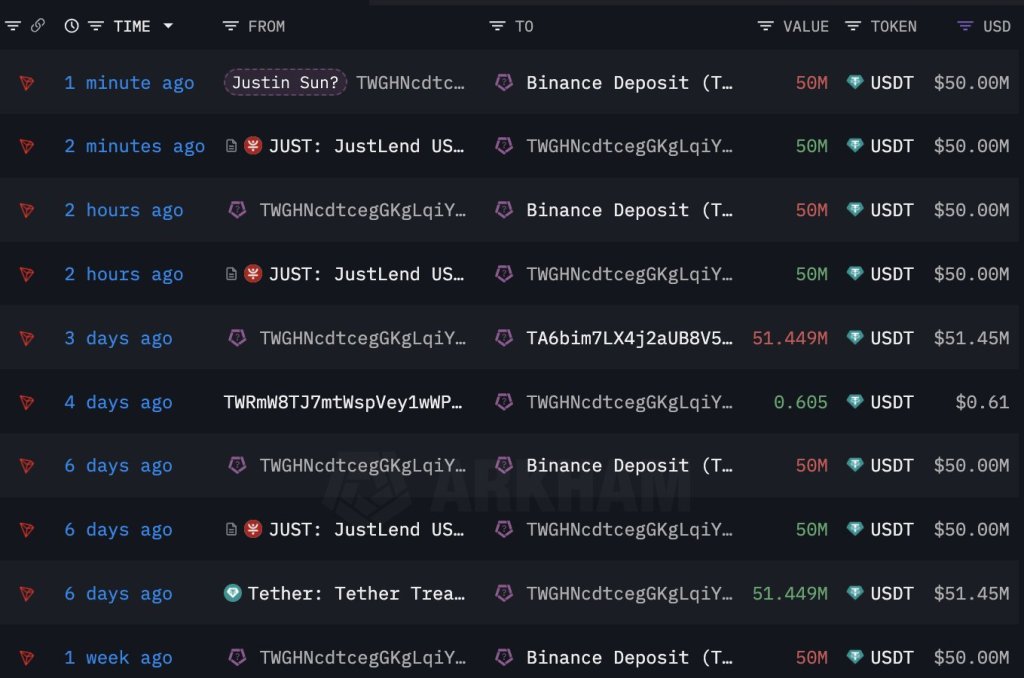

Justin Solar, co-founder of Tron, a sensible contract platform for deploying decentralized functions (dapps), is as soon as once more transferring and shuffling thousands and thousands of {dollars}.Based on Lookonchain experiences data On February 29, Solar reportedly transferred 100 million USDT to Binance, simply days after shifting the massive quantity earlier this week.

Justin Solar holds thousands and thousands of ETH: Will co-founder purchase extra?

Between February 12 and 24, Solar-related wallets acquired 168,369 ETH at a median value of $2,894. The acquisition was valued at roughly US$580.5 million, with present unprofitable earnings of roughly US$95 million. Profitability is more likely to enhance given the sturdy demand for cryptocurrencies in latest days, particularly prime currencies comparable to Bitcoin and Ethereum.

The Ethereum value chart reveals that ETH has been in a transparent upward pattern, rising from round $2,200 in early February to over $3,450 on the time of writing. At this charge, the possibilities of the second most useful coin rising are excessive given institutional curiosity in sturdy crypto belongings together with ETH.

As Bitcoin approaches $70,000, the probability that Ethereum may even rise to all-time highs round $5,000 will enhance.

Since ETH already has numerous tokens, there may be hypothesis that the co-founders will double down and buy extra tokens. The crypto neighborhood will proceed to watch this handle till this occurs and there may be dependable on-chain data to help the acquisition.

Spot Ethereum ETF and Dencun improve are key updates

Optimism is excessive to date, particularly among the many broader altcoin neighborhood. As Bitcoin races to new all-time highs, fueled by billions in institutional funding, eyes might be on the U.S. Securities and Trade Fee (SEC). Spot Ethereum exchange-traded funds (ETFs) have a number of functions.

The company has not but offered a transparent timeline for approving or rejecting derivatives. Regulatory uncertainty over the standing of ETH is a big headwind that might delay and even forestall the well timed authorization of the product.

Nonetheless, the neighborhood is trying ahead to the subsequent communication in Could. If the spot Ethereum ETF is profitable, the token may observe Bitcoin to new all-time highs.

Till then, nevertheless, all eyes are on Dencun’s anticipated implementation. The improve addresses challenges confronted by Ethereum, together with scalability. Ethereum builders hope to make use of Dencun to put the inspiration for additional enhancements in throughput within the coming years.

As throughput will increase, transaction charges lower, overly enhancing consumer expertise. The improve may go a good distance towards solidifying Ethereum’s place within the crypto area, away from stiff competitors from Solana and others together with BNB Chain.

Characteristic footage are from DALLE, charts are from TradingView

Disclaimer: This text is for academic functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is strongly recommended that you simply conduct your individual analysis earlier than making any funding choices. Use of the data offered on this web site is completely at your individual danger.