Information reveals that Solana and Chainlink are among the many prime cryptocurrencies with open curiosity rising to comparatively excessive ranges.

Solana and Chainlink presently have excessive open curiosity values

In response to knowledge from on-chain analytics corporations saintCuriosity within the cryptocurrency derivatives market has elevated dramatically not too long ago.

The related metric right here is “Open Curiosity,” which tracks the overall quantity of derivatives contracts presently open on all centralized exchanges for any given asset.

When the worth of this indicator rises, it implies that traders are rising their publicity to derivatives out there. This development might sign increased volatility, because the trade’s complete leverage tends to rise when new futures positions emerge.

Then again, a decline on this indicator implies that holders are closing their positions or being forcibly closed by the platform, leading to a doable lower within the leverage ratio. Due to this fact, this development can result in asset costs changing into extra steady.

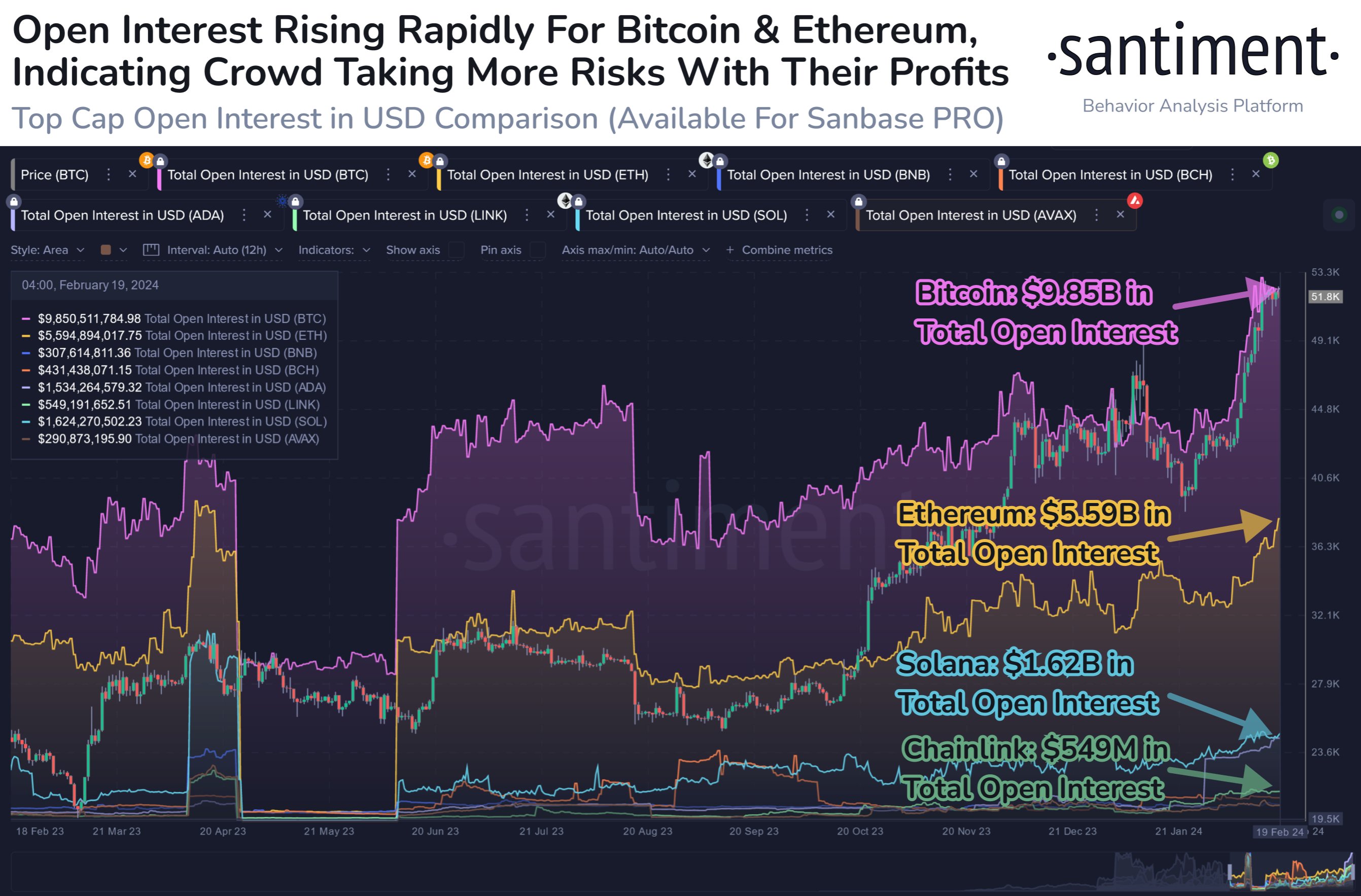

Now, the chart beneath reveals open curiosity developments for varied prime property within the cryptocurrency area over the previous yr:

Seems to be like the worth of the metric has been sharply going up for a few of these property | Supply: Santiment on X

As proven within the chart above, Bitcoin and Ethereum’s open curiosity has exploded not too long ago following the most recent value will increase. Usually, such dramatic value actions would appeal to numerous speculators to the asset, so the indicator’s upward trajectory isn’t a surprise.

The size of the rise could also be a bit alarming, although. As you possibly can see from the chart, BTC’s open curiosity is presently round $9.85 billion, whereas ETH’s open curiosity is round $5.59 billion.

Amongst altcoins, Solana and Chainlink are significantly eye-catching, with indicators reaching $1.62 billion and $549 million respectively. After all, these values are a lot smaller than Bitcoin and Ethereum, however their market caps are additionally a lot smaller than these two giants.

“Bitcoin’s open curiosity particularly topped $1 billion for the primary time since July 2022, which actually reveals that pleasure remains to be there,” the evaluation agency famous. “Typically rising too rapidly can point out some warning indicators. “

Traditionally, excessive open curiosity has been regarding as a result of in such market circumstances, large-scale liquidation occasions usually tend to happen attributable to ample leverage.

Such occasions may cause liquidations to happen concurrently, typically chaotically, and end in some wild value swings. For the reason that present open curiosity of Solana, Chainlink, and different prime property could also be overheated, it might be value watching within the coming days, as any additional enhance might function a warning.

SOL value

As of this writing, Solana is buying and selling at round $110, down greater than 3% prior to now seven days.

The worth of Solana seems to have been shifting sideways not too long ago | Supply: SOLUSD on TradingView

Featured photos from iStock.com, charts from TradingView.com, Santiment.web

Disclaimer: This text is for instructional functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It’s endorsed that you just conduct your individual analysis earlier than making any funding choice. Use of the data supplied on this web site is totally at your individual threat.