A current report from market intelligence agency Chainaanalysis revealed that international cryptocurrency earnings will attain a staggering $37.6 billion in 2023. The revenue surge displays improved asset costs and market sentiment in contrast with 2022.

Whereas this determine is decrease than the $159.7 billion in features through the 2021 bull market, it marks a pointy restoration from the $127.1 billion anticipated losses in 2022.

Cryptocurrency earnings surge sharply

this Report It exhibits that though crypto asset value development charges are comparable in 2021 and 2023, complete returns are decrease within the latter. In response to Chainaanalysis, this distinction could also be resulting from a lower in buyers’ willingness to transform crypto belongings into money.

The evaluation additional exhibits that buyers seem to anticipate additional value will increase in 2023, as crypto asset costs haven’t exceeded earlier ranges. all time excessive (ATH) Not the identical as in 2021.

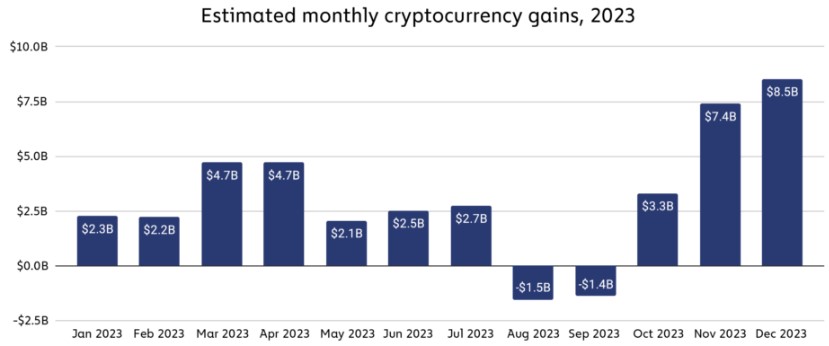

Cryptocurrency features have remained comparatively secure in 2023, save for 2 consecutive features months of losses August and September, as proven above. Nevertheless, features have since surged, with features in November and December exceeding all earlier months.

America leads

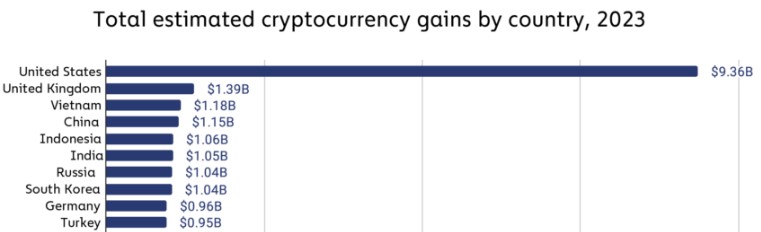

Main the way in which by way of cryptocurrency features is the US, with income anticipated to be $9.36 billion in 2023. The UK ranks second with an estimated $1.39 billion in cryptocurrency features.

It’s price noting that some upper-middle-income and lower-middle-income international locations, particularly Asian international locations resembling Vietnam, China, Indonesia and India, have achieved vital features, every exceeding US$1 billion, rating among the many prime six on this planet.

Chainaanalysis has beforehand noticed excessive cryptocurrency adoption inside these revenue classes, notably in “low- and middle-income” international locations, which have proven resilience even through the current financial downturn. bear market. Earnings estimates counsel that buyers in these international locations have reaped substantial features from embracing the asset class.

Lastly, the Chainaanalysis report means that the optimistic development noticed in 2023 has continued into 2024, with distinguished cryptocurrencies resembling Bitcoin (BTC) reaching an all-time excessive of $73,700 following Bitcoin’s approval alternate traded funds (ETFs) and enhance institutional adoption.

If these traits proceed, the corporate believes 2024 earnings will probably be nearer to 2021 earnings.

As of this writing, the full cryptocurrency market cap is estimated at $2.5 trillion, down greater than 4% prior to now 24 hours alone, down from Thursday’s two-year excessive of $2.7 trillion. Bitcoin, alternatively, is at present buying and selling at $68,400 after falling to $65,500, however rapidly recovered to its present buying and selling value, limiting losses to 4% prior to now 24 hours.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for academic functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is strongly recommended that you simply conduct your individual analysis earlier than making any funding choice. Use of the knowledge supplied on this web site is totally at your individual threat.