On-chain knowledge exhibits that promoting strain from long-term Bitcoin holders has lately exhausted itself following a protracted sell-off by the group.

Lengthy-term Bitcoin holders have bought closely over the previous 4 months

As analyst James Van Straten defined in a be aware postal On day “Lengthy-term holders” (LTH) right here check with Bitcoin traders who’ve held Bitcoin greater than 155 days in the past.

LTH is likely one of the two principal segments of the BTC house, the opposite being often called “short-term holders” (STH). STH is of course an investor who purchased previously 155 days.

Statistically, the longer an investor holds a token, the much less possible they’re to promote at any level. Subsequently, LTH represents a extra dedicated section of the BTC market.

STHs, alternatively, are fickle-minded people who’re prone to promote on the first signal of any FUD or profit-taking alternative. Subsequently, promoting from STH is mostly much less noteworthy. Nonetheless, a sell-off in LTH could also be price watching because it not often occurs.

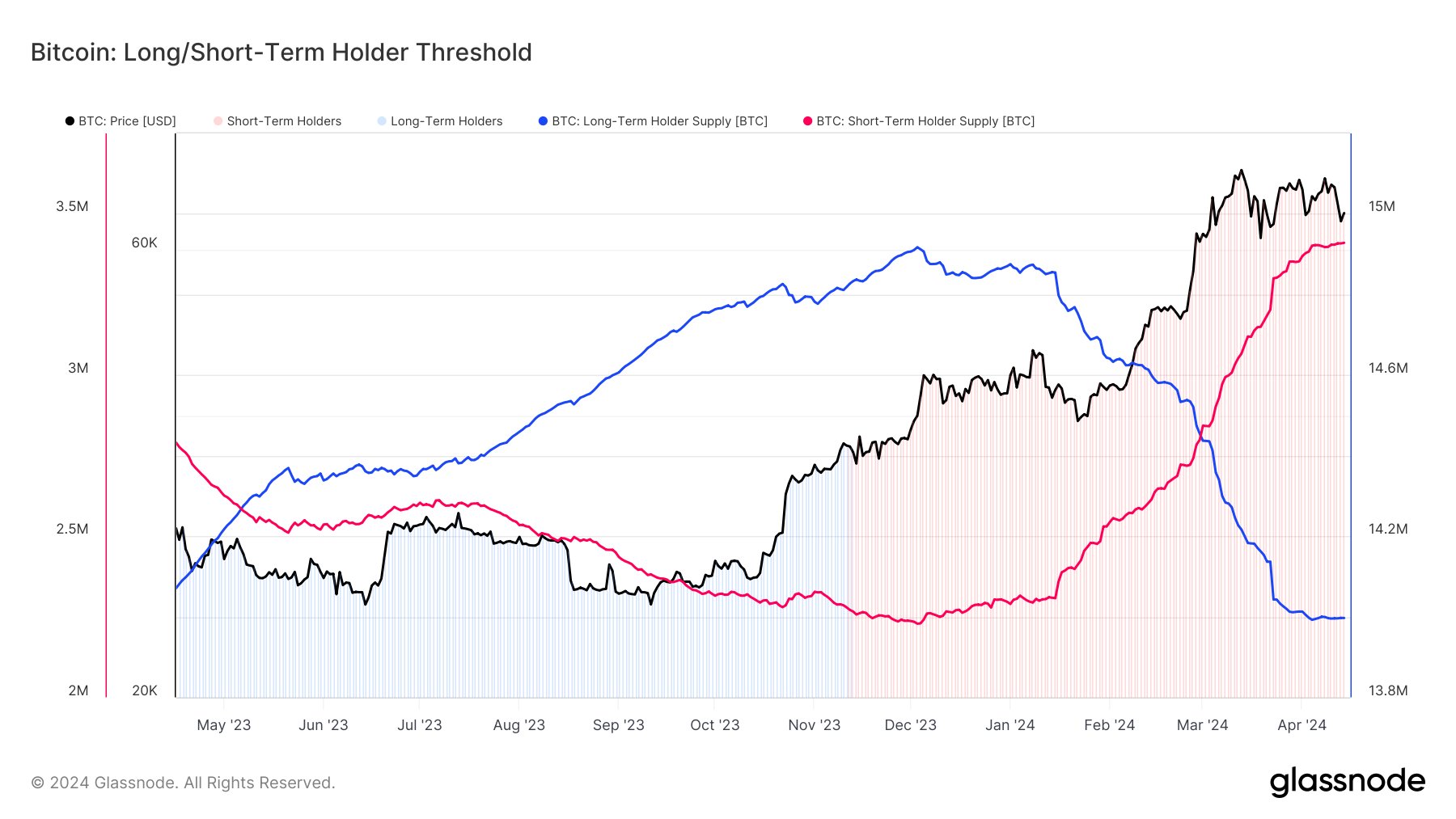

One option to monitor the habits of those Bitcoin teams is thru the whole provide of their respective mixed wallets. The chart under exhibits the provision tendencies of STH and LTH over the previous yr.

How the provides held by these two cohorts have modified through the previous twelve months | Supply: @jvs_btc on X

As proven within the chart above, Bitcoin LTH provide has been growing all through most of 2023.

The factor to notice right here is that the rise in LTH provide doesn’t imply these HODLers are shopping for at the moment. As an alternative, some STH was bought 155 days in the past and ended up being held lengthy sufficient to qualify for the group.

Subsequently, there’s a 155-day delay between the buildup and improve of LTH provide. Nonetheless, relating to gross sales, there isn’t a such time lag, as LTH transferring cash on the blockchain instantly exits the group and turns into a part of STH.

The chart exhibits that the upward development within the provide of those diamond fingers has reversed this yr and LTH has been promoting off. Over the previous 4 months, these traders have allotted 700,000 BTC.

This doesn’t embrace the sell-off within the Grayscale Bitcoin Belief (GBTC), which has been shedding Bitcoin for the reason that SEC accredited the spot exchange-traded fund (ETF) in January. These tokens are additionally mature sufficient to develop into a part of LTH.

Not too long ago, LTH provide has leveled off as the worth has skilled some bearish motion, that means the promoting by these HODLers has lastly stopped, a minimum of for now. It stays to be seen how Bitcoin’s worth will evolve in gentle of this new development.

bitcoin worth

With Bitcoin’s current decline, its worth has fallen to the $63,200 stage.

Seems like the worth of the asset has gone down lately | Supply: BTCUSD on TradingView

Featured pictures from Unsplash.com, Kanchanara on Glassnode.com, charts from TradingView.com

Disclaimer: This text is for academic functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It’s endorsed that you just conduct your individual analysis earlier than making any funding selections. Use of the data supplied on this web site is totally at your individual danger.