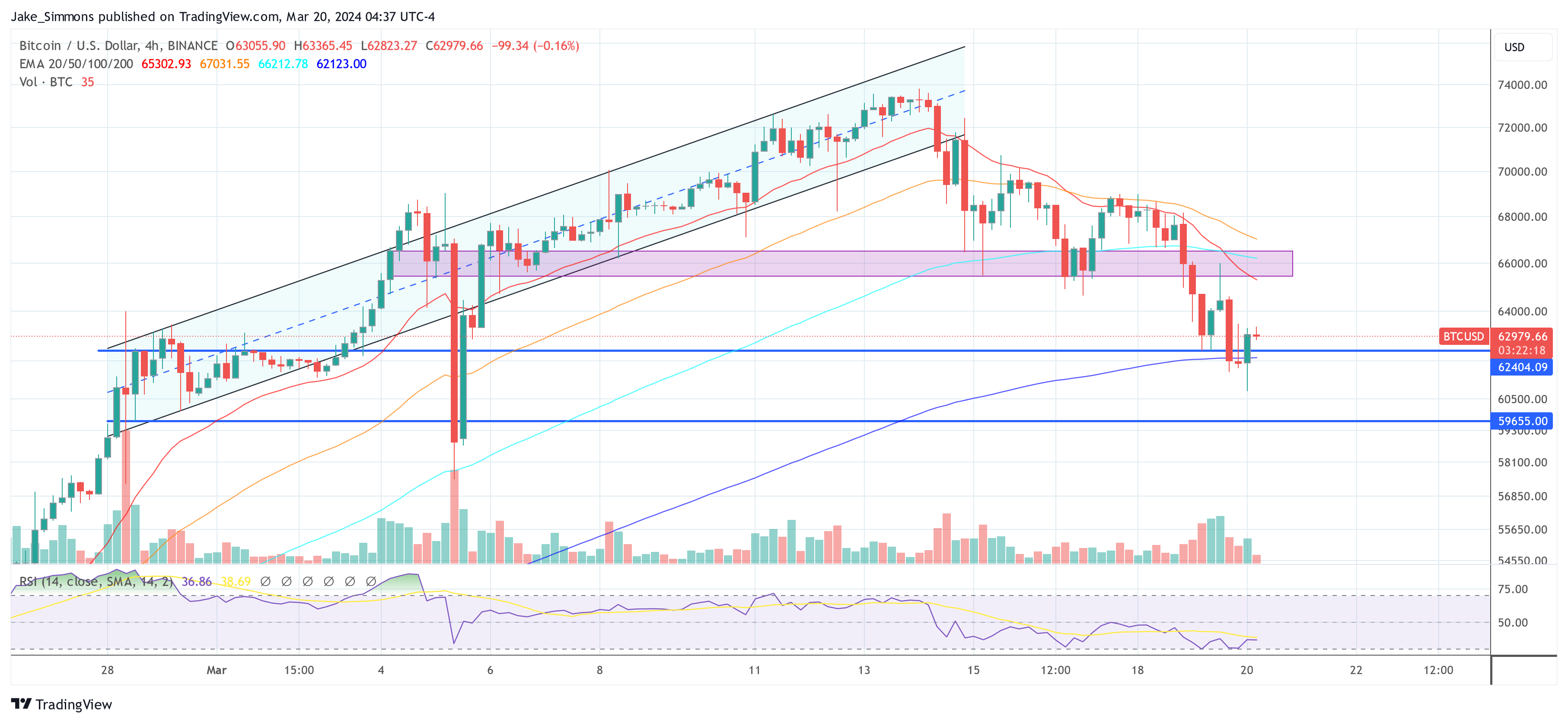

Bitcoin has skilled a steep decline from a excessive of over $73,600 on March 14 to at the moment’s low of lower than $60,800, shedding -17% in worth. This sharp drop has triggered a flurry of exercise on social media platforms, particularly X (previously Twitter), the place cryptocurrency consultants have been enthusiastically discussing the potential causes behind this downturn and speculating on the way forward for the world’s main cryptocurrency.

Deciphering the Bitcoin Crash: Professional Views

Alex Krüger, a revered determine on this planet of macroeconomics and crypto, was fast to determine the principle elements that led to Bitcoin’s worth collapse. Krüger mentioned the plunge may be attributed to a number of key elements: extreme market leverage, Ethereum’s adverse impression on general market sentiment as a consequence of ETF hypothesis, a big discount in Bitcoin ETF inflows, and the irrationality surrounding the Solana memecoin Prosperity. Disdainfully known as “junkcoin mania.”

