S&P World Scores highlighted in a latest evaluation that the potential approval of a spot Ethereum (ETH) exchange-traded fund (ETF) in america that would come with a staking program might amplify focus dangers throughout the Ethereum community.

In accordance with experiences, the SEC could approve an ETH ETF as quickly as Might. Nonetheless, as monetary giants compete for a stake on this rising house, the entry of ETFs might considerably have an effect on the steadiness of energy amongst Ethereum validators, creating new challenges and alternatives.

The SEC has till Might 23 to rule on VanEck’s submitting and should rule on different ETH ETF filings earlier than that deadline.

focus threat

The spot Ethereum ETF proposal from Ark Make investments and Franklin Templeton goals to generate further revenue by staking ETH. Nonetheless, if these staking-enabled ETFs see excessive sufficient inflows, they may impression participation charges on the Ethereum verification community, S&P World analysts wrote.

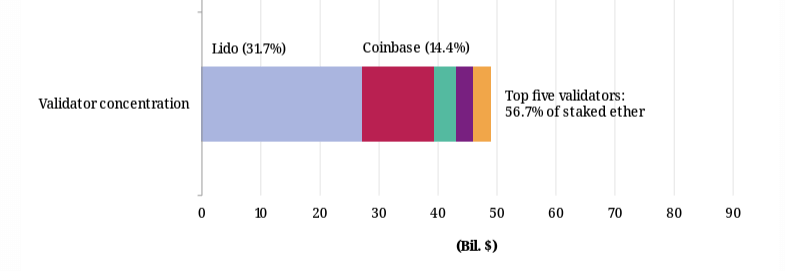

In accordance with the report, Lido at the moment accounts for slightly below a 3rd of staked ETH and is the biggest Ethereum validator. Nonetheless, the report casts doubt on the probability of those ETFs selecting decentralized staking protocols similar to Lido.

As an alternative, a choice for institutional cryptocurrency custodians appears extra probably, suggesting differential impacts on validator focus primarily based on the issuer’s diversification technique.

The report additionally highlights that Coinbase, because the custodian of sure funds, might also pose focus dangers if it receives new ETH on behalf of U.S. ETFs.

The alternate is at the moment accountable for roughly 15% of all ETH staked, making it the second largest validator. It additionally serves as custodian for 3 of the 4 largest non-US-collateralized Ethereum ETFs.

The report states that these points are crucial as a result of reliance on a single entity or software program shopper can introduce dangers of validator outages and assaults. It requires elevated monitoring of focus dangers and emphasizes their significance.

The emergence of latest digital asset custodians might present a manner for ETF issuers to allocate their shares extra broadly, which might additionally mitigate focus threat.

JPMorgan Chase additionally expressed considerations

S&P World’s report echoes considerations raised by JPMorgan Chase in a latest comparable evaluation of Ethereum ETF spot. The lender’s report additionally concluded that Lido and Coinbase’s dominance pose vital focus dangers to the ecosystem.

JPMorgan Chase believes {that a} concentrated variety of validators might grow to be a single level of failure, endangering the steadiness and safety of the community. This centralization additionally supplies profitable targets for malicious assaults, from hacking assaults to coordinated disruptions of community operations.

Moreover, analysts at JPMorgan warned of potential collusion amongst main validators. An oligopoly of validators can manipulate the community’s governance and operational parameters to their very own benefit, on the expense of Ethereum’s broader person base.

This might take the type of censoring transactions, giving preferential therapy to sure operations, or front-running transactions — practices that erode belief in Ethereum’s equity and transparency.

Making certain that Ethereum stays a powerful, safe and decentralized platform requires a collective effort to mitigate focus dangers and create an setting the place nobody validator or group of validators can train disproportionate energy.