Final week, the cryptocurrency funding area witnessed huge outflows from world cryptocurrency funds. A current CoinShares report highlighted almost $1 billion in web outflows from these funds, marking a historic turnaround from a seven-week streak of cumulative inflows of $12.3 billion.

Watch capital outflows rigorously

The scale of those outflows is roughly The $942 million was notably eye-catching, almost double the earlier document of $500 million set in late January.

In accordance with CoinShares, main gamers within the asset administration area, together with BlackRock, Bitwise, Constancy, Grayscale, ProShares, and 21Shares, have borne the brunt of this wave of divestments.

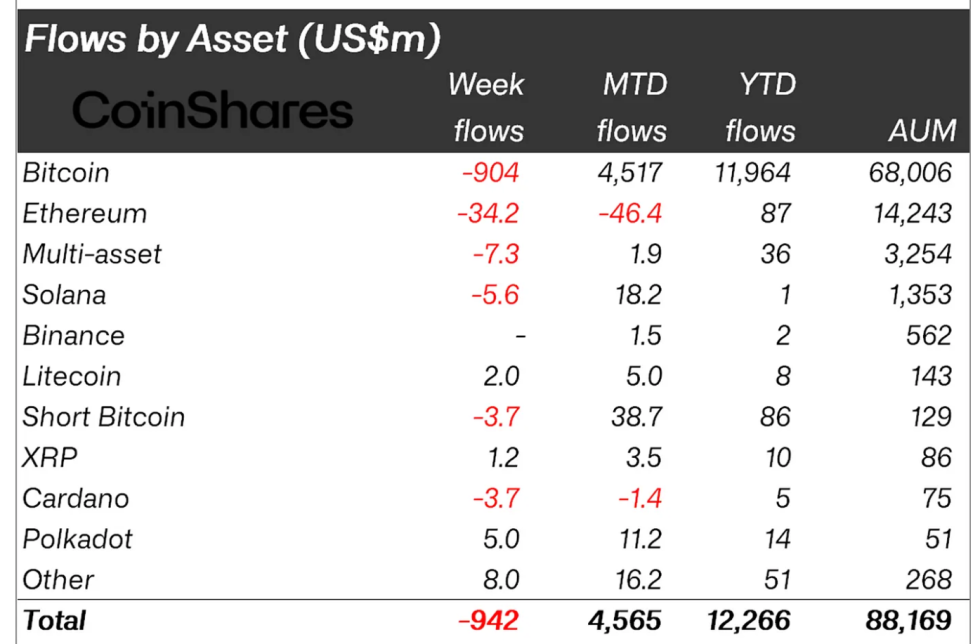

These outflows coincided with a major correction within the worth of the underlying cryptocurrency, inflicting the fund to wipe $10 billion from its belongings below administration (AUM). Nevertheless, whole AUM of $88 billion stays hovering above earlier cycle highs.

Notably, these outflows have clearly impacted buying and selling volumes and asset valuations within the crypto funding merchandise area. Buying and selling volumes plunged by a 3rd to $28 billion final week as a worth correction considerably lowered the funds’ under-management.

The U.S. market, particularly the brand new spot Bitcoin ETF, noticed greater than $1 billion in inflows, which was not sufficient to offset the almost $2 billion in outflows from Grayscale’s GBTC fund swap.

James Butterfill, head of analysis at CoinShares, stated the “current worth correction” induced “investor hesitancy, leading to considerably decrease inflows to new U.S. ETF issuers, with inflows of $1.1 billion, partially offset by present Grayscale’s $2 billion Enormous quantities of cash flowed in.” There have been outflows final week. “

World crypto sentiment and market response

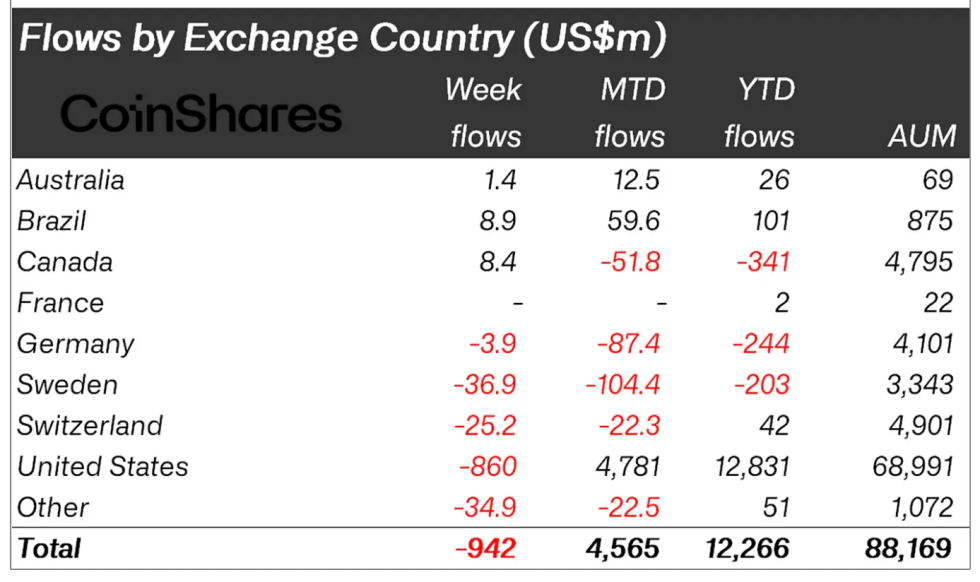

In the meantime, final week’s sentiment wasn’t simply centered on U.S. funds or Bitcoin. Funding merchandise in Sweden, Hong Kong, Switzerland and Germany additionally skilled outflows, however funds in Brazil and Canada recorded inflows, an indication of combined world investor sentiment.

Moreover, Ethereum, Solana, and Cardano-based merchandise confronted outflows, highlighting the broader affect of the market downturn. In distinction, different altcoin funds similar to Polkadot, Avalanche, and Litecoin noticed web inflows, indicating selective investor curiosity within the altcoin area.

This era of market recalibration has additionally sparked conversations amongst trade leaders in regards to the position and accessibility of Bitcoin ETFs in selling broader market integration.

Kraken UK’s Bivu Das and Coinbase UK’s Daniel Seifert each advocate market entry for Bitcoin ETFs within the UK, noting the significance of such funding merchandise in constructing a complete crypto ecosystem.

In accordance with reviews, by offering oblique publicity to Bitcoin worth actions, these devices present traders with a regulated and probably extra accessible avenue, serving to to diversify and mature the digital foreign money market funding panorama.

ICYMI: Kraken UK managing director Bivu Das says he ‘completely’ needs to see #bitcoin A UK ETF, offering regulated cryptocurrency publicity that’s presently missing and boosting the ambitions of a UK crypto hub and legitimizing Bitcoin for establishments.

— AP Crypto (@AP_Crypto_) March 23, 2024

Featured pictures from Unsplash, charts from TradingView