Causes of crash (ordered by significance)

(for these in want)

#1 Leverage is just too excessive (funding downside)

#2 ETH drives the market south (the market decides that ETFs is not going to cross)

#3 BTC ETF adverse influx (be aware, the information is T+1)

#4 Solana Grunge Coin Mania (It’s Too Far)— Alex Kruger (@krugermacro) March 20, 2024

WhalePanda, one other influential voice within the cryptocurrency area, identified that ETF fund outflows are occurring at an alarming price, with a document $326 million flowing out of the market yesterday. The transfer was notably adverse for GBTC, which noticed outflows of $443.5 million.

By comparability, BlackRock noticed inflows of simply $75.2 million, its second-lowest degree to this point. Moreover, Constancy noticed inflows of simply $39.6 million. “Nothing to say, this isn’t good for the worth, we might even see decrease costs now as this information can even have an effect on the market sentiment. Let’s see what the site visitors can be tomorrow. The constructive factor is that we’re nonetheless far-off from the halving About 30 days, GBTC is being affected,” he commented.

Yesterday’s ETF stream was @FarsideUK.

We had $326 million in outflows. The biggest outflow to this point.

BlackRock did not save us $GBTCwhich is clear within the worth motion.$GBTC Outflows have been $443.5 million, whereas BlackRock had inflows of $75.2 million, their second-lowest… pic.twitter.com/hIingoYMly

— WhalePanda (@WhalePanda) March 20, 2024

Charles Edwards, founding father of cryptocurrency hedge fund Capriole Investments, if A historic take a look at Bitcoin’s latest worth motion reveals {that a} 20% to 30% retracement is throughout the regular vary of a Bitcoin bull market.

“A standard Bitcoin bull market retracement is 30%. Again in December, we have been already on the longest profitable streak in Bitcoin historical past. A 20% retracement would take us to $59,000. A 30% retracement That is $51,000. These are prospects that we should always really feel comfy trying ahead to,” he mentioned.

Rekt Capital analyzed Bitcoin’s worth correction because the backside of the bear market in 2022, noting that the present correction is simply the fifth main correction, with earlier corrections exceeding -20% in depth and lasting from 14 to 63 days.All in all, there are two key takeaways from the present pullback

The nearer Bitcoin will get to the -20% retracement, the higher the chance.

Backtracking takes time to totally mature (not less than 2-3 weeks, as much as 2 months).

For the reason that bear market backside in November 2022…

Bitcoin has skilled the next pullbacks:

• -23% (February 2023) for 21 days

• -21% (April/Could 2023) for 63 days

• -22% (July/September 2023) for 63 days

• -21% (Jan 2023) for 14 days

this… pic.twitter.com/cQyQOLA5Zv

— Rekt Capital (@rektcapital) March 19, 2024

Alex Thorn, head of analysis at crypto big Galaxy Digital, beforehand warn The potential for a significant correction throughout a bull market means that the present pullback is comparatively customary. “Two weeks in the past, I warned {that a} main correction was not solely doable however ‘doable’ in a Bitcoin bull run. At -15%, which has been pretty customary traditionally, the bull market climbed a wall of fear. “

Macro analyst Ted (@tedtalksmacro) is especially involved in regards to the impression of the upcoming Federal Open Market Committee (FOMC) assembly.he highlight The big outflows from spot BTC ETFs have been attributed to merchants’ cautious stance forward of the FOMC resolution and the potential impression of the U.S. tax season.

Nevertheless, following the drop to $60,800, Ted mentioned the market could have absolutely priced within the worst-case state of affairs and hinted at a doable bullish reversal if the FOMC resolution is in keeping with market expectations for a year-end price reduce. He mentioned:

It is time to bid. Federal Open Market Committee (FOMC) hedges are full, with worst-case state of affairs pricing in place. The one factor that occurs from right here is that these protecting stances loosen up in or out of at the moment’s sport. The Bulls ought to step up quickly. […] The market has absolutely priced in expectations that the Federal Reserve will stay on maintain once more at at the moment’s assembly, and expects three rate of interest cuts by the tip of the 12 months. Any deviation from at the moment’s new financial forecast/dot chart materials will lead to wild market strikes.

At press time, BTC was buying and selling at $62,979.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It’s endorsed that you just conduct your individual analysis earlier than making any funding selections. Use of the data supplied on this web site is solely at your individual danger.