At the moment’s Bitcoin value motion is the results of a mix of things, together with large liquidations, macroeconomic pressures, destructive Coinbase premiums, and the influence of Bitcoin ETF dynamics. These elements mixed to trigger a major decline within the value of Bitcoin.

#1 Lengthy Hole

Bitcoin market costs dropped sharply at present due to an enormous liquidation occasion within the futures market. In accordance with information from Coinglass, greater than $682.54 million was liquidated by cryptocurrency merchants throughout greater than 191,000 merchants prior to now 24 hours.

The surge in liquidations brought on the worth of Bitcoin to plummet 8% in only a few hours, from $72,000 to $66,500. Though the worth of Bitcoin has recovered barely, rebounding to the $68,000 stage, it’s nonetheless almost 10% under the all-time excessive of $73,737 on March 14.

80% of the liquidations had been lengthy positions, accounting for a complete of $544.99 million. Brief place liquidations accounted for the remaining $136.94 million, and Bitcoin lengthy liquidations alone accounted for $242.37 million.

#2 Macro surroundings impacts Bitcoin value

The macroeconomic state of affairs has put further strain on Bitcoin’s worth. Ted, a macro analyst referred to as @tedtalksmacro, highlights the influence of macro circumstances on the cryptocurrency market on X.

he point out”, “If BTC had been digital gold, it will be anticipated to commerce consistent with gold, however with the next beta. ” With subsequent week’s Federal Reserve assembly approaching, macroeconomic elements are anticipated to briefly take heart stage.

The U.S. Producer Worth Index (PPI) information launched yesterday confirmed that it grew by 0.6% in February, exceeding expectations by 0.3% from the earlier quarter, triggering a sequence response. The CPI has additionally warmed up not too long ago than anticipated, inflicting U.S. bond yields to rise. The benchmark 10-year fee rose 10 foundation factors to 4.29%, the two-year fee rose 10 foundation factors to 4.29% from 4.63%, and the two-year fee rose to 4.69% from 4.63%. These developments have led merchants to regulate their expectations for the Federal Reserve’s rate of interest coverage in 2024.

Mohamed A. El-Erian, Queens School, Cambridge, Allianz and Gramercy, commented Concerning the state of affairs: “U.S. authorities bond yields surged at present, in response to a different (barely) higher-than-expected inflation studying (this time the Producer Worth Index).” This exhibits a rising consciousness Continued inflation poses a problem to reaching the Federal Reserve’s 2% inflation goal.

#3 Coinbase Adverse Premium/Quiet Bitcoin ETF Day

Another excuse why Bitcoin fell under the $70,000 mark is that “Coinbase Premium” (the change that hosts most spot Bitcoin ETFs) fell into destructive territory for the primary time since February 26, indicating bearish sentiment within the US market. This phenomenon could also be the results of heavy promoting in grayscale GBTC, whereas exercise in spot ETFs has been comparatively quiet.

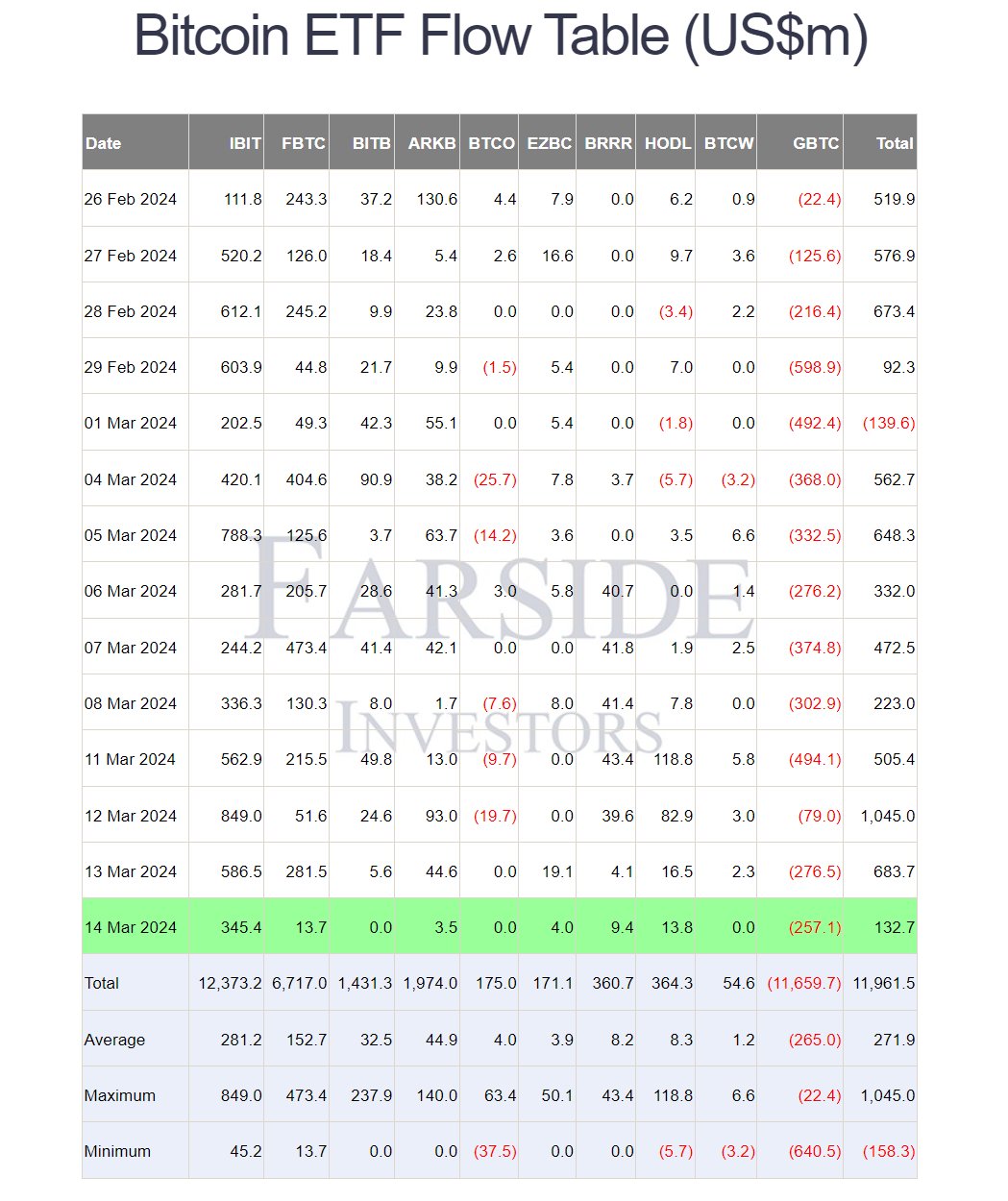

After a report $1 billion in internet inflows into spot ETFs on March 12, latest inflows fell to simply $132.7 million, with BlackRock contributing the lion’s share at $345.4 million. In the meantime, Constancy and ARK noticed inflows of $13.7 million and $3.5 million, respectively, following beforehand sturdy weeks. GBTC outflows had been reported at $257.1 million, consistent with the common.

Cryptocurrency Analyst WhalePanda commented On this regard, he identified that regardless of the lower in capital inflows, “$132.7 million remains to be 2 days of mining rewards.” He hinted that the market might rebound, saying: “We’re simply adjusting the vary now, and people who are overleveraged can be Margin name required. I feel the following improve is subsequent week.”

At press time, BTC was buying and selling at $67,916.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It’s endorsed that you just conduct your personal analysis earlier than making any funding resolution. Use of the knowledge supplied on this web site is totally at your personal threat.