Solana’s price performance has been outstanding in recent times, surpassing Ripple and Binance Coin to become the fourth largest cryptocurrency by market capitalization. Over the weekend, SOL price breached the key $100 level for the first time since April 2022, bringing optimism to investors. However, altcoins have retraced 7%, showing that the market is overheated. As of this writing, the “Ethereum Killer” is trading just below $111.60.

SOL Outlook

Solana price has recovered significantly over the past few weeks, climbing above the psychological $100 level. The altcoin has been one of the best-performing assets this year, with gains of more than 1,025% year-to-date, and more gains in the past month alone. However, analysts note that even with this growth, Solana’s chances of breaking above $260 ATH are slim.

The reason behind this is the increase in supply relative to its value. In November 2021, Solana price hit an all-time high of $260, when its total market capitalization was approximately $78 billion. Although the crypto asset is worth less than half of its peak, its market capitalization currently hovers near $50 billion.

This is due to the increase in Solana supply by more than 100 million SOLs in the past two years. Some analysts say that for altcoins to retest $260, their total market cap would have to reach around $111 billion, which seems quite difficult with institutional investors pouring billions into the asset.

SOL’s recent surge has been fueled by massive on-chain activity. Ongoing hype about the blockchain’s fast transactions and low fees has boosted SOL’s on-chain activity. Additionally, the cryptocurrency market has been on an upward trend over the past few weeks, buoyed by a weak U.S. dollar and a potential January 10, 2024 deadline for the first approval of a spot Bitcoin ETF.

Solana Price Outlook

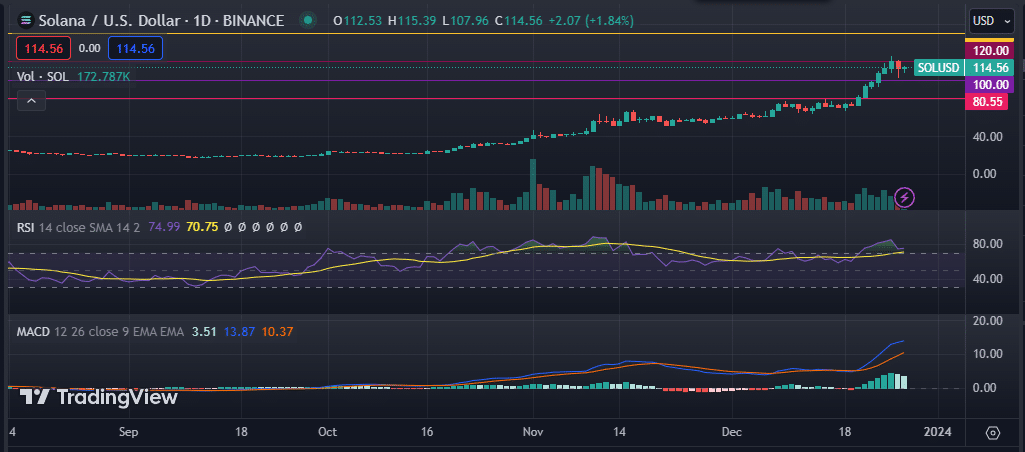

Solana price has been on a strong bullish trajectory over the past few weeks despite a strong rejection at the important resistance level of $120. The digital asset remains above the 50-day and 200-day exponential moving averages as well as the 100-day and 200-day simple moving averages. Its relative strength index (RSI) is 74, indicating that the asset is overbought due to its recent gains.

Therefore, the market must calm down before it can resume its rebound. Furthermore, its bullish momentum is currently waning, characterized by the shrinking green bars of the Moving Average Convergence Divergence (MACD) indicator.

Therefore, Solana price may retrace to $100 or lower until the market cools off, after which it will gather strength to resume the rally. On the other hand, if bulls continue to charge the altcoin, Solana could flip immediate resistance at $120, bolstering confidence in its current market position.

SOL Price Chart