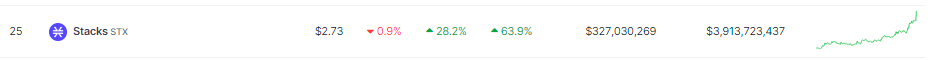

Stacks (STX), a cryptocurrency that facilitates sensible contracts on the Bitcoin blockchain, has overcome broader market turmoil to emerge as an outperforming cryptocurrency. Over the previous week, STX costs have soared greater than 60%, reaching a nine-day excessive of $2.15 and approaching an all-time peak of $2.45. This spectacular rally has propelled Stacks into the highest 25 cryptocurrencies by market capitalization, leaving many questioning: What’s driving this surge?

Stacks (STX) rises over 60% on Bitcoin rally

A number of elements seem like driving Starks’ rise. First, its distinctive capability to convey sensible contract performance to Bitcoin has resonated with buyers in search of superior purposes on the world’s oldest blockchain. Not like Ethereum, Bitcoin basically lacks help for sensible contracts, limiting its DeFi and NFT features.

Supply: Coingecko

Stacks bridges this hole by anchoring Bitcoin and offering sensible contract performance. This progressive strategy has attracted a number of consideration, particularly since Bitcoin itself has seen a latest worth rise, reaching over $52,000 on the time of writing.

The correlation between Stacks and Bitcoin is simple. Each belongings noticed a notable restoration within the second week of February, with STX mirroring Bitcoin’s climb from $38,500 to $50,000. This intertwined destiny highlights the affect that broader Bitcoin sentiment has on Stacks’ worth motion.

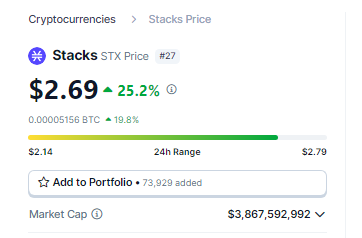

STXUSDT buying and selling at $2.69 the 24-hour chart: TradingView.com

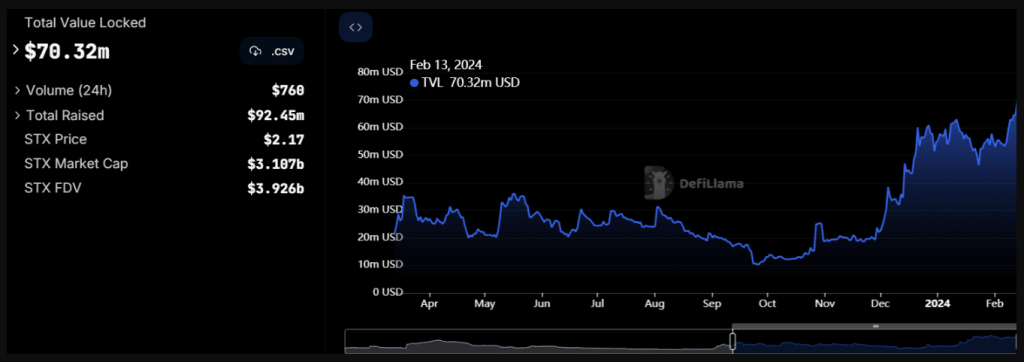

STX’s TVL surges

Along with worth motion, one other bullish indicator has emerged for Stacks’ DeFi ecosystem. In response to DefiLlama, the whole worth locked (TVL) within the Stacks DeFi protocol has surged by greater than 50% prior to now three weeks to $70.21 million. This progress means elevated investor confidence and aggressive capital commitments within the Stacks DeFi area.

Technical evaluation additional amplifies the optimistic outlook. Analysts predict the rally is more likely to proceed, with worth targets starting from $2.475 to $2.82. This bullish forecast hinges on STX’s capability to interrupt by way of resistance at latest swing highs at $2.06, a decisive technical milestone achieved earlier this week.

Stacks Complete Worth Locked. Supply: Defillama

.@stack Coin market capitalization rose from round sixtieth to thirty fourth in a single yr, surpassing many family names

Because the Bitcoin L2 narrative begins to dominate discussions and L1 community charges attain all-time highs, count on it to enter the highest 20 across the time of the halving

As we enter…

— trevor.btc — b/acc (@TO) February 12, 2024

Nevertheless, it’s essential to acknowledge the inherent volatility of the cryptocurrency market. Current U.S. inflation knowledge triggered a sell-off throughout the market, reminding buyers of the unpredictability of the asset class. Though Stacks managed to get well rapidly, the incident highlights the significance of accountable funding practices and thorough threat evaluation.

Regardless of the dangers, Stacks’ distinctive worth proposition and up to date momentum can’t be ignored. Its capability to attach Ethereum’s sensible contract capabilities with Bitcoin’s safety and immutability makes it a doubtlessly disruptive power within the blockchain area.

Featured photos from Pexels, charts from TradingView

Disclaimer: This text is for academic functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is suggested that you just conduct your personal analysis earlier than making any funding resolution. Use of the data supplied on this web site is completely at your personal threat.