On-chain information reveals that Solana and different high cryptocurrencies have seen a decline in buying and selling quantity just lately. That is what the market seems like.

Solana, Bitcoin and Ethereum transaction volumes have declined over the previous month

In keeping with information from on-chain analytics firms saintCryptocurrency market buying and selling volumes have been declining since their peak in early March.

“Buying and selling quantity” right here refers back to the whole quantity of any given asset traded on varied spot cryptocurrency exchanges.

When the worth of this indicator is excessive, it implies that many cash are being moved on these platforms, which signifies that buying and selling curiosity in a given asset is at present excessive.

Alternatively, decrease indicator values might imply that the cryptocurrency market is at present inactive. This development might point out that normal curiosity within the coin is at present low.

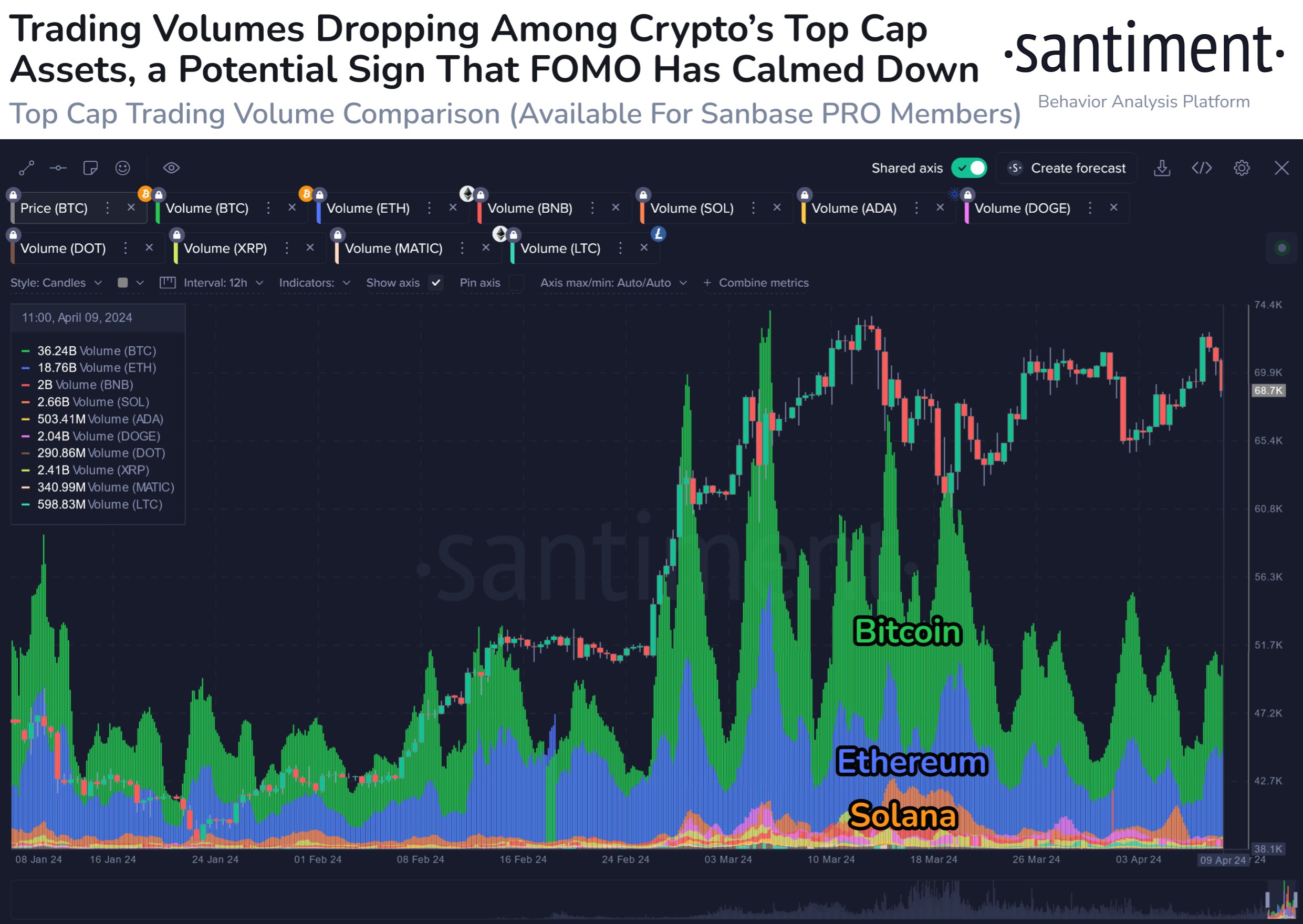

Now, the chart under reveals the quantity traits for varied high belongings within the area, reminiscent of Bitcoin (BTC), Ethereum (ETH), and Solana (SOL):

Appears to be like like the worth of the metric has gone down for all of those cash just lately | Supply: Santiment on X

As proven within the chart above, buying and selling volumes for these high cryptocurrencies surged in late February and continued into early March.

Particularly on March 6, this indicator confirmed a very apparent peak. Nevertheless, since this excessive, the indicator has been on a gradual decline.

“This seems to be due partially to the range-bound sample that started in mid-March, leading to much less confidence amongst merchants to make the precise choices,” the analytics agency defined.

Bitcoin naturally accounts for the biggest share of transaction quantity amongst all belongings, whereas the second-largest forex, Ethereum, accounts for the second largest share.

Apparently, amongst altcoins, Solana retains the primary place general regardless of BNB (BNB) having a bigger market cap. For SOL, the height in buying and selling quantity got here barely later than for BTC and ETH, presumably as a result of SOL continued to development upward whereas many different currencies fell in mid-March.

Nevertheless, Solana’s buying and selling quantity finally declined, in step with the development of different high belongings. From this perspective, general market curiosity has been sluggish just lately.

“As soon as Bitcoin, Ethereum and different high shares begin establishing constant course once more, anticipate constant buying and selling to begin rising once more,” Santiment stated.

SOL value

The previous week hasn’t been the very best of instances for Solana traders, because the asset’s value fell greater than 12% through the window, falling to only $165.

The value of the asset seems to have plummeted over the previous few days | Supply: SOLUSD on TradingView

Featured photos from Shutterstock.com, Santiment.web, charts from TradingView.com