Avalanche (AVAX), a blockchain platform recognized for its scalability and infrastructure, made important progress within the fourth quarter (This autumn) of 2023. Based on a report by Messari, Avax Grow to be one of many high performing tokens, driving the protocol to make important progress on key metrics.

Avalanche’s File-Breaking Milestone

this Report It reveals that AVAX’s market worth has grown considerably, with a quarterly improve of 344% and an annual improve of 326%, reaching US$14.4 billion by the top of the yr. This large progress has pushed AVAX’s market capitalization rating from twentieth to ninth amongst all cash, a rise of 11 spots (it at the moment ranks tenth, behind Cardano (ADA)).

One of many drivers of Avalanche’s big income progress is the surge within the variety of inscriptions, particularly describe (ACS-20 token).

The quantity of name information transactions on these chains has elevated considerably, resulting in a big improve in income. Avalanche’s income surged from November to December, rising 2,874% in U.S. {dollars}, from $1.9 million to $56.5 million.

Whereas income surged, day by day transaction quantity additionally elevated considerably, rising by 450% quarterly to 1.5 million transactions. The appearance of Avascriptions can be driving most of those transactions.

Avalanche’s C-chain skilled a record-breaking 6.3 million transactions, of which practically 6.1 million had been inscribed. This marks the best single-day buying and selling quantity ever recorded for Avalanche.

C-Chain’s gross sales fell by 50% month-on-month Day by day energetic addresses, that is primarily resulting from lowered exercise on LayerZero, a bridge between completely different blockchains. Nevertheless, the report highlights that Avalanche has seen a big improve within the variety of energetic validators, rising 20% month-on-month from 1,374 validators to 1,651.

Messari mentioned that the expansion within the variety of validators, coupled with the 11% month-on-month improve in AVAX shares, reveals promising long-term demand for AVAX within the coming yr.

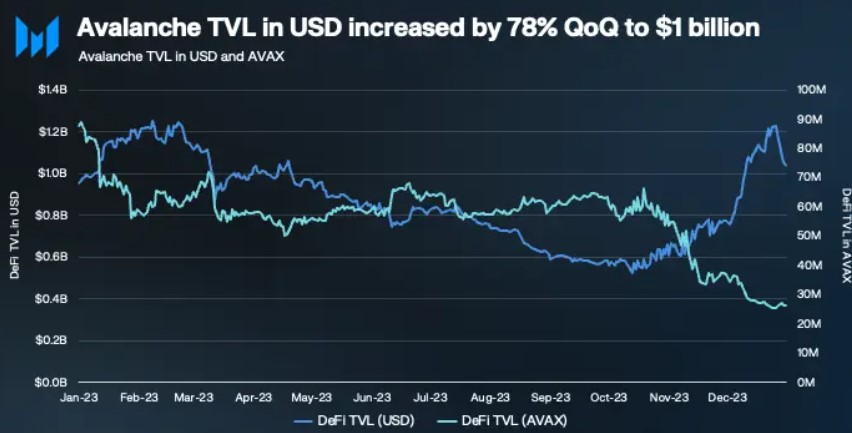

Avalanche’s TVL surges 78%

avalanche Complete worth locked TVL (TVL) in U.S. {dollars} elevated considerably by 78% from the earlier quarter, reaching $1.03 billion by the top of the fourth quarter of 2023. This makes Avalanche the seventh USD-denominated TVL chain.

Nevertheless, TVL denominated in AVAX fell 71% sequentially, primarily resulting from a rise in TVL denominated in US {dollars} pushed by AVAX value appreciation.

The report additionally reveals the efficiency of varied protocols on Avalanche. TVL’s largest settlement, AAVE, grew 60% month-on-month, whereas BenQ and dealer joe The month-on-month progress was 205% and 131% respectively. Collectively, these three protocols account for 79% of Avalanche TVL, demonstrating their dominance within the ecosystem.

Smaller protocols like Pangolin and GMX have additionally proven spectacular progress, whereas Balancer has attracted important TVL on Avalanche with the assistance of Benqi’s sAVAX liquidity pool. As well as, the common day by day buying and selling quantity of DEX surged within the fourth quarter, with a quarterly improve of 245%.

Evaluation of the 1-day chart reveals that Avalanche’s token buying and selling pair AVAX/USD skilled important progress within the fourth quarter, breaking away from a long-term sideways value motion.

Nevertheless, following a noteworthy Upward pattern Pushing the coin to $50, its highest stage in 20 months, AVAX skilled a pointy correction on December 24, plummeting to $27 value ranges.

Cryptocurrencies have rebounded because of the rise in Bitcoin (BTC) and the final bullish sentiment out there. AVAX has gained 13% in value over the previous 14 days and has now reclaimed the $40 space.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for academic functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is strongly recommended that you just conduct your personal analysis earlier than making any funding choice. Use of the data supplied on this web site is totally at your personal threat.