The bullish momentum in Bitcoin costs has waned over the previous few weeks, calling into query the progress of the cryptocurrency’s bull cycle. The cryptocurrency market skilled a flash crash on Friday, April 12, inflicting the worth of the main cryptocurrency to drop from $70,000 to under $67,000.

This newest downturn highlights the problem in Bitcoin costs returning to the current all-time excessive of $73,737 set in mid-March. On-chain analytics platform Santiment has recognized a particular Bitcoin indicator that might sign a resumption of the bull market.

If this indicator drops, the Bitcoin bull run may resume

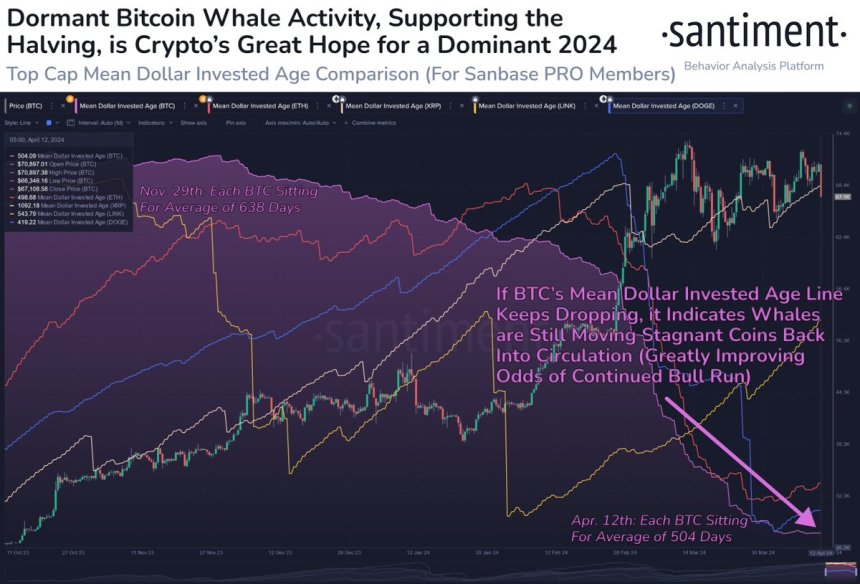

In a current article on X, blockchain intelligence agency Santiment supplied thrilling insights into the present cycle and Bitcoin’s worth efficiency. The agency identifies the typical greenback funding age indicator as one of many indicators it watches when market leaders transfer sideways.

In line with Santiment, the Common USD Funding Age metric tracks the typical funding age of belongings inside the identical pockets. When this indicator rises, it implies that investments have gotten extra stagnant and older cash are being held in the identical pockets.

Conversely, a decline within the common greenback funding age indicator means investments are flowing again into common circulation. This “falling line” additionally exhibits elevated on-line exercise.

A chart displaying Bitcoin's Imply Greenback Invested Age | Supply: Santiment/X

From a historic perspective, Bitcoin has exhibited a declining common greenback funding age line throughout earlier bull cycles. In line with Santiment, that is the case for main cryptocurrencies through the present bull run that began in late October 2023.

Nonetheless, the on-chain analytics platform famous that Bitcoin’s common greenback funding age line has been shifting sideways over the previous few weeks. This phenomenon is much more stunning contemplating that the much-anticipated halving occasion is a few week away.

The Bitcoin halving will scale back miner rewards in half (from 6.25 BTC to three.125 BTC). It is a bullish occasion that has most traders optimistic in regards to the outlook for the premier cryptocurrency in 2024.

Judging from Santiment’s newest report, traders could need to pay shut consideration to the typical Bitcoin funding age indicator. The bullish market is more likely to proceed if Bitcoin’s common USD funding age line resumes its decline, which means main stakeholders resembling whales will carry the coin again into common circulation.

Bitcoin Value at a Look

On the time of writing, Bitcoin is buying and selling at round $66,548, with the value down a major 6% up to now 24 hours.

Bitcoin worth falls under $67,000 on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Disclaimer: This text is for academic functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It’s endorsed that you simply conduct your individual analysis earlier than making any funding choice. Use of the knowledge supplied on this web site is fully at your individual danger.