Ethereum is presently buying and selling at $2,290, up barely by $0.17 over the previous week. Regardless of the shortage of a lot motion, with costs buying and selling round $2,300 for a lot of the week, on-chain knowledge on outflows sheds mild on the present sentiment amongst merchants. Based on on-chain analytics agency IntoTheBlock, $500 million price of ETH was withdrawn from centralized exchanges this week, bringing whole outflows over the previous month to $1.2 billion.

Ethereum outflows from exchanges surge

Ethereum Unexpected worth development This follows the approval of a spot Bitcoin exchange-traded fund in the USA. In consequence, varied on-chain knowledge confirmed sturdy bullish sentiment, and the second-largest cryptocurrency has since seen outflows from exchanges. Outflows specifically intensified final week, with a big portion of the $1.2 billion in ETH withdrawn from exchanges over the previous month, in keeping with IntoTheBlock.

$500 million $ETH Withdrawals from central exchanges this week add to whole outflows final month of over $1.2B pic.twitter.com/e8NFOGtrDV

— IntoTheBlock (@intotheblock) February 2, 2024

Ethereum presently buying and selling at $2,308 on the every day chart: TradingView.com

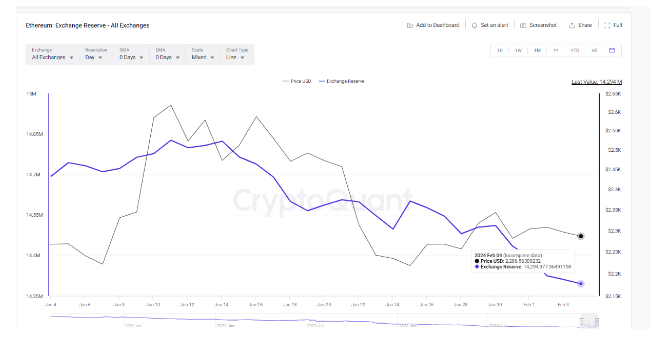

Based on knowledge from CryptoQuant, 1.622 million ETH was withdrawn from cryptocurrency exchanges final week. Related metrics from analytics platforms present that exchanges’ ETH reserves have been plummeting over the previous yr. As of January 4, statistics present that the full quantity of ether cash deposited on varied cryptocurrency exchanges is 14.69 million. Nonetheless, this quantity has decreased by 397,012 ETH over the previous month, falling to 14.296 million ETH on the time of writing, its lowest stage ever.

What does this imply for ETH worth?

Lowering your FX steadiness will scale back the quantity of ETH out there for buying and selling, thereby rising shortage. Knowledge from Cryptoquant and IntoTheBlock means that Ethereum could also be getting ready for a worth surge attributable to elevated shortage.

As of this writing, Ethereum is up 3.21% on a month-to-month foundation. Nonetheless, it’s price noting that the cryptocurrency has been in a downward development after hitting a 23-month excessive of $2,706 on January 12.A big a part of this downward development will be attributed to $1 billion sell-off by Celsius Community as a part of its plan to repay collectors. On the similar time, cryptocurrencies face continued competitors from different blockchains, Solana lately surpassed When it comes to every day buying and selling quantity on decentralized exchanges.

based mostly on present worth motion, it appears to be like like Ethereum has established assist simply above $2,280 and is now trying a powerful transfer above this worth level. One cryptocurrency analyst mentioned that the present configuration is clearly a reproduction of the 2021 worth motion that led to ETH reaching its present all-time excessive of $4,878 within the following months.

$ETH Clearly repeating the earlier chart configuration. 🚀#Ethereum #ETH #alternativeseason pic.twitter.com/AA1PJiN24h

— Tardigrade Dealer (@TATrader_Alan) February 3, 2024

Featured picture from Adobe Inventory, chart from TradingView