The XRP Ledger blockchain lately built-in a brand new modification known as Clawback (XLS-39) that permits issuers to reclaim tokens allotted to accounts. Whereas this replace sparked numerous discussions throughout the XRPL neighborhood, one notable dialog centered across the idea of a “clawback-enabled token financial system” proposed by Neil Hartner, a senior software program engineer at Ripple.

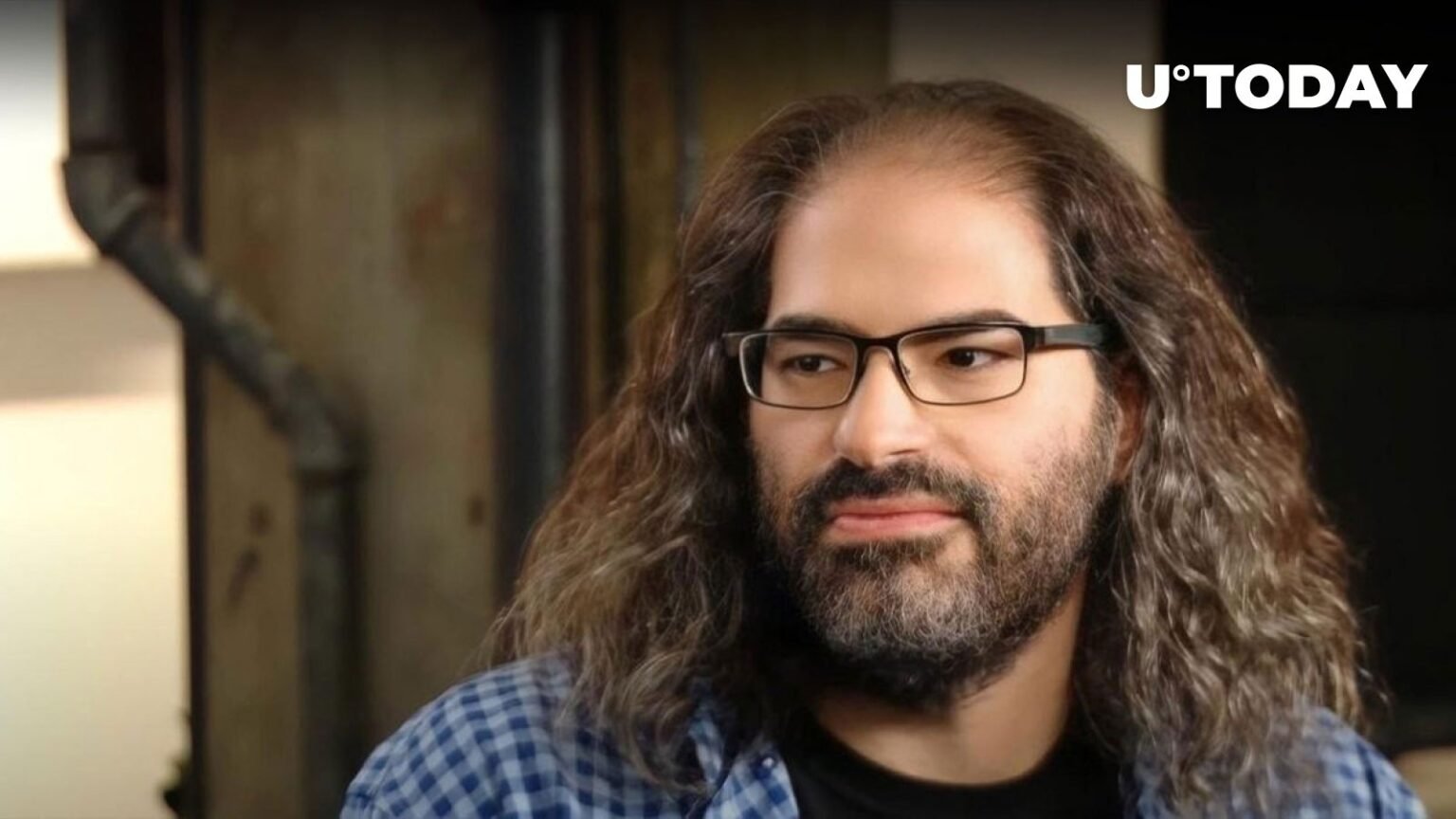

Hartner instructed making a Robinhood (RHD) token that envisioned redistributing tokens from the highest 10% of holders to the underside 90% at random intervals. Nonetheless, Ripple chief know-how officer and XRP Ledger co-founder David Schwartz expressed doubts concerning the thought, saying sarcastically, “I really like the concept.”

XRPL developer Wietse Wind questioned the necessity to accumulate massive quantities of such tokens and in contrast them to the spirit of the legendary Robin Hood. Wind instructed {that a} true Robin Hood token, like its namesake, could be intrinsically precious to its customers, thereby eliminating the necessity for extreme hoarding.

Schwartz echoed Winder’s sentiments, arguing that people wishing to carry massive quantities of tokens may simply allocate the tokens to a number of accounts, thereby circumventing the proposed clawback mechanism.

In essence, the controversy surrounding the viability and desirability of Hutner’s proposal highlights broader questions concerning the effectiveness and practicality of implementing clawback mechanisms within the token ecosystem.

Ripple Chief Expertise Officer David Schwartz elaborated on the shortcomings of Robinhood’s token idea, emphasizing the potential for customers to sport the system and the necessity for tokens to inherently derive their worth.