Disclaimer: The opinions expressed by our authors are their very own and don’t signify the views of USA At present. The monetary and market data offered on U.At present is for informational functions solely. U.At present just isn’t answerable for any monetary losses incurred whereas buying and selling cryptocurrencies. Please contact a monetary professional to conduct your personal analysis earlier than making any funding selections. We imagine all content material to be correct as of the date of publication, nevertheless some provides talked about could not be obtainable.

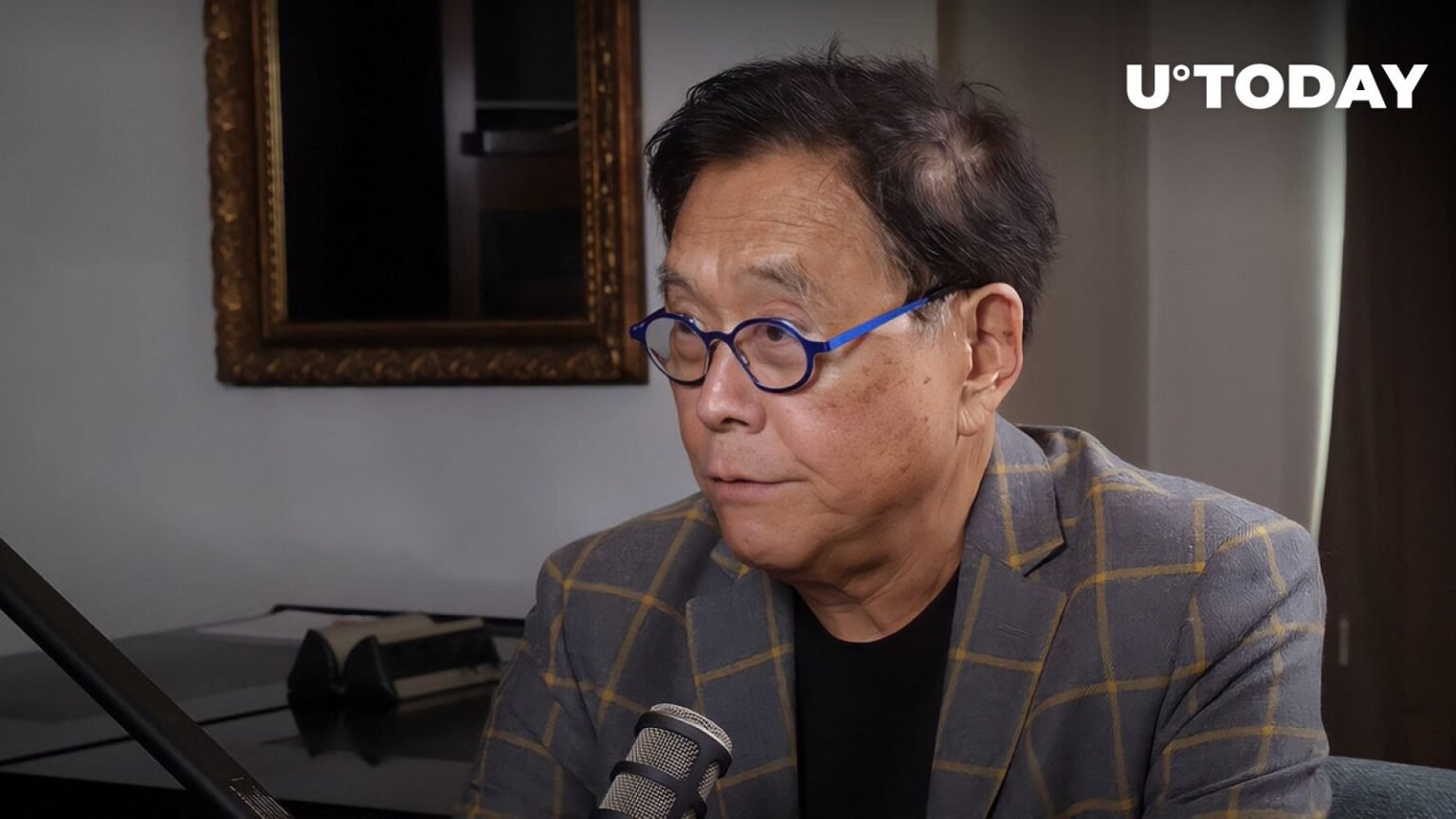

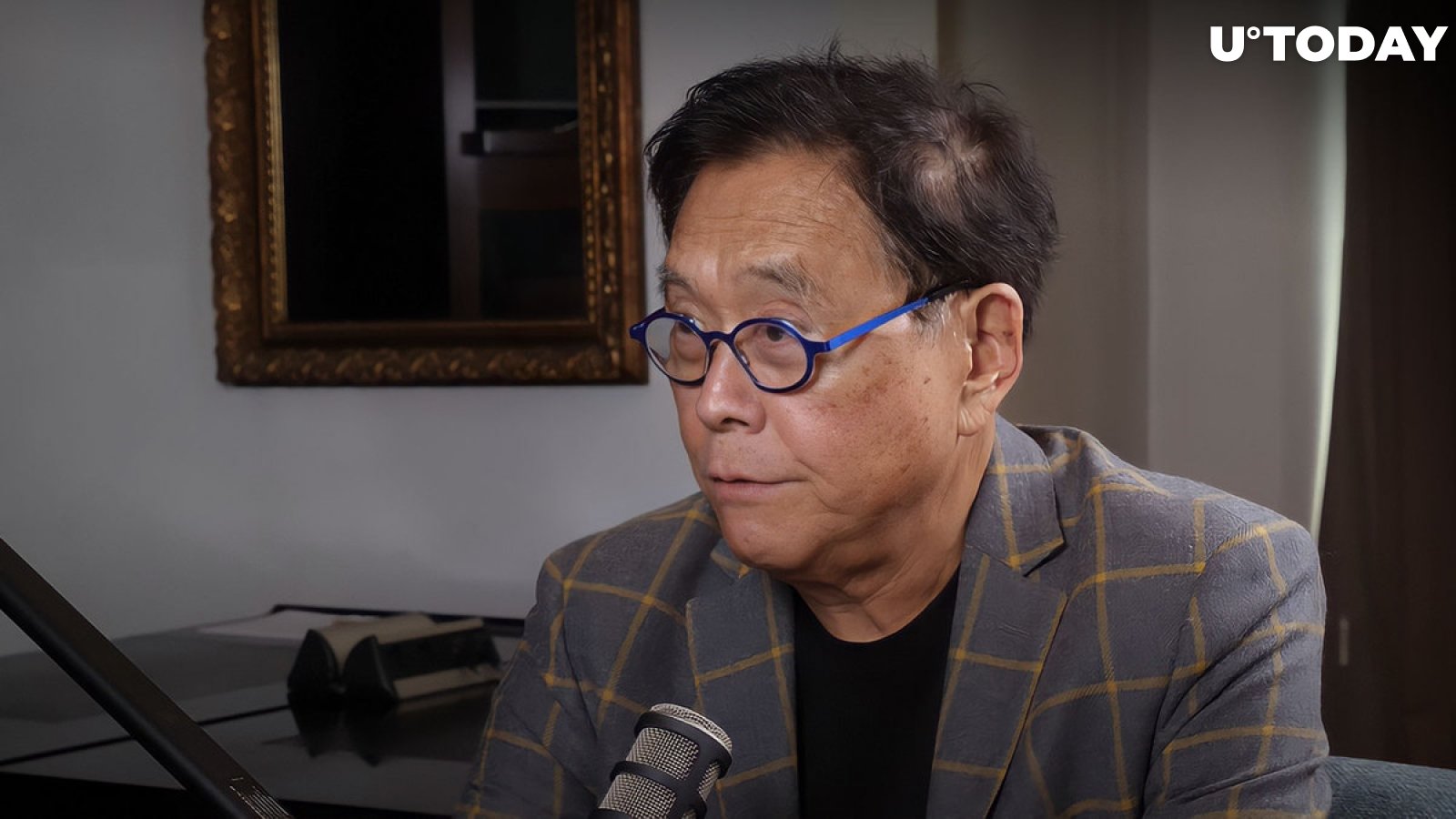

As issues develop about financial institution failures and financial instability, Robert Kiyosaki, the acclaimed writer of the best-selling e book “Wealthy Dad Poor Dad,” is sounding the alarm once more. In current social media posts, Kiyosaki emphasised the significance of economic preparation, likening the present financial scenario to flight faculty the place people should discover ways to navigate turbulent instances.

Kiyosaki’s warning got here because the Federal Deposit Insurance coverage Company (FDIC) launched troubling information exhibiting file unrealized losses on securities held by U.S. banks. The current collapse of a New York neighborhood financial institution has additional heightened issues in regards to the stability of the banking sector.

In response to those developments, distinguished figures within the monetary business have begun advocating for various belongings corresponding to Bitcoin. ARK Make investments’s Cathie Wooden predicts that Bitcoin’s reputation and inflows will surpass gold throughout the banking disaster. Former BitMex CEO Arthur Hayes additionally weighed in on the opportunity of additional financial institution failures and the Federal Reserve’s response, suggesting that such an occasion might set off an increase in Bitcoin costs.

$1 million to purchase Bitcoin

Kiyosaki has lengthy warned of market downturns, arguing that belongings corresponding to gold, silver and Bitcoin are vital hedges in opposition to financial turmoil. He predicts that if conventional markets battle, the worth of those belongings will surge.

Moreover, Kiyosaki expects Bitcoin to succeed in unprecedented highs, probably hovering to $120,000 in 2024 and even reaching $500,000 per BTC subsequent yr. If the worldwide financial system turns into unstable, he expects Bitcoin to surge to $1 million.

As uncertainty looms over the monetary panorama, Kiyosaki’s assertion of BTC as a parachute in turbulent instances resonates with many buyers in search of to guard their wealth from potential crises.