Final week, there was an enormous influx of funds into international digital asset funding merchandise, with whole funds reaching US$1.1 billion, bringing the year-to-date influx to US$2.7 billion.

CoinShares’ newest weekly report confirms a surge in inflows into digital asset funding merchandise, which has pushed belongings beneath administration to their highest degree since early 2022 and now stands at $59 billion. The US spot ETF market has performed a key position on this improvement, with inflows reaching $1.1 billion final week.

Bitcoin stays the clear market chief, accounting for roughly 98% of whole inflows final week. Ethereum and Cardano additionally noticed elevated confidence, receiving $16 million and $6 million in inflows respectively. Altcoins equivalent to Avalanche, Polygon, and Tron have seen small however constant inflows throughout this era. Outcomes for blockchain shares had been combined, as a single issuer largely drove outflows; different firms within the sector additionally noticed incremental development.

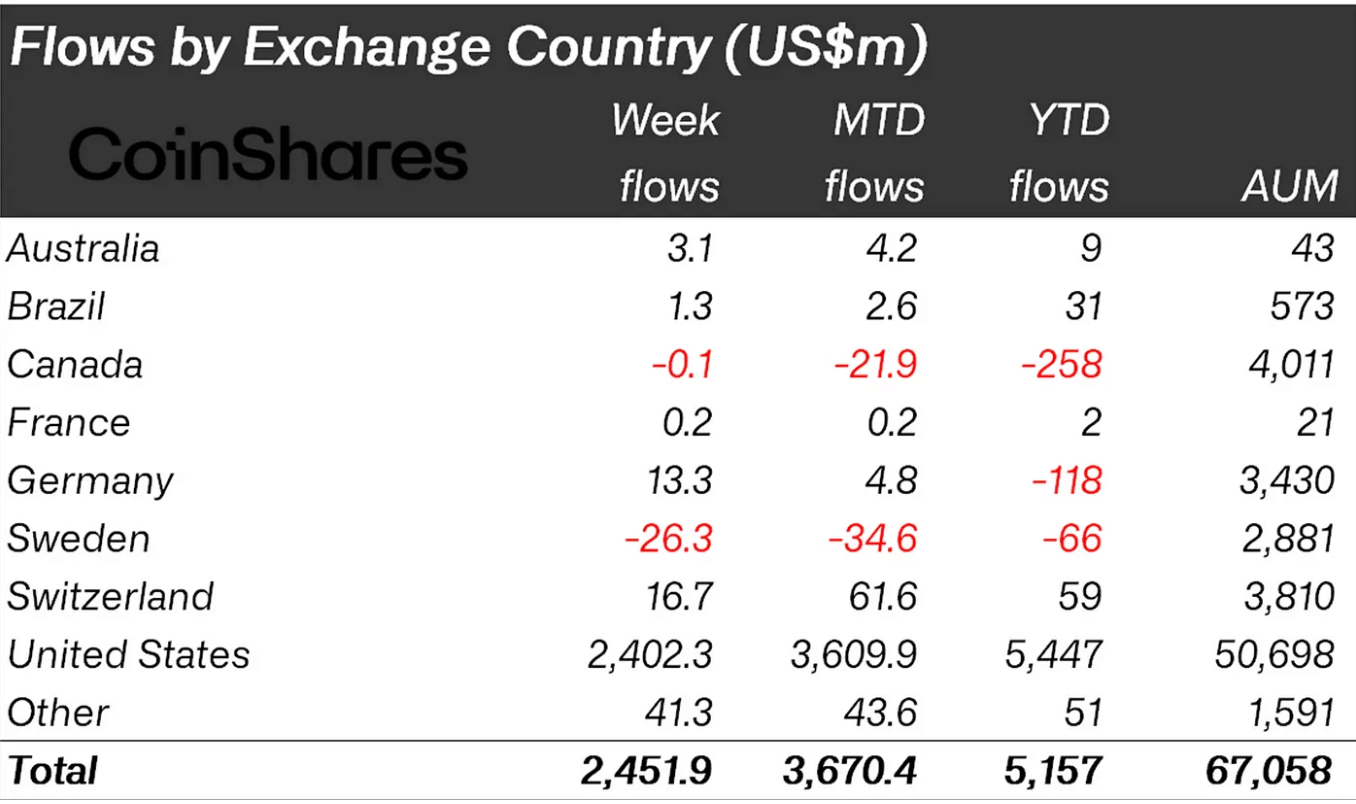

The report additionally reveals regional tendencies in these inflows. Whereas america leads the best way, reactions elsewhere have been combined. For instance, Switzerland noticed inflows of $35 million, whereas Canada and Germany noticed smaller outflows. This geographical distribution of inflows and outflows highlights the nuanced international perspective of digital asset investing.

