Willy Woo, on-chain analyst, believe Bitcoin’s rise is much from over. Given the event of Bitcoin’s macro oscillator and the chance of conventional finance leaping on the bandwagon (FOMO), the chance of at the least two sturdy Bitcoin rallies within the coming session can’t be discounted.

On-chain knowledge reveals Bitcoin has extra room to rise

In an article on X, Woo stays assured in regards to the prospects of the world’s most beneficial cryptocurrency. Relying on on-chain developments, there are indicators that the coin may transfer firmly greater, breaking out of its present calm.

Bitcoin stays principally range-bound at time of writing, buying and selling inside a good space with a ceiling at $73,800 and fast help at $69,000. Though analysts are assured in regards to the future, the coin has failed to beat sturdy promoting momentum from sellers and escape to new all-time highs in a continuation of the shopping for pattern.

Judging from the foreign money settings, the present sideways pattern could also be accumulation or distribution, relying on the path of the breakthrough. For instance, any rise above $72,400 may spur demand, pushing the coin in the direction of $73,800. Quite the opposite, if it falls beneath $69,000 and the center BB, BTC could fall to the March 5 low and even decrease.

Will TradFi FOMO and brief squeeze enhance BTC?

Wu stated that even when the upward momentum slows, the potential for “one other sturdy rally” is excessive. The analyst additionally added that there may very well be two spikes if TradFi traders are “petrified of lacking out” on Bitcoin. In the course of the 2017 bull market, Bitcoin costs rose to $20,000, largely as retailers stepped in and held FOMO foreign money.

With the launch of a spot Bitcoin exchange-traded fund (ETF) in america, there’s hypothesis that extra establishments and high-net-worth people are shopping for Bitcoin. If BTC rises above $74,000, extra funds could move into a number of spot Bitcoin ETFs, stimulating demand.

This bullish outlook comes as different analysts count on Bitcoin to soar within the coming classes.In an article by X, an analyst explain The upcoming brief squeeze may push the coin above the March highs. Every time a brief squeeze happens, the worth rises, forcing sellers to purchase again at a better worth, accelerating the upward pattern.

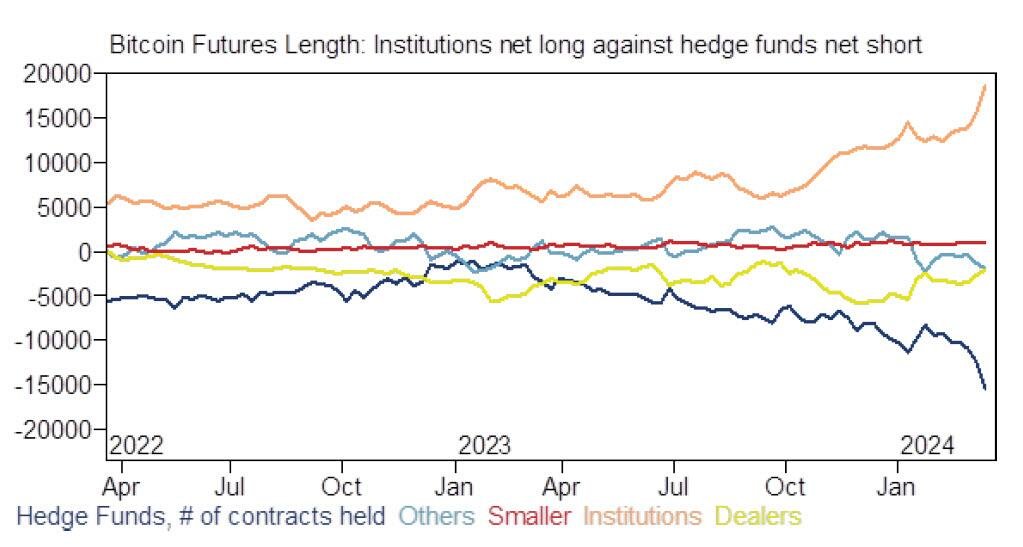

This evaluation is the explanation for the file hole between institutional traders betting on worth will increase and hedge funds promoting the token.

Function photos are from DALLE, charts are from TradingView

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is suggested that you just conduct your personal analysis earlier than making any funding resolution. Use of the data supplied on this web site is solely at your personal threat.