Bitcoin (BTC) has proven spectacular efficiency within the first quarter (Q1) of 2024, as highlighted in a latest report from market intelligence information analysis agency Messari. The analysis agency recognized key elements resulting in Bitcoin’s worth development, market cap dominance, and the emergence of recent developments within the cryptocurrency ecosystem.

Inscription exercise drives up Bitcoin charges

Analyze detailed key information ReportWithin the first quarter of 2024, the value of Bitcoin rose sharply, rising 68.78% quarterly to achieve an all-time excessive of $73,100 (ATH).

This worth improve pushed Bitcoin’s market cap dominance to 49.7% by March 2024. Apparently, the analysis agency famous that this dominance is typical of the start of a brand new period. Halving cycleBitcoin is mostly forward of different cryptocurrencies.

One other related information is registration exercise within the fourth quarter of 2023, which elevated charges by 699.4% in comparison with the earlier quarter. Nevertheless, within the first quarter of 2024, subscription-related bills fell by 41.9%. Though whole prices fell, Transactions associated to inscriptions Nonetheless accounting for 18.4% of whole Bitcoin charges, indicating that they continue to be related.

Common every day buying and selling quantity and every day lively addresses additionally decreased by 15.3% and 4.7% respectively from the earlier month. The report means that the drop in buying and selling exercise could also be attributed to a lower in bot or “tremendous person” exercise. This shift coincides with a discount in registration-related actions and costs.

Inscription-related exercise initially surged in February 2023, leading to a major improve in transaction quantity.Though registration-related exercise declined within the first quarter of 2024 in contrast with the earlier quarter, it was nonetheless considerably increased year-over-year, demonstrating its continued affect on registration-related exercise community.

ETFs gathered 212,000 BTC in Q1

Messari emphasised that the primary quarter of 2024 confirmed the expansion of the programmable layer within the cryptocurrency ecosystem. Mature layers corresponding to Rootstock and Stacks paved the way in whole worth locked (TVL), whereas newer layers corresponding to BOB and Merlin have skilled fast development.

The 127% month-on-month development in TVL primarily comes from non-BTC property, as the quantity locked in Bitcoin lags behind the Lightning Community and alt-L1 networks that host massive quantities of BTC.

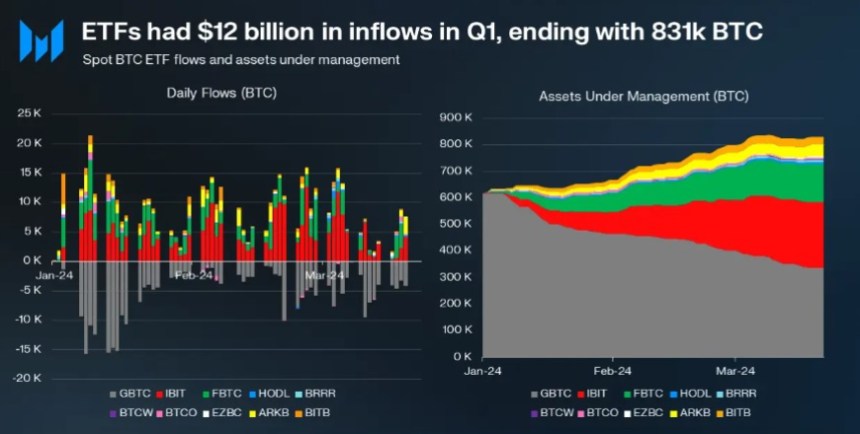

Finally, 9 initiatives have been accepted and launched Spot ETFs An ETF conversion marks a significant milestone within the legalization of Bitcoin by the U.S. authorities and conventional finance (TradFi).

The report famous that these ETFs obtained greater than $12 billion in inflows within the first month. Notably, the BTC ETF’s property below administration (AUM) exceed these of the silver ETF, however nonetheless lag behind the gold ETF.

Institutional BTC holdings are additionally surpassed by the biggest institutional holder, MicroStrategy, with 215,000 BTC. The cumulative influx of ETFs within the first quarter was 212,000 BTC, additional establishing Bitcoin’s outstanding place available in the market. Monetary market.

Bitcoin’s stellar efficiency within the first quarter of 2024, marked by vital worth positive factors and market cap dominance, has cemented its place because the main cryptocurrency.

Anticipation of the availability halving, in addition to the success of BTC ETFs and institutional inflows, have contributed to Bitcoin’s development and recognition in conventional finance.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for academic functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is suggested that you simply conduct your individual analysis earlier than making any funding determination. Use of the knowledge supplied on this web site is completely at your individual danger.