CoinShares evaluation reveals that outflows from current digital asset funds have slowed, though considerations stay in regards to the potential impression of Genesis’ $1.6 billion stake sale.

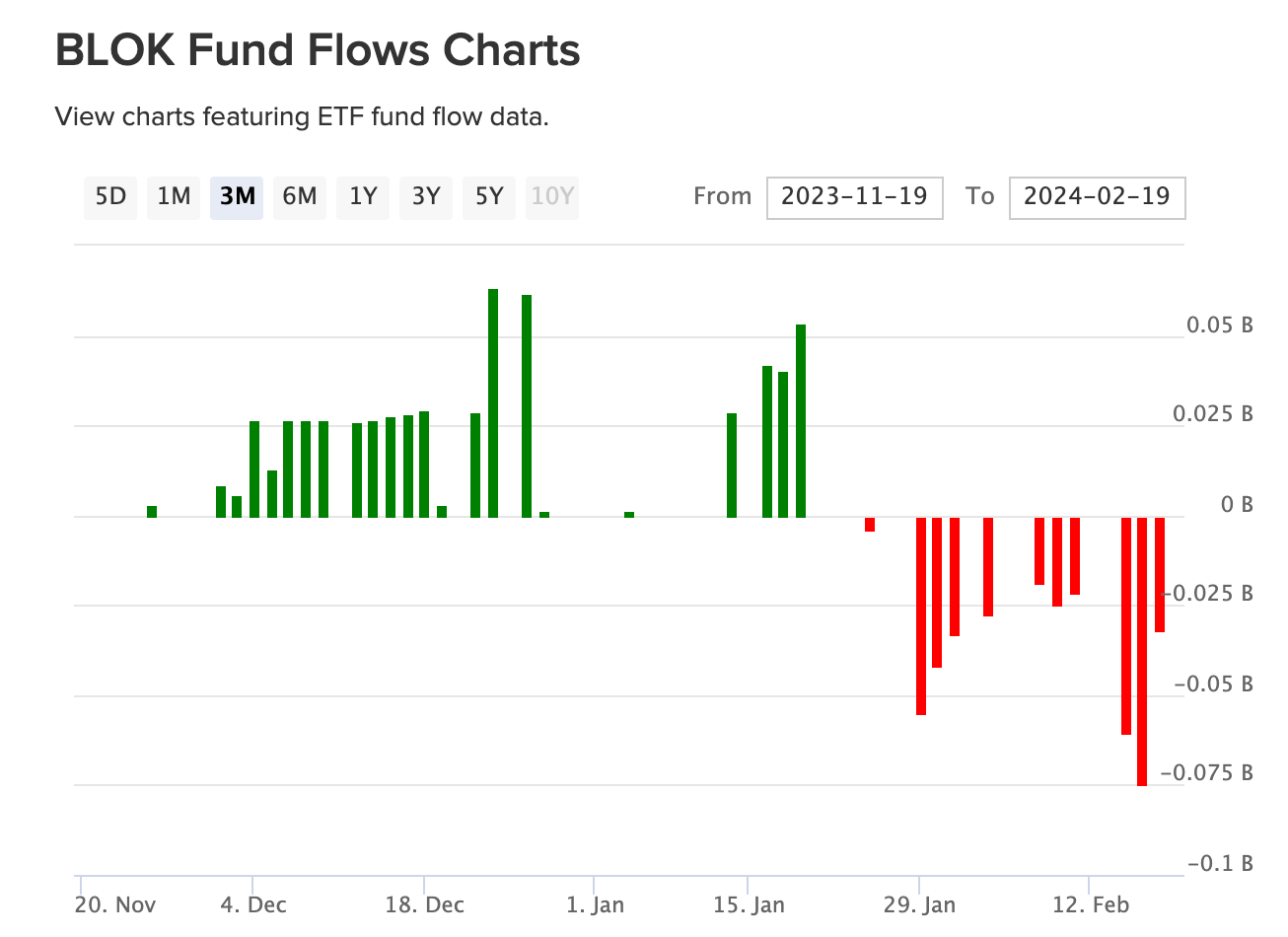

The general pattern of digital asset funding merchandise is enhancing. Nonetheless, the efficiency of blockchain shares was combined, with Amplify Transformational Information Sharing ETF (BLOK) seeing vital outflows totaling $67 million, whereas different shares collectively noticed inflows of $19 million. The distinction illustrates the differing investor sentiment and methods throughout the broader cryptocurrency and blockchain investing world. In accordance with knowledge from the VettaFi ETF database, BLOK has continued to expertise outflows since mid-January.

All in all, the newest CoinShares report highlights the large inflow of capital into digital asset funding merchandise, with Bitcoin persevering with to focus. Giant inflows, the best ranges of administration since early 2022, and regional variations in funding flows replicate the rising maturity and class of the cryptocurrency funding house.