What are AI tokens?

AI tokens function the forex for transactions throughout the AI platform, enabling customers to pay for providers, entry knowledge, and take part in platform actions. Some AI tokens additionally grant governance rights to holders, permitting them to take part in decision-making processes that have an effect on the event of the venture.

Usually, synthetic intelligence tokens reward customers for actions comparable to offering knowledge, offering computing assets, or growing synthetic intelligence functions, motivating customers to contribute to protocols or initiatives.

Regardless of latest hype, a number of indicators for key synthetic intelligence cash level to additional development for the business

AI Cryptocurrency Market Overview

The marketplace for synthetic intelligence tokens has seen vital development in latest months, with buying and selling volumes and market valuations surging throughout exchanges. Nevertheless, regardless of vital advances in AI know-how, the sphere continues to be in its early levels.

As the synthetic intelligence craze continues to influence the worldwide tech panorama, the proliferation of AI-related crypto tokens displays the rising potential of this rising asset class. This development is especially noteworthy, even surpassing Bitcoin’s latest beneficial properties to a report excessive of $73,600.

On February 22, sector tokens rose by a median of seven.7%, with Ocean Protocol’s OCEAN and Fetch.AI’s FET rising by greater than 10%. The CoinDesk 20 index (CD20), which tracks main cryptocurrencies, rose 2.68% over the identical interval.

Worldcoin’s WLD had the very best rise amongst AI cash, surging 30% to succeed in an all-time excessive of $7. Worldcoin was based by OpenAI CEO Sam Altman, and a few merchants view Worldcoin’s rise as a guess on OpenAI’s development.

A tweet from Ethereum co-founder Vitalik Buterin about the potential for synthetic intelligence auditing good contracts boosted lesser-known tokens like 0x0 and TokenFi’s TOKEN, which jumped as a lot as 15% because of their affiliation with the subject.

Regardless of the latest hype, a number of indicators for key synthetic intelligence cash level to additional development for the business.

Fetch.ai (FET)

Fetch.ai is a platform that gives instruments to construct, deploy and monetize AI providers with out altering present APIs. It connects varied integrations to create new providers that may be accessed by a single immediate.

The Cambridge-based Synthetic Intelligence Lab was based in 2017 and launched by Binance in 2019. Its platform has been on-line on the mainline since 2020, integrating decentralized machine studying on a decentralized ledger.

The system makes use of autonomous software program brokers to optimize providers, assist IoT gadgets and facilitate safe communications and automation. These brokers can independently search, negotiate, commerce information, and share predictions and worth.

Fetch.AI makes use of its native token FET as the primary forex for on-line transactions and providers. FET is crucial for accessing providers, knowledge, infrastructure and synthetic intelligence algorithms on the platform. It’s also used to register, stake and reward community individuals. FET facilitates transactions throughout the Fetch.AI open financial framework, enabling customers to deploy brokers and take part in community actions.

that is latest report SingularityNET, Fetch.ai, and Ocean Protocol are discussing merging their tokens into the ASI token value roughly $7.5 billion. The potential merger, which might be introduced quickly, pending neighborhood approval, would create a collaborative “superintelligence collective” led by SingularityNET’s Ben Goertzel and chaired by Fetch.ai’s Humayun Sheikh. Every platform will retain its operations whereas benefiting from collective collaboration.

Render Token (RNDR)

Render Token (RNDR) gives assist for a decentralized GPU cloud computing community designed for high-demand duties comparable to AI/ML coaching and rendering. Customers can stake and lock RNDR tokens to entry GPUs throughout the community

Render farm suppliers are incentivized by the RNDR token for renting out their graphics processing energy. As of now, RNDR has a market capitalization of $1.22 billion.

Render has carved out a singular area of interest within the AI ecosystem, positioning itself because the market chief in GPU distribution for Web3. To additional strengthen its place, Render is coming into into strategic collaborations with key companions within the blockchain know-how area.

Regardless of market developments, Render persistently exceeds expectations, highlighting its distinctive worth proposition and business recognition. As synthetic intelligence in blockchain continues to develop, and because the business matures, Render, along with Fetch.ai, will achieve vital first-mover benefits.

Bit Tensor (TAO)

Bittensor goals to democratize synthetic intelligence growth by making a peer-to-peer ecosystem the place customers can construct and deploy machine studying (ML) fashions. The platform permits completely different machine studying fashions to work together and study collaboratively, thereby making a extra open and inclusive synthetic intelligence growth atmosphere.

