Bitcoin evangelist Tuur Demeester not too long ago shared His ideas on Bitcoin’s potential to hit the $1 million mark by 2028. Demeester’s tackle the topic stands in cautious distinction to a few of the extra optimistic predictions within the crypto neighborhood.

This dovish view comes at a time when others, comparable to Samson Mow, have expressed sturdy confidence in Bitcoin’s capacity to achieve this milestone after the following halving.

Bitcoin will probably be value $1 million by 2028 unsure

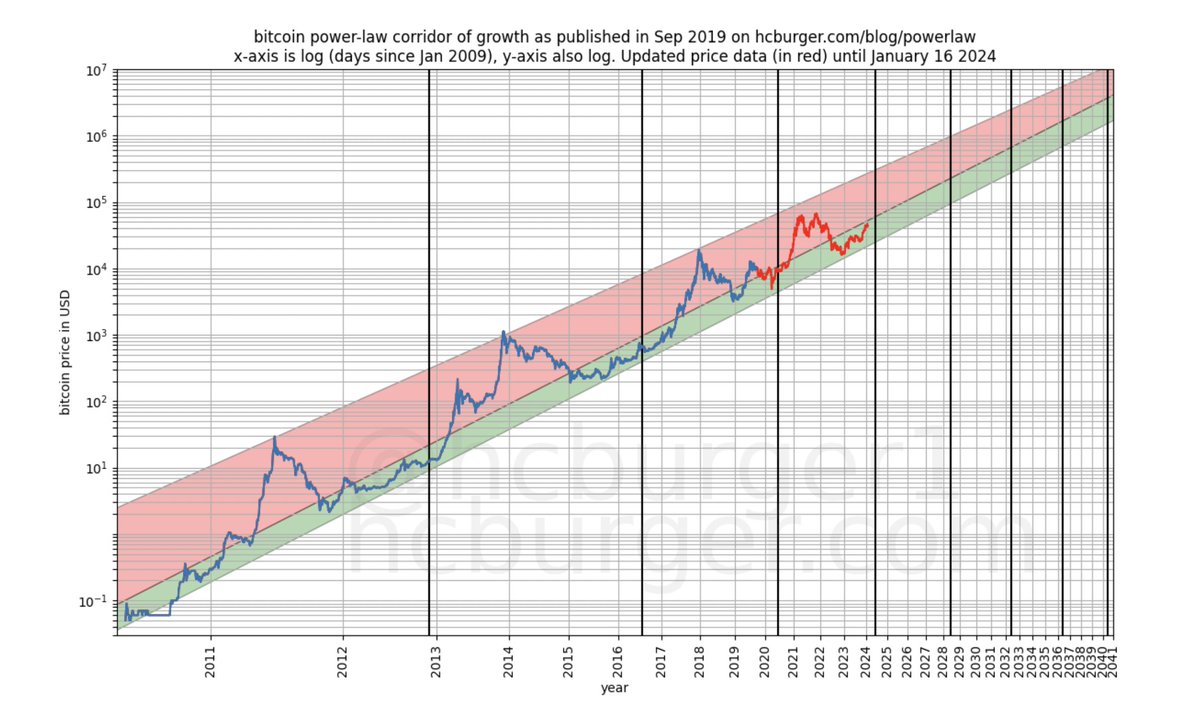

Demeester’s skepticism was expressed in response to a publish wherein investor Fred Krueger shared a chart suggesting Bitcoin may attain $1,000,000 ranges by 2028.

Whereas admiring chart fashions, Demister expressed uncertainty, acknowledging the unpredictability of the market and its incapability to problem even the best-established fashions.

Will BTC take till after summer season 2028 to achieve $1 million? I don’t know, however I do know that each lovely mannequin (like this one 🤌) is destined to be damaged by Mr. Market. https://t.co/GcmhfL2C16

— Tuur Demeester (@TuurDemeester) February 2, 2024

Expectations surrounding a BTC worth of $1 million are intently tied to its halving occasion, which happens roughly each 4 years. After this 12 months’s halving, the following halving will happen in 2028. These occasions reduce in half the variety of newly mined BTC per block, limiting provide and doubtlessly affecting worth.

The upcoming halving in April this 12 months will considerably cut back the every day minting quantity of Bitcoin from 900 to 450. Traditionally, such provide modifications have resulted in important worth actions, lending credibility to varied fashions predicting important worth will increase sooner or later.

Amongst these predictions, an X person claimed to have the expansion chart cited by Demeester and supplied insights. They argue that some market legal guidelines, such because the time worth of cash within the inventory market, are unlikely to be damaged.

Likewise, Bitcoin’s pure adoption price could restrict its “explosive” progress, offering room for market volatility with out disrupting the underlying mannequin.

Hello Tur, this plot is mine. There are some guidelines that Mr. Market won’t ever violate. For instance, the inventory market grows about 7% per 12 months. Because of the time worth of cash (by nature) this can’t be violated.

Time-based energy legal guidelines are additionally troublesome to interrupt upward as a result of that may…— hcburger (@hcburger1) February 2, 2024

Totally different views on the way forward for Bitcoin

Different Bitcoin fanatics comparable to Jan3 CEO Samson Mow are extra optimistic. Mow predicts Bitcoin will attain $1 million, which may trigger a sudden surge that may trigger “most ache” to some market members.

He mentioned such a pointy enhance may occur rapidly “inside days or perhaps weeks”, though the precise start line stays unsure.

My most important prediction is that it’ll attain $1 million in just a few days to weeks. Start line to be decided.

— Samson Mow (@Excellion) January 14, 2024

Mow thought of quite a lot of elements when analyzing potential triggers for Bitcoin’s rise. These embrace Bitcoin-specific indicators comparable to alternate commerce inflows (ETFs), BTC hashrate, and whale exercise on Bitfinex. As well as, Mow additionally seems at broader financial indicators comparable to Tether’s USDT property below administration, authorities debt funds, and the debt-to-GDP ratio.

these are #bitcoin Macro indicators I’m following:

⬆️ ETF inflows

⬆️ Computing energy

⬆️ Finex whale stacking

⬆️200WMA Pattern

⬆️ Tether USDt AUM

⬆️ Authorities debt curiosity funds

⬆️ Debt-to-GDP ratio

⬆️ Nation-states undertake Bitcoin

⬆️ Actual inflation

⬆️M3 cash— Samson Mow (@Excellion) January 28, 2024

Mow believes that these elements, coupled with nation-state adoption, actual inflation charges, and M3 cash provide, may considerably impression Bitcoin’s efficiency.

Amid this controversy, Bitcoin has surged considerably over the previous 24 hours, reclaiming the $43,000 mark with a present buying and selling worth of $43,123.

Featured pictures from Unsplash, charts from TradingView

Disclaimer: This text is for academic functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is suggested that you just conduct your personal analysis earlier than making any funding determination. Use of the data supplied on this web site is solely at your personal threat.