this Spot Bitcoin ETF The hype for these funds has lived as much as expectations, because the funds have boosted institutional adoption of the flagship cryptocurrency Bitcoin.That is additional supported by a current evaluation that captured Bitcoin’s quantity black stone Different issuers have collected funds this week alone.

Spot Bitcoin ETF issuer purchased over 19,908 BTC this week

knowledge Information show from the on-chain analytics platform Lookonchain Spot Bitcoin ETF Issuers In whole, greater than 19,908 BTC ($860 million) have been bought this week. On the similar time, it’s price mentioning that Lookonchain’s knowledge didn’t embody WisdomTree’s BTC purchases in its evaluation, suggesting that the quantity could also be greater if the asset supervisor’s purchases are additionally taken under consideration.

Extra knowledge Data from Arkham Intelligence supplies insights into Bitcoin volumes knowledge Tree This week it secured funding for its Bitcoin fund. It reveals that 74 BTC has entered the asset administration firm’s spot Bitcoin ETF pockets deal with.The addition of those crypto tokens means all Spot Bitcoin ETF Issuers Practically 20,000 BTC have been bought this week alone.

Curiously, the Bitcoin ETF current stories Holding 3.3% of the circulating provide of Bitcoin, it highlights the success it has achieved since its launch. Information from Lookonchain reveals that these ETFs at the moment maintain greater than 657,000 BTC (excluding WisdomTree).

Bitwise Chief Funding Officer (CIO) Matt Hougan additionally disclose How these funds achieved $1.7 billion in flows after the primary 14 buying and selling days.That is much more spectacular when he’s in comparison with Gold ETF, which generated $1.3 billion in income in an analogous timeframe.in one other X postshe talked about that these spot Bitcoin ETFs attracted $700 million in web inflows this week alone.

BTC worth recovers above $43,000 | Supply: BTCUSD on Tradingview.com

BlackRock lastly beats Grayscale

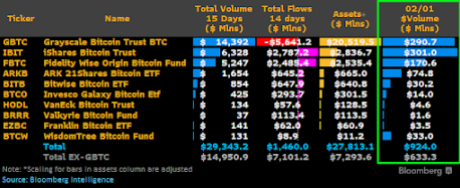

Bloomberg analyst James Seifert talked about in an article X posts BlackRock’s IBIT seems to be to have turn out to be the primary buying and selling quantity to surpass Grayscale GBTC In in the future.Previous to this, Grayscale continued to take care of the file of primary day by day transaction quantity, though IBIT is shut A number of occasions.

Judging from the information shared by Seyffart, it can go On February 1, GBTC’s buying and selling quantity seems to have reached $301 million, whereas GBTC’s buying and selling quantity was $290. Nonetheless, he additional said that the entire buying and selling quantity for the day was “just a little bit unhealthy,” with buying and selling quantity throughout all spot Bitcoin ETFs totaling $924 million.

Curiously, this occurs to be the primary time the day by day buying and selling quantity of a spot Bitcoin ETF has fallen under $1 billion. Nonetheless, the Bloomberg analyst had no opinion on what prompted this comparatively subpar efficiency.

Featured picture from US International Buyers, chart from Tradingview.com

Disclaimer: This text is for academic functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is suggested that you simply conduct your personal analysis earlier than making any funding resolution. Use of the knowledge offered on this web site is completely at your personal threat.