By integrating synthetic intelligence and blockchain know-how, Bittensor presents a singular strategy to synthetic intelligence growth to responsibly harness the transformative potential of cryptocurrency. The mixture goals to interrupt down obstacles to entry in synthetic intelligence growth and allow broader participation and innovation within the discipline.

Launched in 2021 by the Opentensor Basis, Bittensor is a comparatively new venture led by builders Jacob Robert Steeves and Ala Shabaana. The Opentensor Basis’s aim in selling Bittensor is to determine an interconnected and coordinated world provide of computing energy to develop open supply and accessible synthetic intelligence know-how.

Bittensor runs on a community referred to as “subtensor”, which is linked to a number of “subnets”, 32 of that are at present energetic. Customers can create or be part of subnets and pay to take part utilizing TAO tokens.

This aggressive mannequin encourages development and excessive requirements, permitting customers to contribute as miners or validators relying on their computing assets. General, it incentivizes participation in and helps Bittensor’s decentralized AI ecosystem.

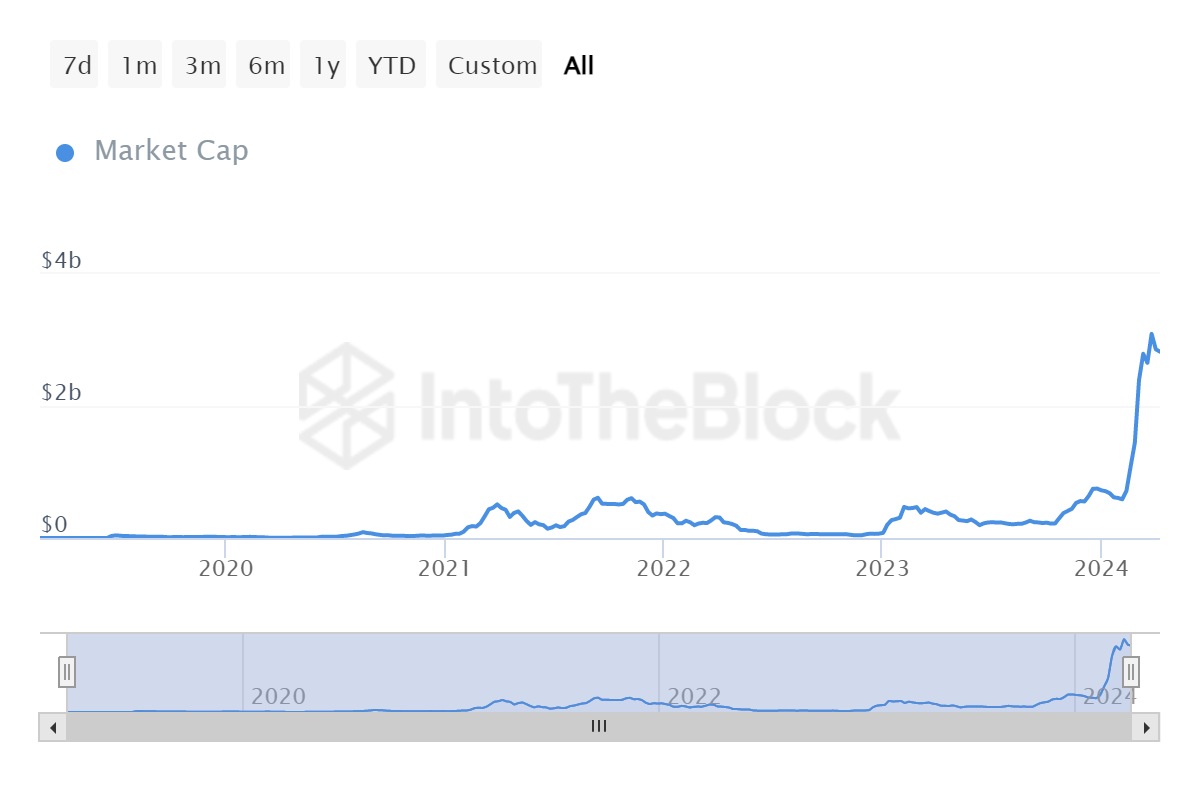

TAO was one of many winners of this rally, with its market worth hovering 500%.

Over the previous week, TAO has gained greater than 18.0%, rising from $609.71 to its present value. The coin’s all-time excessive value is $757.60.

Over the previous week, Bittensor’s buying and selling quantity has surged by 643.0%, in keeping with the expansion of the whole circulating provide of the token, which has elevated by 0.7%.

The present circulating provide is 6.58 million cash, accounting for about 31.32% of the utmost provide of 21 million cash. As of now, TAO ranks twenty eighth in market capitalization, with a valuation of US$4.68 billion.