Bitcoin costs have been unstable, lately falling from a peak of over $73,000 in March to present spot ranges. As promoting strain builds and a few buyers fear about potential short-term losses, analysts are turning to historic knowledge for insights. This historic evaluation is important in figuring out whether or not we have now reached a market prime or whether or not that is only a non permanent pause earlier than the pattern resumes.

Does the depth of this correction depend upon that?

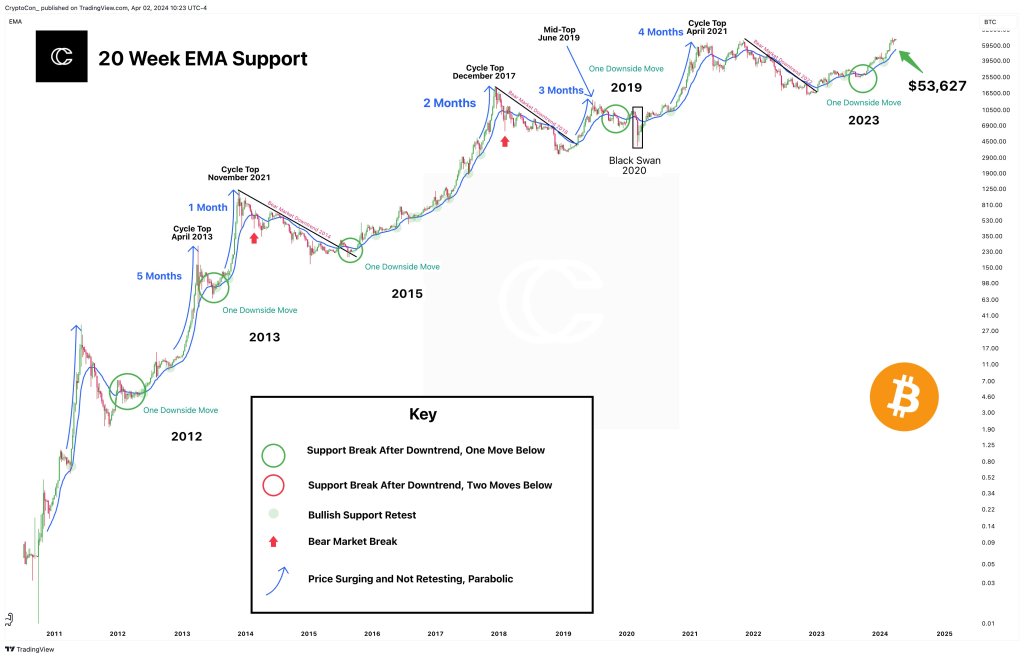

In an article by X, an analyst explain The depth of the present correction will largely depend upon whether or not Bitcoin goes “parabolic.” At any time when an asset goes “parabolic” in worth, it means valuations have risen sharply, and to some extent, analysts consider that is unsustainable.

On this case, costs have a tendency to chill down later, however after key resistance ranges and even all-time highs have been breached. If that’s the case, then the present calm might level to a possible “first cycle prime” forming in March 2024 on the all-time excessive of $73,800.

The formation might be much like what was seen in April 2013 and 2021.

Nevertheless, in one other state of affairs, merchants ought to anticipate a special association, assuming that current worth development isn’t unsustainable or parabolic. Assuming that is the case, Bitcoin might proceed to fall and revisit established help ranges.

Analysts predict a doable pullback to the $53,600 help stage within the coming periods.timeHis pullback will lead to “a smoother curve just like the one seen in 2016-2017,” the analyst continued.

Influence of Bitcoin Halving

Along with this evaluation, one other analyst additionally floated the idea of Bitcoin’s halving cycle. Usually, taking a look at historic patterns, costs are likely to plummet forward of the halving occasion within the third week of April.

In an article by X, the analyst explain The present rejection and the failure of bulls to push the worth greater recommend that the coin could consolidate between $60,000 and $70,000 within the coming weeks.

Bitcoin continues to face strain and extra losses are seemingly within the coming days. In accordance with the day by day chart formation, BTC worth pattern is beneath the midline BB. Notably, it confronted a robust rejection on the $71,700 space.

Whereas the uptrend stays, patrons will solely have the ability to take management and reverse present losses if costs rise, ideally as participation ranges improve.

Function photos are from DALLE, charts are from TradingView

Disclaimer: This text is for instructional functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is strongly recommended that you just conduct your personal analysis earlier than making any funding resolution. Use of the knowledge offered on this web site is completely at your personal danger.