in accordance with data In line with information from on-chain analytics platform Ethereum (ETH) Lookonchain, whales have withdrawn roughly $64.2 million value of ETH from main exchanges.

This vital stream of funds coincides with a big enhance within the value of ETH, displaying rising curiosity within the asset.

Ethereum whale motion reveals confidence

In line with Lookonchain’s findings, the vast majority of ETH provide has been moved from alternate wallets to custodial wallets. The on-chain analytics platform reported that the Ethereum deal with tagged 0x8B94 had withdrawn 14,632 ETH from Binance, value roughly $45.5 million.

Lookonchain stated the funds have been actively pledged inside six days, displaying an intention to undertake a long-term funding technique.

The platform’s evaluation additionally famous that two different new whale wallets have transferred 6,000 ETH from Kraken to undisclosed pockets addresses up to now two days, totaling $18.7 million.

whales are accumulating $ETH!

0x8B94 Withdraw 14,632 $ETH($45.5 million) from #binance and staked it throughout the previous 6 days. https://t.co/bywnrZ2glt

Withdraw 6K from 2 contemporary whale wallets $ETH($18.7 million) from #kraken Up to now 2 days. https://t.co/0kEvOmiv3h https://t.co/90fqjJXsSu pic.twitter.com/J0ewl8S3OX

— Lookonchain (@lookonchain) February 26, 2024

This pattern reveals that increasingly more main traders are buying massive quantities of Ethereum from buying and selling platforms, which can be a method to attain long-term asset appreciation.

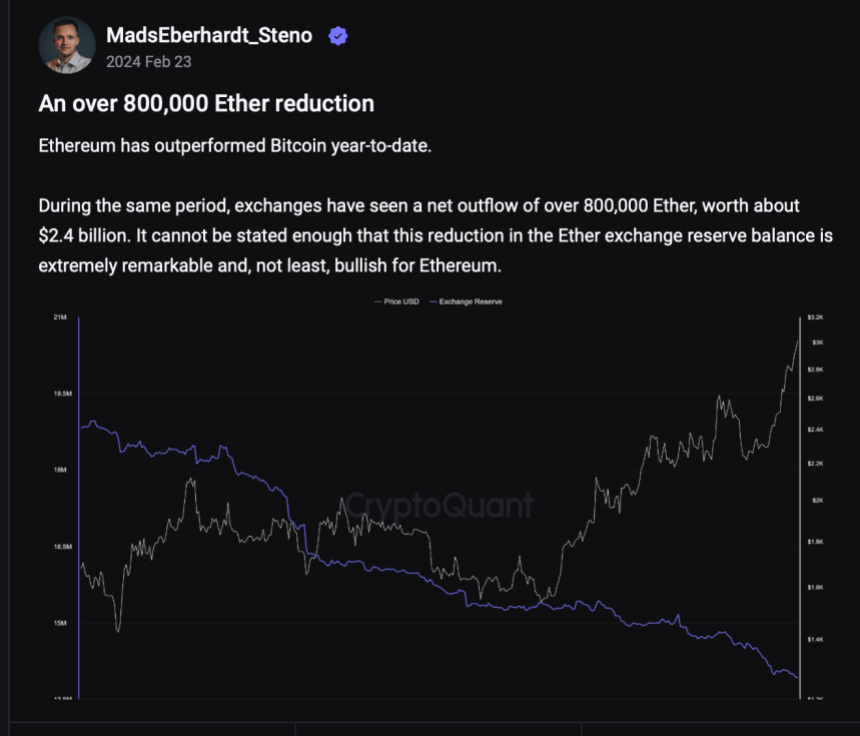

That is additional echoed by a current evaluation by CryptoQuant’s Quicktake, which highlighted a big pattern in Ethereum withdrawals from exchanges over the previous few weeks. This remark depends on the “Trade Reserves” indicator, which displays the variety of ETH tokens held in wallets throughout all centralized exchanges.

When the worth of this indicator will increase, it implies that traders are depositing extra belongings than withdrawing from centralized exchanges, which signifies that Ethereum reserves are rising. Conversely, a decline on this indicator signifies a internet outflow of belongings from these platforms.

In line with information from CryptoQuant, greater than 800,000 ETH (roughly $2.4 billion) has exited cryptocurrency exchanges because the starting of this yr. Massive outflows from these platforms sometimes point out a surge in investor confidence within the Ethereum community and its native token.

Ethereum Worth Momentum and the Potential for a Main Breakout

In the meantime, the worth of Ethereum has additionally proven bullish momentum, gaining 5.5% over the previous week and regaining the important thing $3,000 mark.

Finance guru Raoul Pal has drawn consideration to Ethereum’s potential for a significant breakout, pointing to a “double chart sample” noticed on the ETH/BTC chart.

The ETH/BTC chart is completely gorgeous…and primed for the following large transfer – a breakout of the enormous wedge…let’s see how that performs out… pic.twitter.com/5x4tJLjtJy

— Raoul Parr (@RaoulGMI) February 25, 2024

Pal highlighted a “big wedge” sample alongside an inner descending channel, indicating a consolidation part with bullish potential.

Featured pictures from Unsplash, charts from TradingView

Disclaimer: This text is for academic functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is suggested that you simply conduct your personal analysis earlier than making any funding determination. Use of the knowledge supplied on this web site is completely at your personal threat.