The next is an excerpt from the most recent version of Bitcoin Journal Professional, Bitcoin Journal’s premium market e-newsletter. To be among the many first to obtain these insights and different on-chain Bitcoin market evaluation immediately into your inbox, Subscribe now.

As Bitcoin’s halving approaches, the dual pressures of sharply rising demand and lowering provide have created an uncommon market, turning traditionally constructive omens into explosive revenue alternatives.

The approval of a Bitcoin ETF adjustments the face of Bitcoin as we all know it. The ensuing developments have induced upheaval around the globe for the reason that U.S. Securities and Trade Fee (SEC) made its fateful choice in January. Billions of {dollars} have poured into these new funding alternatives, and regulators in lots of international locations are contemplating Bitcoin’s function in monetary establishments. Regardless of some preliminary setbacks, the market has simply reached new all-time highs and regardless of the volatility, costs have remained inside a really spectacular vary.

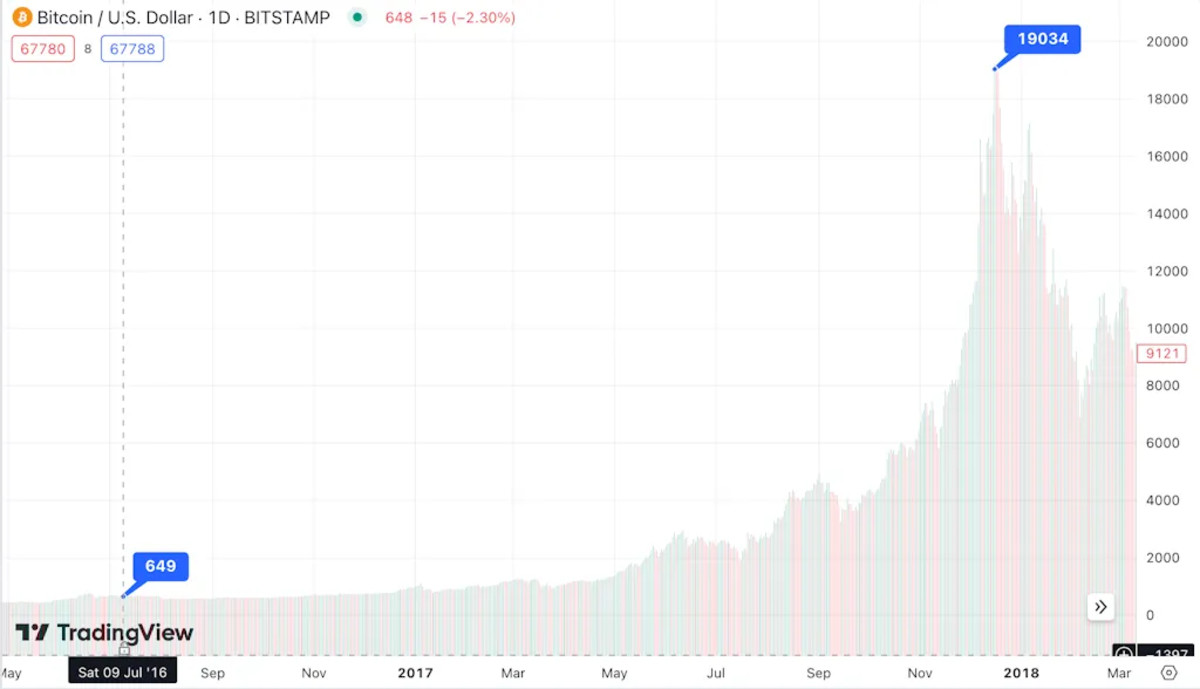

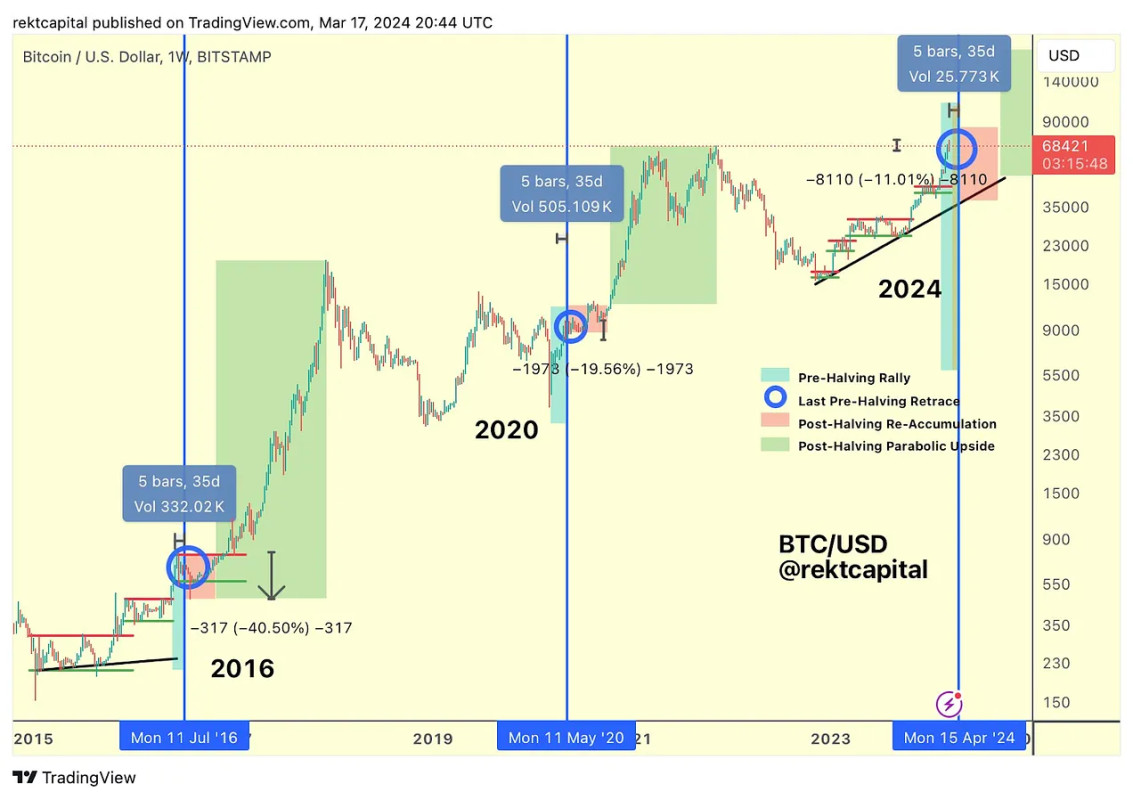

Nonetheless, the scenario we’re in is exclusive and will influence markets in unpredictable methods. Bitcoin’s subsequent halving is coming in April, and it is going to be the primary time in its whole historical past {that a} halving coincides with an all-time excessive worth. Whereas there are massive variations between every main halving, the overall development is evident: Even with large regular positive factors, it takes a few yr to 18 months for Bitcoin to interrupt all data in actual phrases. Costs soared. One yr after the halving in June 2016, the worth of Bitcoin greater than doubled; nonetheless, a couple of months later, the expansion was near 30 instances.

There’s loads of optimism amongst necessary business gamers, equivalent to Normal Chartered Financial institution, which boldly predicts that the worth of Bitcoin will greater than double to $150,000 by the top of the yr. Nonetheless, their evaluation of the scenario isn’t primarily based totally on the halving development, however on the massive success of Bitcoin ETFs, and this success has induced us hassle. As neighborhood discussions are fast to level out, these main ETF issuers have poured billions into Bitcoin, shopping for at an alarming price and amassing a number of the world’s largest Bitcoin provides virtually in a single day. In the event that they collectively purchase much more than the worldwide scale, how will they react when the spigot of latest cash is blocked?

