On-chain information exhibits that Bitcoin presently has a thick provide wall between $60,300 and $62,155 ranges, which can stop the asset from falling.

Massive quantities of Bitcoin had been bought at costs near present costs

As analyst Ali explains in a brand new report postal At X, BTC now has a significant wall of help beneath it. In on-chain evaluation, the power of help and resistance ranges is measured by the quantity of Bitcoin bought by buyers.

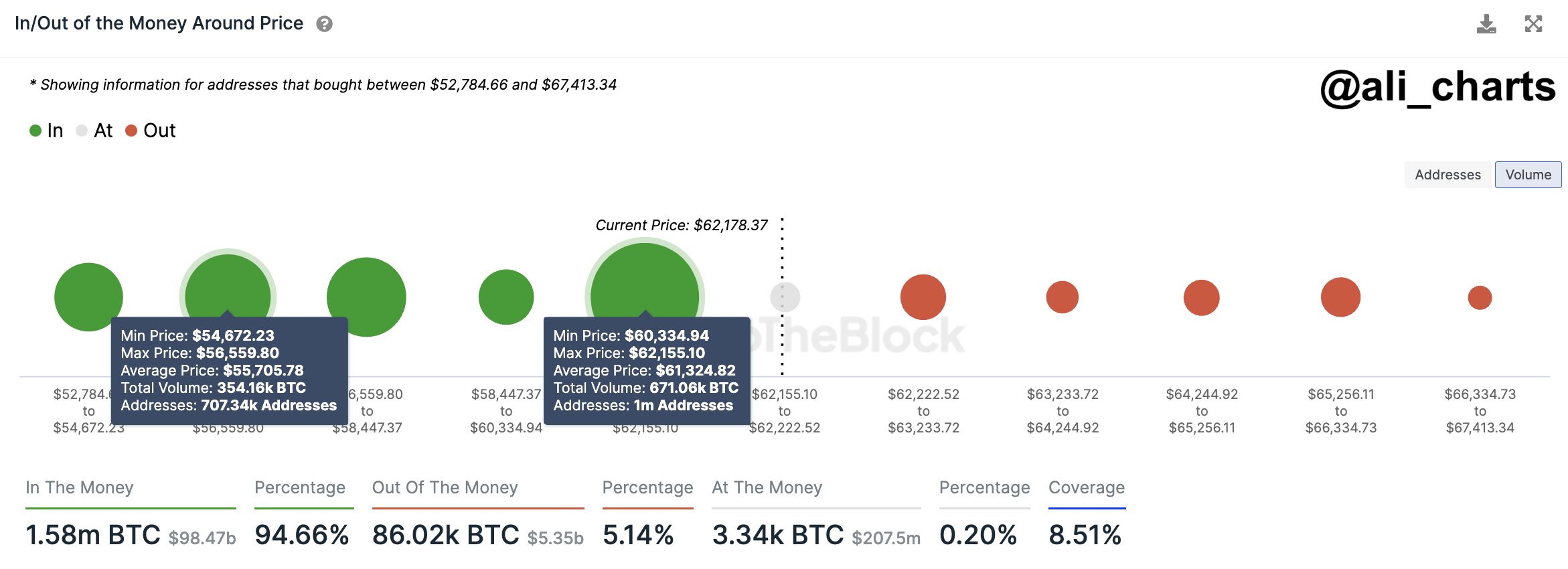

The chart under exhibits the distribution of investor price foundation over BTC’s worth vary round its present spot worth:

The quantity of Bitcoin that the holders purchased on the varied worth ranges | Supply: @ali_charts on X

Right here, the scale of the dot represents the quantity of tokens bought by the handle between corresponding worth ranges. It’s evident from the chart that the density of tokens within the $60,300 to $62,100 vary is presently significantly excessive.

Most worth ranges inside this vary are barely decrease than the present spot worth of the cryptocurrency, that means buyers who purchase right here will make some revenue, albeit solely a small one.

Typically talking, when worth retests the associated fee foundation of those buyers who had been worthwhile previous to the retest (that means worth has approached their price foundation from above), these addresses are more likely to generate a shopping for response.

It is because holders like this will likely have cause to imagine that in the event that they had been capable of revenue earlier than, they can revenue once more within the close to future, and due to this fact they might accumulate on this “dip”.

Such reactions can naturally present help for cryptocurrencies. Nonetheless, the scale of this help will naturally not be important if just a few buyers purchased at that stage within the first place. Alternatively, a slim vary of dense addresses could show to be a supply of great help.

Within the above worth vary, which is near the present spot worth, 1 million addresses acquired a complete of roughly 671,000 BTC. The analyst famous: “This space of accumulation highlights sturdy investor confidence and will function a key help stage for Bitcoin, doubtlessly buffering additional losses.”

Whereas there are extra cash within the worth vary on the present worth, as you possibly can see from the chart, this isn’t the case within the above vary. Identical to the availability pockets under could be a supply of help, the availability pockets above can even act as resistance.

The truth that the aforementioned provide wall is pretty skinny means that there will not be many buyers ready for a fast exit at breakeven, so promoting stress needs to be low.

That stated, it doesn’t suggest there’s no resistance in any respect. Bitcoin is presently close to all-time highs, which implies the overwhelming majority of the availability is in revenue. At these ranges, an enormous sell-off to seize these positive factors could also be the primary problem in stopping the run from persevering with.

bitcoin worth

At present, Bitcoin is buying and selling round $62,000, which implies it’s on the sting of a significant help wall.

Seems to be like the worth of the coin has been sharply going up not too long ago | Supply: BTCUSD on TradingView

Featured pictures from Shutterstock.com, IntoTheBlock.com, charts from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is strongly recommended that you just conduct your individual analysis earlier than making any funding determination. Use of the data offered on this web site is totally at your individual danger.