10 spot Bitcoin ETFs skilled their largest three-day outflows since launching in January, report Bloomberg. This shift in investor sentiment comes after rising curiosity drove features for the market’s largest cryptocurrency. A brand new all-time excessive of $73,700.

Bitcoin ETF outflows hit file excessive

Web exits from Bitcoin ETFs totaled $742 million from Monday to Wednesday, reflecting outflows from Grayscale Bitcoin Belief (GBTC) and related product subscriptions from well-known corporations reminiscent of BlackRock (IBIT) and Constancy Investments (FBTC). sluggish.

based on Bloomberg ETF professional Eric Balchunas mentioned the Grayscale Bitcoin Belief skilled a major surge in outflows. This latest growth factors to a ‘second wind’ for buyers Withdraw cashSimply this week, belief funds noticed $1.4 billion in outflows.

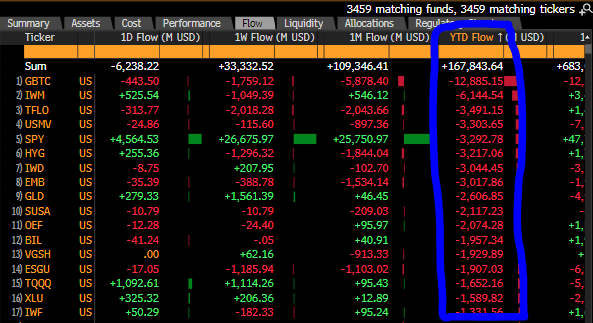

Notably, because the chart above reveals, these withdrawals have surpassed all different ETFs in year-to-date outflows and set a brand new file for cumulative outflows in ETF historical past.

Nonetheless, GBTC nonetheless occupies a outstanding place in income era. The fund presently ranks third out of three,400 out there ETFs, demonstrating its continued monetary success.

though latest capital outflowsThe general efficiency of those funds stays noteworthy, with web inflows reaching $11.4 billion since launch, based on knowledge compiled by Bloomberg. This marks probably the most profitable debuts within the ETF class.

Cryptocurrency Analyst Predicts ‘Vital Rally’ for Bitcoin

Bitcoin surged greater than 5% within the U.S. on Wednesday, pushed by indicators from the Federal Reserve hinting at its potential. reduce rates of interest.

Nonetheless, Asian markets confirmed a special image on Thursday, with Bitcoin shedding momentum in comparison with continued features in international shares and gold. In keeping with Bloomberg, information of outflows from Bitcoin ETFs flooded the market, leading to very totally different performances.

Nonetheless, outstanding cryptocurrency analyst Michael van de Poppe shared a daring prediction on social media platform X (previously Twitter).in his postalHe expressed optimism about Bitcoin’s “important rebound,” suggesting it could proceed to rise.

Van de Poppe additionally predicted that Bitcoin might consolidate within the quick time period earlier than embarking on one other rally in direction of the all-time highs reached earlier than the halving occasion, which is predicted to start someday in April.

At the moment, BTC is buying and selling at $66,200, up 4% previously 24 hours regardless of ongoing outflows from the ETF market. Over the longer time-frame, Bitcoin has proven constant features, rising 27% over the previous 30 days and a powerful 136% year-to-date.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is strongly recommended that you just conduct your personal analysis earlier than making any funding resolution. Use of the data offered on this web site is solely at your personal danger.