In different phrases, we face a scenario the place demand is at an all-time excessive however provide isn’t sufficient to fulfill it. enterprise insider Coinshares calls the upcoming halving a “important occasion” on condition that the ETF has “made everlasting adjustments to Bitcoin’s underlying infrastructure.” A number of spot Bitcoin ETFs resulted in 4,500 Bitcoins being minted on January 11 (buying and selling day solely), whereas on common solely 921 new Bitcoins are minted per day. ” And that’s simply contemplating pre-halving mining charges, ETF issuers are already counting on second-hand Bitcoin gross sales to fill their coffers, and this development appears sure to extend within the close to future.

However is not {that a} good factor? Typically talking, constructive demand shocks are normally related to worth will increase. Moreover, whereas such shocks to key commodities equivalent to oil might result in inflation, Bitcoin isn’t but a major a part of the general world financial system. The identical shortcomings are unlikely to happen presently. In different phrases, the reply is normally sure, however the scenario can nonetheless give rise to alarming developments. For instance, a very puzzling improvement occurred on the night time of March 18: whereas Bitcoin was sliding at a excessive of round $70,000, the worth of Bitcoin on BitMEX fell beneath $90,000 within the blink of an eye fixed. The fast worth restoration has nothing to do with this trade in any means, however it’s nonetheless an unprecedented improvement.

BitMEX introduced that the perpetrator for this adverse worth surge was a sequence of enormous promote orders in the midst of the night time, and that they’re investigating the exercise. Particularly, some nameless whales have emerged as doable candidates for these gross sales. We nonetheless don’t know precisely who they have been or who was shopping for Bitcoin at such an alarming price, however this is only one instance of how a large sell-off can undermine market confidence. In any case, this incident is only one notably stark instance of an total development. Spot promoting continues to “proceed” as Bitcoin worth plummets. The market hit a low of $62,000 on Tuesday afternoon and was close to $72,000 on Friday morning.

Nonetheless, merchants stay solely optimistic that these worth drops are nothing greater than “bear traps” related to the pre-halving setting, they usually’re not the one ones. Outstanding executives together with Binance CEO Richard Teng and Crypto.com CEO Kris Marszalek have endorsed the view that such worth drops are a very pure and momentary a part of the deliberate halving. Within the weeks main as much as the latest halving, a major downward development in worth, from 20% to 40%, was clearly observable. Nonetheless, the worth rebounded shortly and utterly, rising to new all-time highs.

In different phrases, a number of the latest sudden worth dives might be defined solely by historic Bitcoin information. The pertinent query we face, then, is whether or not the way forward for Bitcoin will observe the identical path. Just about all out there indicators level to optimistic long-term forecasts. The constructive demand shock from ETF acquisitions and the halving will probably make it harder for the common shopper to buy Bitcoin, however how will this issue be mirrored? The value is greater. Moreover, a promoting level of the ETF is that a lot of atypical customers will use it to hunt Bitcoin income, moderately than direct custody. This alone will encourage ETF issuers to maintain shopping for strain excessive. It’s inconceivable to say how lengthy this market situation will final or what it would imply for Bitcoin’s use as an precise foreign money, however as issues stand, there’s nothing to recommend that Bitcoin gained’t proceed to develop.

So is it any surprise that the neighborhood is making ready for the halving with such bated breath? The most important names within the business are fastidiously making ready for “Bitcoin’s Largest Celebration,” with stay protection and meetups in 7 international locations (and counting), with the halving not anticipated for an additional month. If January’s beautiful regulatory victory turns into unprecedented progress by December, 2024 will probably be seen because the yr Bitcoin really turns into built-in into the worldwide monetary infrastructure. Actually, the most important concern is whether or not Bitcoin’s use as a foreign money will diminish when its fiat worth is so costly. Nonetheless, the indicators appear clear proper now: Bitcoin will carve a path into the long run.