes.

On-chain information exhibits Bitcoin provide is tightening

Unspent transaction output and accumulation developments recommend that Bitcoin provide is tightening as institutional curiosity rises.

Bitcoin futures holdings hit a two-year excessive, exceeding $50,000

Bitcoin futures open curiosity hit an all-time excessive in step with its value breakout.

Bitcoin’s Threat-Adjusted Return Potential Soars as Sharp Sign Surges

A brand new indicator from Glassnode exhibits Bitcoin market sentiment is poised for a rebound.

Why did Bitcoin’s market capitalization surge to over $102 billion, whereas its precise market capitalization solely grew by $4 billion?

Whereas Bitcoin’s market capitalization has grown considerably, its realized market capitalization supplies a extra stable perspective on worth.

Bitcoin breaks via $44,000 as unrealized earnings surge to spice up market confidence

As market sentiment improves, Bitcoin traders’ profitability soars.

What Bitcoin’s buying and selling patterns on centralized exchanges inform us in regards to the market

CryptoSlate’s evaluation of Kaiko information exhibits that many of the world’s Bitcoin transactions happen on Binance outdoors the USA.

Bitcoin choices present long-term bullishness and near-term pessimism

Amid the present market indecision, Bitcoin choices information suggests a bullish future outlook.

How ETFs Have an effect on Bitcoin’s Provide Distribution Amongst Completely different Populations

Spot Bitcoin ETFs result in important modifications within the distribution of Bitcoin provide.

Bitcoin breaks via $43,000, short-term buying and selling quantity peaks

Bitcoin’s SLRV ratio exhibits that the spot Bitcoin ETF almost certainly spurred unprecedented short-term buying and selling quantity.

Whales and establishments lead surge in Bitcoin buying and selling quantity

Glassnode information exhibits that whales and establishments are the principle gamers within the progress of Bitcoin buying and selling quantity.

For this reason the Bitcoin perpetual futures market was risky in January

In January, merchants revalued Bitcoin perpetual futures amongst rising ETF choices.

Marathon vs. Riot: Analyzing the True Value of Mining 1 Bitcoin

Estimating the true common value of mining a single Bitcoin for 2 of the most important publicly traded Bitcoin mining firms.

February’s Prime Alpha Insights

HODL wave evaluation reveals the function of speculative markets

Bitcoin’s journey from $25,000 to $50,000 was not marked by excessive short-term hypothesis.

On-chain metrics reveal Bitcoin community well being, trace at potential decline

Month-to-month and annual metrics for Bitcoin on-chain exercise reveal community well being and utilization developments, highlighting potential declines.

Bitcoin’s STH realized value approaches $40,000, indicating sturdy market momentum

Analyzing the dynamics of Bitcoin: Realizing the function of value in present market developments.

Asia falls, US leads Bitcoin value surge

America, with its bullish stance, leads the way in which with a whopping 12,200% value change.

Evaluation Challenges Bitcoin’s Diminishing Returns Idea Amid Current Rally

Bitcoin’s present cycle exhibits power, with an appreciation of almost 287% from its lowest level, difficult the speculation of diminishing returns.

Bitcoin traders exhibit long-term holding resilience in 2021

Beginning in 2021, Bitcoin traders will cut back their value base via strategic shopping for in bear markets.

After 153 days of buying and selling between $40,000 and $45,000, Bitcoin is predicted to put up its sixth consecutive month-to-month shut above $50,000

Bitcoin broke above $50,000, indicating that it’s going to proceed to consolidate after breaking out of the long-term vary.

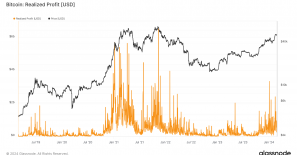

Quick-term holders carry report $3 billion in earnings to exchanges

The success of the spot ETF pushed Bitcoin above $58,000, demonstrating investor confidence.

Bitcoin traders put up 128th straight day of internet earnings

Regardless of Bitcoin’s sturdy efficiency, the depth of profit-taking in 2024 has not been capable of match the keenness of the 2021 bull run.

From all-time highs to important lows: Bitcoin charges after Inscription increase

Bitcoin dealing with charges hit a brand new low, and miners anticipate charge revenue to stabilize at 6%.

The put up From Credit score Spreads to Holding Patterns: Navigating February’s Crypto Market Adjustments appeared first on CryptoSlate.